Which Major Currency Will Be The First To Fall?

Authored by Bruce Wilds via Advancing Time blog,

…Could the euro beat the Yen in the race to the graveyard?

Before saying anything else, it is important to note, when it comes to the major currencies, it is safe to assume they are manipulated by central banks. It is in the best interest of Central Bankers to keep them trading in a rather tight pattern as so not to rock the foundation of the global financial system. On top of the stress being placed upon economies due to the war in Ukraine, the one thing bankers don’t want to deal with is the growing fear the fiat monetary system is about to fail.

The destruction of the myth that a major currency cannot fail could create a situation where we would see skittish investors dumping currencies in mass. As wealth rushed from currencies into tangible assets inflation would soar. When a currency implodes it fosters a transfer of wealth from those holding the now worthless paper to those holding other currencies or tangible assets. The group-think of all the major central banks until just recently has been concreted into a global monetary policy favoring inflation in order to support economic growth. This monetary policy is now being challenged by rising prices at the same time economies are slowing.

It is important to remember that fiat currency systems depend on the faith of its users and participants to survive. The emergence of a slew of new cryptocurrencies is an indication faith in the current fiat currencies is beginning to wane. These digital currencies that have flooded the market are disconnected from central banks. Also adding to the perception we are about to see a major shakeup in the global financial system are efforts by countries such as China and Russia to move more trade away from the dollar. This is happening at the same time we see the cost of living for the 16 nations that share the euro currency rose to 5.1% in January, a new record high, few interest rate increases expected in 2022, and a time the German PPI is 18% and Spain’s 31%.

Recently, Zoltan Pozsar, an Investment Strategist at Credit Suisse and is based in New York, has appeared all over the media touting a theory that would affect us all. He is touting the idea Russian sanctions combined with its relationship with China and a crisis in some commodities are threatening the dollar’s reserve status. He claims this will bring about a Bretton Woods III event where commodity collateral may repave the road to hard money.

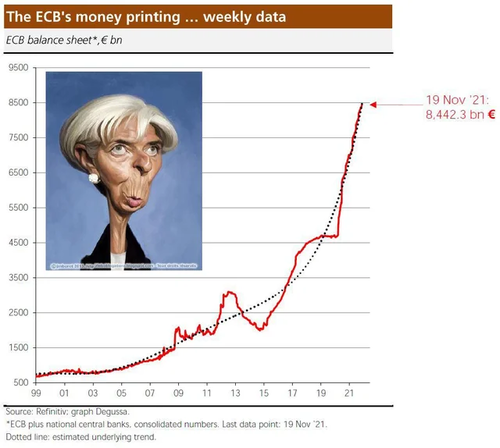

While Pozar may not be completely right, if we are moving in that direction, the effect has broad implications for all of us. It would substantially redefine the relationship between fiat currency and tangible assets. A strong argument can be made that even though the BOJ is the top dog when it comes to monetizing debt it may not be for long. The ECB is catching up in the percentage of central bank holdings of government bonds in percent of total issuance. Considering all of Europe’s problems the big issue is envisioning a scenario from which an economic renaissance might flow.

To say the Euro-zone banking system deception which has been going on for many years is continuing understates the size of the fraud occurring before our eyes. A program known as “Target 2” has been the salvation of the euro and is responsible for preventing countries from collapsing. Since 2015 when Draghi started QE, the Bundesbank has been buying bonds on the market. The Italian central bank is dependent on the ECB which buys Italian government bonds. Germany then sends euros to Italy transferring the debt via Target 2 to their German bank. The growing differences in the Target 2 balance sheet are the result of the Germans taking these bonds. Italians have also added to the capital flight by liquidating their bonds and sending their money abroad.

Italy Is Far Worse Post Covid-19

Target 2 translates into enormously huge debt claims on the Germans that are not covered by any securities. In short, if Italy (or even Spain) would withdraw from the Euro-zone, the Germans would be left holding worthless paper. The bottom-line is Brussels and Germany must continue buying what could be considered, “bad debt” to keep the system afloat. All this raises the question of when the value of the euro will begin to reflect the stress which has been masked over and greatly ignored. In short, the choice of Europe has been whether to put a lot of bad debt on the balance sheet of the European Central Bank or deal with defaults and the contagion that flows from them. To be clear, many German economists criticize Target 2 and see it as a check that cannot be cashed.

As for the yen, for a long time, many investors have viewed it as a safe-haven currency, so much in fact that it has been called a “widowmaker” trade for those betting on its decline. For years Japan has been the poster child and living proof that low-interest rates do not guarantee economic growth and prosperity. Going unnoticed by many investors is that the BOJ has been pumping up Japan’s stock market by buying into the ETF market. This has morphed into a program that seems akin to Mario Draghi’s fraud of doing “whatever it takes” to give the appearance their economy is moving forward. Following along the line of thought that while there is no way of avoiding the final collapse of a boom brought about by credit expansion years ago, Ludwig Von Mises wrote; “The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” In short, the BOJ now has little choice but to go all-in which strips away any illusion all is well.

Japan Led The Way In This Experiment

Before the “Bernanke has all the answers” era, many of us criticized Japan for failing to own its problems. At the time the idea was that only by letting its zombie banks and industries fail could Japan clean out the system and move forward. Instead, the Government of Japan ran huge deficits and ran up massive debt. For decades Japan languished and avoided disaster only by the fact that it enjoyed a large trade surplus year after year and was able to pigtail onto the rapid growth occurring in China. Today much of that trade surplus has vanished but Japan’s massive debt remains.

After 2008 Japan decided to put itself on the leading edge of an experiment to propel its economy forward. This includes the BOJ not only expanding its balance sheet but pumping up the market by jumping into the ETF market, what the country is not doing is taking big steps toward economic reform. All this has morphed into a program that seems to share a key focus on doing “whatever it takes” to keep the economy moving forward. The problem in pursuing the flawed policy of never allowing the market to slip but putting it on a path ever upward until everyone doubting the strength of the market finally capitulates is that it thwarts true price discovery.

Recently articles have surfaced exploring how the central banks and governments have distorted true price discovery in stock markets across the world. By buying stocks they are taking or transferring branches of industry or commerce from the private sector to state ownership or control. The keyword here is “ownership.” This is because the state may choose to abdicate control over decisions leaving them in the hands of management. It has been estimated the BOJ holds around 35 trillion yen, accounting for roughly 80% of Japan’s ETF market. In some ways, the actions of Japan’s central bank could be considered nothing more than a new model of “stealth nationalization.”

This is a course filled with moral hazard since it destroys true price discovery the bedrock of free markets. We cannot underestimate the importance between assets prices and the feedback signals they send. These are critical in determining value, especially when it comes to assets such as stocks, bonds, currencies, or paper promises which carry no utility value and can perform no useful task. When true price discovery is lost or impaired management teams no longer get market feedback as to whether an executive decision is good or bad, this dilutes the market’s ability to reward and punish companies no matter how disastrous their decisions.

To keep the illusion of a viable economy alive central banks must continue expanding credit and debt so the wheels do not come off the economy. It is hard to create the illusion all is well if unemployment soars and defaults skyrocket. This means the central banks remain trapped in a box Ben Bernanke built, Janet Yellen reinforced, and Jerome Powell has not tried to escape from. It is easy to see how central bank policy, right or wrong, falsely accomplishes two things, it bolsters and supports current holdings while reinforcing the image markets are climbing higher because our economic future is getting brighter which is a narrative mainstream media is glad to provide.

This may have started as a “short-term solution” but Ben Bernanke upped the ante by setting the money printing machines on high and flooding America and the world with QE. When other central bankers embraced this solution the world embarked on a grand experiment. The big problem is momentum seems to ebb shortly after each new wave of stimulus and another fix seems to constantly be needed. Current policies are not creating true growth in productivity or real wealth but simply driving up the value of certain markets and assets. This benefits those who own or have assets but does little or even hurts the poor or those who have nothing. It also increases economic inequality and social unrest. The harsh reality central bankers, politicians, and the world must face is the medicine for curing high inflation is high-interest rates. This will not go down well and to some an unacceptable solution.

For years, Japan and Italy, both mired in debt, have been on artificial support. Not only the size of the debt, but the quality of the debt, suggest a huge drop in the values of their currencies must occur. Weakness in the euro or even the yen almost certainly will result in a stronger dollar which could be the catalyst for a crisis in currencies issued by emerging market economies. In short, there is the potential to see such an incident over to the rest of the developed world and evolve into a global deleveraging event. This will most likely be seen as part of the great reset many of us have come to expect will occur at some point. Meaning, promises will be broken and rules will be rewritten as we go through the wash. If I’m correct this reset will involve a massive transfer of wealth with many people having their assets rinsed away as society gets put through the wringer.

Tyler Durden

Tue, 03/29/2022 – 14:50