FOMC Minutes: Anticipation For “Rate Increases” But Risk Fed Could Tighten “More Than Necessary”; Financial Conditions Already “Tightened Notably”

As we wrote in our preview to the Minutes from the July FOMC, expectations were wide ranging: on one hand the minutes were expected to detail the Fed’s dovish breakaway from forward guidance (as the Fed, like the BOE, finally admitted it has no clue what will happen next week let alone net year). On the other, the market is looking for clues on the rate path and the terminal rate… or in other words, forward guidance.

Well, those hoping for some glimpse into what’s coming got just that when the Fed revealed moments ago that while “Fed Officials Judged Moving to Restrictive Stance Was Required” as “inflation was “unacceptably high” and inflationary pressures as broad based” and officials also “Judged That Bulk of Tightening Effect Yet to Be Felt” while “Playing Down Lower Commodity Prices Cooling Inflation”, there was a rather dovish twist in that nany Fed officials saw a risk to over-tightening, because of constant changes in the economic environment and the lag in the meffect of monetary policy, saying: “the committee could tighten the stance of policy by more than necessary to restore price stability” and furthermore, officials saw a “slower pace of rate hikes at some point.”

The question, of course, is when?

Here are some more highlights from the minutes:

POLICY

Several of the participants who commented on issues related to financial stability noted that, on balance, asset valuations had eased from elevated levels in recent months.

A few participants mentioned the need to strengthen the oversight and regulation of certain types of nonbank financial institutions.

Participants generally judged that the bulk of the effects on real activity had yet to be felt because of lags associated with the transmission of monetary policy, and that while a moderation in economic growth should support a return of inflation to 2 percent, the effects of policy firming on consumer prices were not yet apparent in the data.

A number of participants posited that some of the effects of policy actions and communications were showing up more rapidly than had historically been the case, because the expeditious removal of policy accommodation and supporting communications already had led to a significant tightening of financial conditions.

RATES

All participants agreed 75bps interest rate was appropriate.

Many officials saw Fed could tighten more than necessary.

Some participants said policy rate would have to reach a sufficiently restrictive level to control inflation and remain there for some time.

Participants concurred future rate hikes would depend on incoming information, judged that at some point it would be appropriate to slow pace of increases.

INFLATION

Participants agreed there was little evidence inflation pressures were subsiding and that it would take considerable time for situation to be resolved.

Participants emphasized that slowdown in demand would play an important role in reducing inflation.

Participants noted recent readings on inflation expectations were consistent with long-run expectations anchored at 2%.

Participants noted that expectations of inflation were an important influence on the behavior of actual inflation and stressed that moving to an appropriately restrictive stance of policy was essential for avoiding an unanchoring of inflation expectations.

Participants judged that a significant risk facing the Committee was that elevated inflation could become entrenched if the public began to question the Committee’s resolve to adjust the stance of policy sufficiently.

ECONOMY

Participants said strength of labor market suggests economic activity stronger than implied by weak Q2, raising possibility of upward GDP revision.

BANKS

Several participants noted that capital at some of the largest banks had declined in recent quarters.

These participants emphasized that it was important that the largest banks have strong capital positions and that appropriate settings of regulatory and supervisory tools can help deliver that outcome.

A couple of these participants highlighted the potential role that usage of the countercyclical capital buffer could play in this context.

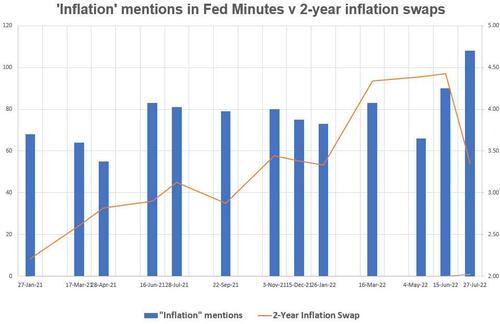

As Bloomberg notes, inflation remains top of mind for the Fed despite market inflation expectations receding: there were 108 inflation mentions in the July minutes, a recent high up from 90 at the June meeting. Meanwhile 2-year breakevens fell from 4.42% at the June Fed meeting to 3.35% at the July meeting and have continued to fall to just 2.74% today.

But perhaps the most important comment for markets was the following:

Participants noted that the Committee’s credibility with regard to bringing inflation back to the 2 percent objective, together with its forceful policy actions and communications, had already contributed to a notable tightening of financial conditions that would likely help reduce inflation pressures by restraining aggregate demand.

This, as we noted, is a ridiculous lie since the Goldman Sachs Financial Conditions index has eased by almost a record amount in the 20-some days since the July FOMC.

The Fed’s comment however makes it clear: the pivot has begun, at least until the next surge higher in gasoline prices, and as Vanda Research strategist Viraj Patel writes, “we’re at halftime in the Fed hiking cycle. And the Fed think the second half will be a lot less aggressive. Good for beaten-down risk sentiment. If the Fed hikes for longer… very possible… it’ll be because of strength in US economy. Rates & equities grind higher?

⚠️ We’re at halftime in the Fed hiking cycle. And the Fed think the second half will be a lot less aggressive. Good for beaten-down risk sentiment. If the Fed hikes for longer… very possible… it’ll be because of strength in US economy. Rates & equities grind higher? $USD #SPX pic.twitter.com/6qhg5MKqZF

— Viraj Patel (@VPatelFX) August 17, 2022

In summary, here is the Minutes takeaway by Bloomberg…

Many Fed officials saw a risk to over-tightening, because of constant changes in the economic environment and the lag in the effect of monetary policy, saying: “the committee could tighten the stance of policy by more than necessary to restore price stability”

Fed officials saw inflation as “unacceptably high” and inflationary pressures as broad based

While recent declines in gas prices would help in the short term, they noted that “declines in the prices of oil and some other commodities could not be relied on as providing a basis for sustained lower inflation, as these prices could quickly rebound”

All Fed officials backed raising rates by 75 basis points at July meeting

“With inflation remaining well above the committee’s objective, participants judged that moving to a restrictive stance of policy was required to meet the committee’s legislative mandate to promote maximum employment and price stability”

… and by us:

Minutes TLDR: Fed only cares about gasoline prices and as long as these are flat or dropping, the S&P can go to 5000

But the best summary comes from Steve Chiavarone of Federate Hermes who said the Fed is trying to have it both ways:

“On the one hand they are calling inflation unacceptably high and inflationary pressures broad-based. On the other they are hinting at slowing the pace of rate hikes, thus allowing financial conditions to ease, well before there is any real evidence of a meaningful move back towards there 2% target. This leaves the market confused as to whether the Fed is likely to continue to raise rates well into 2023.”

Full minutes below:

Tyler Durden

Wed, 08/17/2022 – 14:14