Deglobalization And Central Banking

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

There are primarily two opinions on the future path for inflation. The widely held view thinks inflation will resort back to pre-pandemic levels as the pandemic-related supply and demand distortions continue normalizing. A lesser followed theory believes this surge in inflation, unlike others over the last 30+ years, will be persistent. We initially discussed why this might occur in Persistent Inflation Scares the Fed. The article considers a change in behaviors that might generate a price-wage spiral. Given the significance of inflation on economic growth, Fed policy, and ultimately asset prices, it’s worth exploring deglobalization, another argument for persistently high inflation.

In War and Interest Rates, Zoltan Pozsar makes a strong case that hot economic wars will change the global economic landscape, reversing decades of the benefits of economic globalization and resulting in deglobalization and higher levels of inflation than we are accustomed to. The outcome may change monetary policy goals from supporting asset markets and encouraging debt use to managing geopolitical change and deglobalization.

Zoltan is the global head of short-term interest rate strategy at Credit Suisse. His opinions are often alternative. Whether you agree with him or not, he provokes a high level of thought.

All quotes in this article are from Zoltan unless otherwise noted.

Why High Inflation Matters

Before summarizing Zoltan’s article, it is worth a quick summary of why the future path of inflation is so crucial for investors.

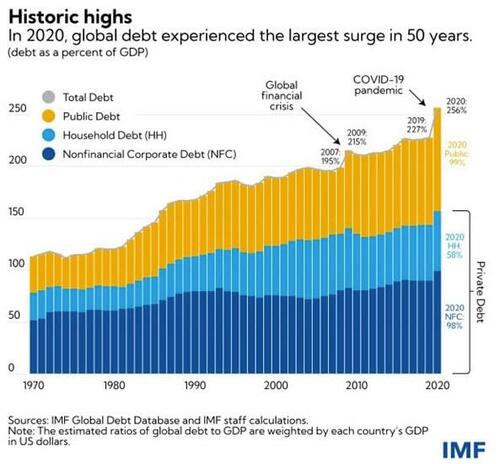

The U.S. and most other developed nations have enormous levels of debt. The IMF graph below shows that global debt as a percentage of GDP has surged 2.5x in the last fifty years.

Higher debt levels as a percentage of GDP were made possible with continually lower interest rates and increasing amounts of unproductive debt. In some cases, negative interest rates and frequent QE kept economies running and countries from defaulting.

Central bankers got away with neglectful monetary policies because inflation was not a concern. The globalization of trade allowed for the flow of cheap goods. Accordingly, the Fed and other central banks conducted easy monetary policies with little fear of stoking inflation. Such an environment was conducive to high asset valuations.

Higher levels of inflation are likely to accompany higher interest rates. High-interest rates are extremely taxing on economies with burgeoning debt levels. Such an environment is unfavorable for high valuations and strong asset price performance. Inflation is therefore a key factor driving asset returns.

Zoltan’s Warning

Zoltan writes his article after recently visiting his firm’s European clients. He broadly seems to disagree with many of his clients’ inflation and central bank policy expectations. To wit:

The expected path of western policy rates rests on two hopes: first, that inflation is about to peak. Second, that we are near peak hawkishness.

Per his experiences, many investors believe inflation is peaking, and central bankers will back off their aggressive monetary policy designed to fight inflation. Zoltan warns, as we do, that investors with such a view may get caught offside. As such, we need to consider some tough questions. For instance:

What if inflation proves persistent and doesn’t retreat by as much or as fast as investors expect?

What if central bankers have no choice but to keep administering the harsh monetary medicine that the markets are struggling to digest?

Three Pillars of the Low Inflation Era

To appreciate Zoltan’s concern for a new inflation regime, it’s worth sharing his opinion on what fostered the low inflation environment of the last 30+ years.

Zoltan posits that low inflation rates rest on three pillars.

First, cheap immigrant labor keeps service sector wages stagnant in the U.S.

Second, cheap goods from China raise living standards amid stagnant wages

Third, cheap Russian gas powering German industry and the EU more broadly

U.S. consumers were soaking up all the cheap stuff the world had to offer…. All of this worked for decades until nativism, protectionism, and geopolitics destabilized the low inflation world.

The Three Pillars are Crumbling

The three pillars described above are turning deflationary pressures into inflationary pressures. Let’s discuss how they are changing.

Nativism

Recent restrictions on immigration into the U.S. reversed a decades-long trend in which cheap immigrant labor provided an ample supply of workers. As a result of excess potential employees, wages were relatively stagnant for a large percentage of the working population.

With wages in check, companies could increase profit margins, boost profits, and keep the prices of their goods from rising too quickly. In some industries, companies could lower prices and maintain profits due to cheap labor.

With less immigration, current workers have more leverage. There are now more job openings than at any time in the last 20 years. Some of this is due to the pandemic, but as we show below, the number of openings is well above pre-covid levels.

As employees become harder to replace and in greater demand by competitors, they seek higher wages. As we show, average hourly earnings for manufacturing employees were generally trending lower until about five years ago, when immigration became more restrictive.

One of the Fed’s primary concerns and reasons for its hawkishness is the potential for a price-wage spiral. A price-wage spiral rests on the ability of workers to demand raises to offset higher prices. Such a circular problem increases the odds that high inflation becomes persistent.

China

Cheap goods from China are not as cheap as they used to be. Further, pandemic-related shortages made it clear the U.S. is too dependent on hostile nations for essential goods, including some technology products and pharmaceuticals. Per the Council for Foreign Relations (CFR): It is believed that about 80 percent of the basic components used in U.S. drugs, known as active pharmaceutical ingredients (APIs), come from China and India.”

The recent Inflation Reduction Bill seeks to bring back the production of semiconductors and other essential goods to the U.S. From a strategic point of view, deglobalization may be intelligent and necessary. However, more expensive labor, higher taxes, and stricter regulations make it costly.

Russia

Before Russia invaded Ukraine, it supplied Europe with approximately 40% of its natural gas and over 50% of its coal. Coal and natural gas help generate about 30% of Europe’s power production. Europe, and Germany in particular, will feel the effect of reduced Russian supply this winter via higher gas prices.

Higher energy costs will not be limited to Europe. The world will pay as Germany will likely restrict its chemical production. Germany’s chemical and pharmaceutical industries account for about 15% of its total gas consumption. Per Reuters: Germany’s chemical industry has already done everything it can to conserve gas use, said chemical association VCI on Tuesday, which warned that the only steps left for the industry would be to scale back or abandon production altogether.

Germany is the world’s third largest exporter of chemical products. If they cut production, chemical price inflation will affect all nations. In turn, the prices of many products using these chemicals will also rise.

Even if Russia makes amends and withdraws from Ukraine, Europe is still likely to seek new dependencies for energy. These come at higher costs. As such, the goods it produces must also come at higher prices.

Hot Economic War

War is inflationary.

Wars come in many shapes and forms. There are hot wars, cold wars, and what Pippa Malmgren calls hot wars in cold places.

Zoltan and Malmgren characterize the hot war with Russia and China involving the trade of goods and commodities as occurring in cold places, the “corridors of power.”

Hot or cold Wars and continued hostilities exaggerate the inflationary effect of pillars two and three crumbling. Essentially the globalization and deflation of the last thirty years will be put in reverse. Welcome to the deglobalization era!

Central banking in the Deglobalization Era

Deglobalization is the process of diminishing interdependence and integration between certain units around the world, typically nation-states. It is widely used to describe the periods of history when economic trade and investment between countries decline. – Wikipedia

Central banks have been saying for over a decade their aim was to fight deflation by inflating asset prices. (As investors) all we had to do was borrow at low rates and buy assets irrespective of quality.

Now our jobs are becoming more difficult.

Further on Zoltan states:

Central banks went from waging war against deflationary impulses coming from the globalization of cheap resources to ‘cleaning up’ the inflationary impulses coming from a complex economic war.

Deglobalization will bring about inflation, just as globalization brought about deflation. If Zoltan is correct, the argument for persistent inflation is credible.

In such an environment, central banks will contend against inflationary geopolitical events. This entails we are exiting a world where central banks manage the demand side of the economy. They are very adept and have the tools to control demand. They do not have the tools to manage supply. We are potentially on the cusp of enormous change.

Summary

Zoltan ends with the following quote:

Today, it’s time to think more about the risk of inflation staying higher for longer due the economic warfare, and less about inflation being driven by a messy re-opening process and stimulus.

The BIS argues inflation may stay higher than what we have grown accustomed to due to a price-wage spiral. Zoltan adds that economic hot wars with China and Russia make persistently higher inflation likely.

Investors are comfortable with a Fed that willingly lowers rates and does QE at the first sign of economic or market trouble. That may change if higher inflation is more persistent. The Fed may have to sacrifice the economy and markets to some degree to ensure tolerable inflation. The Feds job is even more crucial considering the enormous debt loads and reliance on low-interest rates.

Tyler Durden

Wed, 08/24/2022 – 08:45