“I Always Eat Red Meat. I’m Happy”: As Demand For Higher-End Cuts Slides, Beef Prices Are Falling… For Now

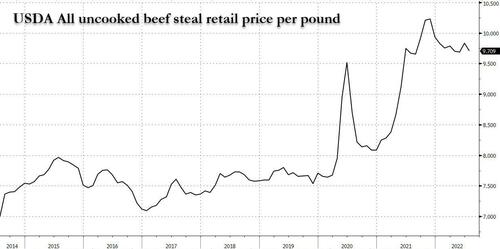

While one wouldn’t know it from looking at USDA data for the uncooked beef prices…

… there are some good news for those seeking to upgrade – however briefly – from horse or cricket in these dystopic days: according to the WSJ, beef is finally getting cheaper, bringing some economic relief to U.S. consumers. Prices of beef, typically among the costliest grocery store purchases, are falling after more than a year of increases as consumer demand softens for some cuts.

While demand has shrunk due to the recent record surge in prices, supplies are improving due to better staffing at meat plants, and supermarkets are offering more discounts on rib-eye, New York strip and other often-expensive products.

For months, prices for food and consumer products have been rising across grocery aisles due to higher costs of transportation, ingredients and labor. Some of the biggest increases have been in the meat section, and shoppers have been buying cheaper cuts or switching to less expensive protein like chicken, pork, horse or cricket. But now that beef prices have plateaued, consumers are finding more deals and options, industry executives and analysts told the WSJ.

Unlike the recent USDA data, retail beef prices fell 0.7% for the four-week period ended Aug. 7, compared with the same period a year ago, according to data from research firm Information Resources Inc. That decline came after beef prices fell 1% during the prior four-week period, which was the first monthly decline since June 2021. U.S. retail beef prices hadn’t fallen for two straight months in over a year and a half, though they remain at historically high levels.

While the pace of U.S. inflation eased slightly in July from a four-decade high as gasoline costs fell from June levels, grocery prices continued their ascent and were up 1.3% in July compared with June, and the cost of eating out at restaurants also increased. But other prices dropped: prices for rib-eye and beef loin are down nearly 10% for the four weeks ended Aug. 7 compared with a year ago, while brisket decreased about 18%. On the other ends, ground beef prices—among the cheapest beef products and still in high demand—increased about 7% over the period, compared with a roughly 20% increase in January.

“The cost of all the stuff is piling up and it’s starting to hit people’s pocketbooks,” said Carey Otwell, director of meat and seafood at Mitchell Grocery Corp. The Alabama-based grocer is selling less premium meat such as grass-fed beef. People continue to buy lower-priced cuts like ground beef, holding up prices for those products. Mitchell’s average cost of a case of beef declined about 13% over the past 12 weeks compared with the same period a year ago.

Arkansas-based Tyson Foods, the biggest U.S. meat processor by sales, said the company’s own average sales price for beef was 1.2% lower over the three months ended July 2, as customers opted for cheaper cuts. The wholesale price of boxed beef shipped from meatpackers as of Aug. 13 is down about 15% from a year ago, according to the Agriculture Department.

Howard Radziminsky, a retiree who lives in Scottsdale, Ariz., said he recently bought rib-eye for $5.97 a pound and New York strip steaks for $4.77 a pound. Radziminsky, who follows a protein-heavy diet and eats red meat five to six days a week, said he hadn’t seen rib-eye sell for under $6 a pound in a while.

“Promotional prices have come back to where they were two years ago,” he said. “I always eat red meat. I’m happy.”

Since the start of the pandemic, meatpacking companies such as Tyson Foods, JBS USA Holdings, National Beef Packing and Cargill have said they couldn’t process as many cattle as usual because their plants were short-staffed. That constrained supplies, they said, and pushed prices higher while demand stayed hot.

But in recent days, some of the bottlenecks at processing plants that drove prices up over the past two years have eased, improving the U.S. beef supply, said Katelyn McCullock, senior agricultural economist at the Livestock Marketing Information Center.

“We’re getting healthier from a labor perspective,” said Shane Miller, head of Tyson’s beef and pork unit, adding that higher wages and a variety of new benefits programs have helped staffing. “We’re running more volume to our plants.”

That said, don’t expect plunging beef prices any time seen: a tight labor market and higher employee turnover and absenteeism rates than before the pandemic at meat plants are expected to keep processing capacity limited in the industry. Boxed beef prices remain roughly 30% above their five-year average, according to the USDA. At the same time, more cattle are being directed to processing plants as ranchers shrink the size of their herds because of persistent drought conditions in parts of the U.S., helping to improve the supply of beef in stores.

Indeed, prices for some beef cuts may not stay down for long as the cattle supply tightens. U.S. beef production is expected to decline later in 2023, constraining the supply of cattle and ultimately raising the price of beef, according to USDA and agriculture executives.

Tyson Chief Executive Donnie King said on a call with analysts this month that he expects the company to pay more for cattle going into 2023 and even 2024 as supply tightens.

Tyler Durden

Mon, 08/22/2022 – 18:40