One Market Indicator With A Perfect Track Record Says Stocks Have Bottomed… Another Says They Are About To Plunge Again

Just when you thought markets have reached peak schizophrenia – not helped by the fact that the Fed wants to have it both ways, and “on the one hand calling inflation unacceptably high and inflationary pressures broad-based, while on the other they hinting at slowing the pace of rate hikes, thus allowing financial conditions to ease, well before there is any real evidence of a meaningful move back towards there 2% target thus leaving the market confused as to whether the Fed is likely to continue to raise rates well into 2023” – we now have a Heisenberg state for markets where one flawless, 100% accurate indicator suggests i) the market is set to to tumble and hit a new bottom, while according to another ii) stocks have already bottomed and will now soar.

In other words, we are about to see at least one of two “guaranteed”, 100% correct indicators be wrong for the first time.

Why? Consider the following: last Thursday we first pointed out that 4220 is critical level for S&P futures: it’s the 50% Fib ES retracement. A close above it would void the bear market rally thesis as there has never been a bear market rally that exceeded the 50% fib and went on to make new cycle lows

4220 is critical level: it’s the 50% Fib ES retracement. A close above it would void the bear market rally thesis as there has never been a bear market rally that exceeded the 50% fib and went on to make new cycle lows pic.twitter.com/dZlXMi1fXG

— zerohedge (@zerohedge) August 11, 2022

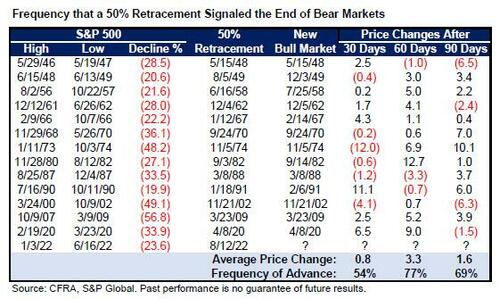

Yesterday, CFRA’s Sam Stovall echoed what we said when it pointed out that “the S&P 500 Index closed above 4,232 on Friday, a 50% retracement of the plunge from its Jan. 3 closing high to its June 16 low. For traders who closely follow Fibonacci analysis, finishing above this level implies a bottom has already been set.”

To sound (or seem) original, CFRA showed a table confirming what we first said, namely that the S&P has never set a lower low in any of the 13 post-World War II bear markets after recovering 50% of its peak-to-trough decline. As a result, Stovall told clients that while markets may be taking a breather, investors should “look upon any possible decline as a dip that should be bought since history says the low is already in.”

So we’ve bottomed then? Well, no… not so fast, because according to another “flawless” indicator, the bottom has yet to come.

As BofA’s Savita Subramanian writes in a market note this morning (available to pro subscribers), only 30% of the bank’s bull market signposts (things that happen before a market bottom) have been triggered vs. 80%+ in prior market bottoms, suggesting that another pullback is likely.

But more to the point, according to Savita, one signpost with a perfect track record is the Rule of 20, i.e., the sum of CPI y/y + trailing P/E has always been lower than 20 when the market bottomed.

What does this mean? Well, outside of inflation falling to 0%, or the S&P 500 falling to 2500, an earnings surprise of 50% would be required to satisfy the Rule of 20, while consensus is forecasting an aggressive and “unachievable” 8% growth rate in 2023 already.

In short, we have reached a perfect quantum state of a market based on flawless backward looking indicators, where one “100% accurate” market signpost predicts stocks melt up from here (or at worst, suffer a modest drop), while another sees stocks tumbling as much as 2,500 if not lower to a new, and far more painful low.

One of the two will see their perfect predictive track record crushed forever.

Tyler Durden

Fri, 08/19/2022 – 10:17