This Is What Hedge Funds Bought And Sold In Q2: Full 13F Summary

While we already covered what may have been the most boring 13F of the second quarter, namely that of Berkshire Hathaway which saw very few changes with Warren Buffett merely adding to a few legacy positions and trimming a few others (full breakdown here)…

… as well as the most interesting one, that from Tiger Global which confirmed that the so-called hedge fund was nothing more than a paper-hands retail investor, dumping most of its biggest holdings just as the market troughed, and leaving the world’s most overrated tech fund missing on all of the recent market upside…

… we also have had quite a few hedge funds inbetween. Courtesy of Bloomberg here are the highlights of the just concluded 13F seasons:

Risk off: Chase Coleman’s Tiger Global Management, Dan Sundheim’s D1 Capital and Michael Burry’s Scion Asset Management were among firms that continued to offload equities in the period. Tiger’s aggregate exposure to stocks dropped by about 55% to $11.8 billion. That’s down from roughly $46 billion at the end of last year. Tiger sharply reduced stakes in eight of the 10 stocks that were its biggest holdings as of June 30. The value of D1’s aggregate stock holdings fell by more than half as it reduced 11 existing long positions, including Expedia Group Inc., while liquidating five others. Burry, meanwhile, dumped all long positions it had held at the end of the first quarter — then worth $162 million — while adding just one new long position: a $3.3 million stake in private-prison operator Geo Group Inc.

Amazon.com, which tumbled 35% during the quarter, was a popular buy-the-dip option. D1, Philippe Laffont’s Coatue Management, Lee Ainslie’s Maverick Capital, Steve Mandel’s Lone Pine and George Soros’s investment firm all increased their stakes in the retail behemoth. Coatue boosted its stake by 36%, making it the firm’s fourth-biggest holding. Stanley Druckenmiller’s Duquesne Family Office took the opposite tack, unloading its entire $199 million position in Amazon.

Investing in energy firms became a popular defensive play as the war in Ukraine helped to push oil prices higher in the second quarter. Warren Buffett’s Berkshire Hathaway Inc., for example, added to its leading stake in Occidental Petroleum Corp. Berkshire now controls a 20% stake in the Houston-based energy firm. David Tepper’s Appaloosa Management, meanwhile, increased its stakes in Constellation Energy Corp. and pipeline operator Energy Transfer LP.

Certain tech stocks fell out of favor as Lone Pine, Maverick and Appaloosa all sold shares of Microsoft Corp., and Dan Loeb’s Third Point unloaded its entire stake in the software giant. D1 also pared its Microsoft holding, although it remains the hedge fund’s biggest long wager. Maverick and Duquesne both liquidated their stakes in Netflix, which plunged 53% in the second quarter.

Some of the biggest university endowments also curtailed risk. Yale liquidated six long positions, leaving it with just two: a Vanguard emerging-markets ETF and an iShares ETF that tracks the S&P 500. Princeton sharply reduced its stake in mining company Lithium Americas Corp., one of just three stocks it owns. Harvard, the richest US college, pared its stake in Facebook parent Meta Platforms Inc. while acquiring one new position, chipmaker ASML Holding NV. It was still more bullish than its peers, adding 670,000 shares of Google parent Alphabet Inc. and boosting its stake in delivery giant Grab Holdings Ltd.

Among other highlights, longtime China bull Ray Dalio closed a position in Alibaba and JD.com in his Bridgewater Associates hedge funds — while establishing a stake in Amazon (whose stock split went into effect in June.) Soros opened a new position in Tesla Inc. of about 30,000 shares, worth about $20.1 million. Walt Disney Co. shares advanced on Monday after activist investor Dan Loeb said he acquired a stake in the entertainment giant and called for sweeping changes at the company.

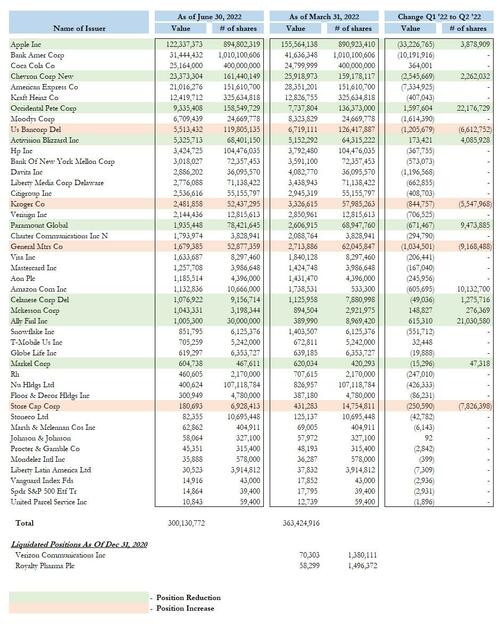

Here is a breakdown of what some of the marquee names did:

APPALOOSA

Constellation Energy, Salesforce are new buys

Added to its holdings in Kohl’s, Energy Transfer

Decreased its position in Amazon, Micron, Occidental Petroleum

BAUPOST GROUP

New Oriental Education and Amazon were new buys, while the firm exited Post Holdings

Added to its holdings in Gray Television

Decreased its stake in Intel

BERKSHIRE HATHAWAY

Exited Verizon Communications

Added to its holdings in Occidental Petroleum and Ally Financial

Decreased its stakes in U.S. Bancorp, General Motors and Kroger

BRIDGEWATER ASSOCIATES

Sea Ltd. and Amazon were new buys, while the firm exited Alibaba and JD.com

Added to its holdings in CVS, Mastercard, Alphabet and Meta Platforms

Decreased its stakes in Linde, Procter & Gamble and PepsiCo

COATUE MANAGEMENT

Datadog and Veeva Systems were new buys, while the firm exited AMD

Added to its holdings in Enphase Energy, JD.com and Alibaba

Decreased its stakes in Rivian Automotive and Tesla

DUQUESNE FAMILY OFFICE

Eli Lilly, Crowdstrike Holdings and Moderna were new buys, while the firm exited Amazon

Added to its holdings in Antero Resources

Decreased its stakes in Freeport-McMoRan and Microsoft

ELLIOTT

Aerojet Rocketdyne Holdings, Pinterest added to new investments; position in Twitter exited

Added to its holdings in Valaris, Noble Corp.

GREENLIGHT

Concentrix and Rivian Automotive were new buys, while the firm exited Intel

Added to its holdings in Consol Energy

Decreased its stake in Teck Resources

ICAHN

Exited Delek US Holdings

Added to its holdings in Southwest Gas

Decreased its stake in Cheniere Energy

JANA PARTNERS

Added to its holdings in New Relic

Decreased its stake in Conagra Brands

MAVERICK CAPITAL

Salesforce was a new buy, while the firm exited Netflix and Mastercard

Added to its holdings in Humana

Decreased its stakes in Coupang, Microsoft and Visa

SCION ASSET MANAGEMENT

Geo Group was a new buy, while the firm exited Bristol-Myers and Booking Holdings

SOROBAN CAPITAL

S&P Global was a new buy, while the firm exited Rivian Automotive

Added to its holdings in Visa, Suncor Energy and Alphabet

Decreased its stakes in Amazon and Microsoft

SOROS FUND MANAGEMENT

Biohaven Pharmaceutical and Tesla were new buys, while the firm exited TJX Cos. and DiDi Global

Added to its holdings in Salesforce, Indie Semiconductor and Qualcomm

Decreased its stakes in Rivian Automotive and JPMorgan

STARBOARD VALUE

Added to its holdings in Mercury Systems

Decreased its stake in Huntsman

THIRD POINT

Colgate-Palmolive and Walt Disney were new buys, while the firm exited S&P Global and Intuit

Added to its holdings in Ovintiv and Cenovus Energy

Decreased its stakes in SentinelOne and PG&E Corp.

TIGER GLOBAL

Alphabet was a new buy, while the firm exited DocuSign and Zoom Video Communications

Added to its holdings in Kanzhun, Gitlab and SentinelOne

Decreased its stakes in Snowflake, Carvana and Microsoft

Source: Bloomberg

Tyler Durden

Tue, 08/16/2022 – 13:00