Bonds & Stocks Bid Despite Rate-Hawknado Ahead Of J-Hole Pow-Wow

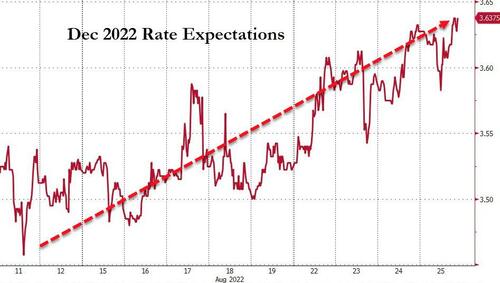

Another wave of hawkish FedSpeak today (George, Bostic, Harker, and Bullard in increasingly ominous policy terms) prompted further tightening in STIRs…

Source: Bloomberg

…but stocks (once again) just shrugged it off as hope remains that Powell punts tomorrow…

Source: Bloomberg

If there is still anyone left believing that Powell will pivot tomorrow, they are in cloud cuckoo-land – he would have to completely reject the words of at least six Fed presidents in the last two days who have expressed nothing but ‘higher for longer’ rates as a possibility.

Will Powell go ‘full Leeroy Jenkins’ on the market?

The market is pricing a peak terminal rate for this cycle at around 3.79% in March 2023 before rate-cuts begin (but all the FedSpeak today signaled that was unlikely – more aggressive hikes then pause was the narrative, not a hike and cut flip-flop)…

Source: Bloomberg

Why are they desperate? Simple – financial conditions are now ‘easier’ than when The Fed actually started ‘tightening’…

Source: Bloomberg

The Dow lagged on the day (thanks to weakness in Salesforce) but had a positive performance while Nasdaq and Small Caps led the pre-Powell surge. In the last hour, the “we know something you don’t know” panic-buying accelerated into the close. Futures were bid aggressively at both the EU cash open and the US cash open…

“Most Shorted” stocks surged once again today…

Source: Bloomberg

Very strong 7Y auction (after ugly auctions earlier in the week) helped extend gains in bond land today… but the short-end (2Y) dramatically underperformed…

Source: Bloomberg

The 10Y Yield dropped back near 3.00% today…

Source: Bloomberg

All of which flattened the yield curve (2s30s) dramatically…

Source: Bloomberg

The dollar extended yesterday’s slide, but was bid into and across the European open (like it has been for the last few days)

Source: Bloomberg

Bitcoin chopped around today to close practically unchanged around $21500…

Source: Bloomberg

Oil prices slipped lower today…

European NatGas continued its explosion higher, now trading at a stunning $533 per barrel of oil equivalent…

Source: Bloomberg

And some more context, Germans are paying the equivalent of $1200/barrel of oil for their electricity demands (1Y ahead)…

Source: Bloomberg

Interestingly, the discount for Russian (Urals) crude below Brent is tightening…

Source: Bloomberg

Gold managed modest gains on the day with overnight gains being dumped as US opened…

Finally, Bloomberg reports that a measure of aggregate profit margins improved in the period to 15.5% — the most since 1950 — from 14% in the first three months of the year.

Source: Bloomberg

This won’t last… unless government intervention has finally killed capitalism.

Tyler Durden

Thu, 08/25/2022 – 16:00