Ugly, Tailing 5Y Auction Sends 10Y Yield To Highest In Two Months

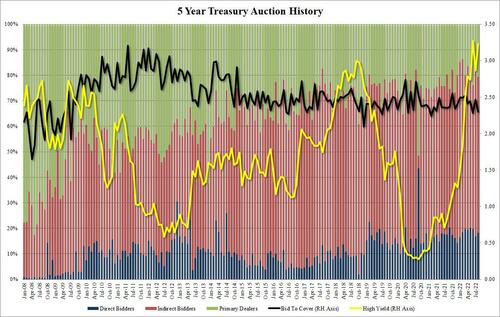

After yesterday’s ugly 2Y auction moments ago the Treasury completed the week’s second coupon issuance when it sold $45 billion in 5Y bond due Aug 31, 2027, and which saw the yield surge to the second highest on record, up from July’s 2.860% to 3.230%, and just shy of the record 3.271% print in June; the high yield (74.56% allotted at high) also tailed the When Issued 3.220% by 1bp – this was the fourth tailing 5Y auction of the past five.

The bid to cover was ugly, slumping to 2.30 from 2.46 in July, and far below the six-auction average of 2.437. In fact, with the exception of June’s 2.28, today’s auction had the lowest bid to cover since Feb 2021.

The internals were also ugly, with Indirects sliding to 61.2% from 66.4%, although not that far below the recent average. And with directs taking down 18.2% (the second lowest since January), Dealers were left holding 20.6%, up from 16.8% last month and above the six-auction average 18.0%.

Overall, a subpar – if hardly catastrophic – auction, and one which sent the 10Y yield to 3.12%, the highest since late June, as stocks reverse much of their earlier gains.

Tyler Durden

Wed, 08/24/2022 – 13:15