Jackson Hole: More Things To Worry About

By Simon White, Bloomberg Markets Live reporter and commentator

Anticipation that Powell’s Jackson Hole keynote will showcase his inflation-fighting resolve should depress equities in coming days. However, it’s hard to envision how he can successfully cause rates to reprice, and the speech will likely fall short of expectations.

It’s an article of faith among most analysts that inflation is too high and that it requires a significant tightening in financial conditions to bring it back to target. Furthermore, the 2023 Fed dots are 51bps higher than Jan. 24 implied Fed fund futures.

With equities still in a relatively buoyant frame of mind Powell seems to have a free shot at establishing his hawkish credentials.

There’s a good chance the Fed chief will craft a speech that signals that he is focused almost solely on inflation, the risk of the wage-price spiral, and the costs of inflation expectations getting out of hand (as Bloomberg economist Yelena Shulyatyeva has suggested). He should try to convince markets that these risks far exceed the costs of bumpy landing.

However:

What more can he say that hasn’t already been said? In the last press conference, Powell implied that the headline inflation measure was unusually important because of its role in potentially de-anchoring inflation expectations. He also said “nothing works in the economy without price stability” and “we don’t see it (the fight against inflation) as a trade-off with the employment mandate”. This language would need to be significantly sharpened or strong research findings would need to be produced to illustrate that the trade-off should be put on hold for there to be an impact on the longer-dated Fed expectations

Will markets be able to believe that the Fed will go on hiking once a sizable number of people are put out of work, and the noise of the mid-term elections is behind us?

There are precedents for the Fed dots sharply being disconnected from market pricing, and for the markets being right. For instance, the market was pricing 1.75% for Jan-2020 fed funds on June 13, 2017, versus the median dot released on June 14 which had Fed funds at 2.9% at end 2019, and the gap widened into September. It turned out that the market was right: effective fed funds ended 2019 at 1.55%

Granted, he could choose to focus on the need for tighter financial conditions or choose to flag a short-term front-loading of hikes at a faster pace than the market expects.

While both are reasonable for equity markets to worry about, there are reasons to be skeptical that either course of action will be taken.

Simpler than trying to deal with expectations further out would be to flag an imminent front-loading of hikes at a faster pace than the market expects:

Presumably, the very strong labor market and high headline inflation can be used as justification. Powell could easily communicate with the board ahead of time to get buy-in, and Bernanke probably did in 2012 to flag September QE3.

However, this is not the norm for Jackson Hole, which tends to deal with issues at a longer-time horizon.

Furthermore, it’s not short-term pricing that’s the problem. The Jan-23 Fed Fund Futures are already 11bps north of the dots.

Another method would be talk about the need to tighten financial conditions in the short term, which would imply that longer-term rates are too low, and that the Fed would not respond to equity weakness:

However, in Powell’s most recent press conference and the minutes, all references to financial conditions indicate that the Fed is happy with the tightening so far, and there doesn’t seem to be recognition that these conditions are too loose.

Indeed, the line on page 10 of the minutes which describes “a notable tightening of financial conditions” is quite typical of how they are described on all 9 occasions. That is, Fed might want conditions to tighten over time, but there seems no urgency in recent communications.

* * *

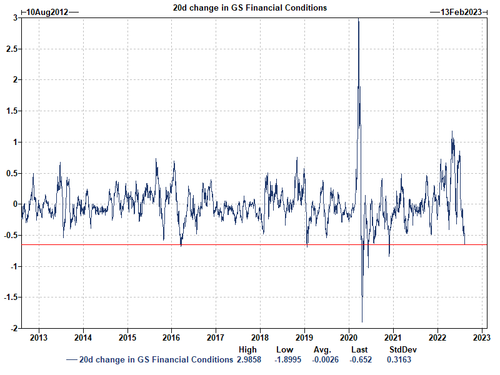

One final point here, from ZH, is that contrary to the Fed’s view that financial conditions have tightened “notably”, just the opposite has in fact occurred because as Goldman showed recently, the 20+ day period since the July FOMC has seen one of the biggest easings of financial conditions (driven by the surge in markets) on record.

Tyler Durden

Fri, 08/19/2022 – 08:15