Like A “Paper-Hands” Amateur, Tiger Global Dumped Most Of Its Biggest Tech Holdings At The Bottom

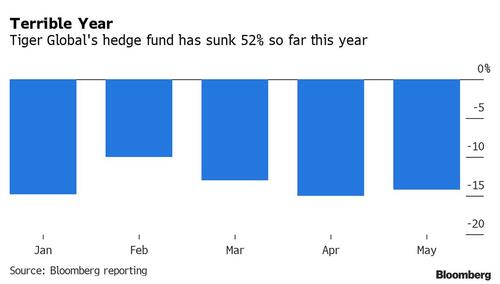

Two weeks ago when we reported that despite the frenzied meltup in both the S&P which was up nearly 10% as well as the Nasdaq, which soared 12.3% in July, tech-momentum chasing juggernaut (and nothing more) Tiger Global – which should have been surging thanks to its exuberantly tech-heavy portfolio – had risen just 0.4% in July, bringing its loss this year to 49.8%, following losses every single month of the year in 2022…

… we asked, rhetorically, if Tiger had in fact acted like the rankest amateur “paper-hands” retail investor, and dumped its tech stocks just as the Nasdaq had bottomed, instead of buying more of those names in which it had conviction at deeply depressed valuations awaiting the inevitable rebound.

It turns out the answer is yes: according to the latest 13F filed by the hedge fund, Tiger’s aggregate exposure to stocks dropped by about 55% to $11.8 billion. That’s down from roughly $46 billion at the end of last year. And answering our question, Tiger disclosed that it had sharply reduced stakes in eight of the 10 stocks that were its biggest holdings as of June 30, and had sold out of 19 names, decreased its holdings in 48 stocks, offset by increases in just 8 companies with 4 new positions. This is a continuation of what the flailing “hedge” fund did in Q1, when the fund ditched 83 stocks and bought just two new ones.

In other words, yes, contrary to what a real hedge fund would do, Tiger proved once again to be nothing but a glorified momentum chaser with zero conviction for even its biggest trades, which it puked during the “max pain” moment of the drawdown, instead of showing why it has collected billions in fees in the past decade with at least some conviction.

Some more details: of the 10 stocks that are now Tiger’s biggest, the firm made huge cuts to eight of them. Most notably it axed its stake in JD.com by 37%, Microsoft by 29%, CrowdStrike by about a quarter, ServiceNow by more than half. Tiger Global also sold shares of Snowflake for the first time following seven quarters of buying. It also exited DocuSign, Zoom Video, Alibaba and 15 others.

To be sure, it also bought a little: Tiger upped its stake in Meta, and started a new position in Alphabet, and software company Samsara.

Of course, none of these new bullish bets will be enough to offset the catastrophic performance suffered YTD which the fund has now ensured it will be stuck chasing for years as it has no realistic way to clibming back out of the high watermark hole its has dug itself for years. If anything, we wonder if Tiger will try the Malvin hail mary next, begging LPs to eliminate the high watermark entirely, or failing that, to quietly return what money is left to investors before restarting as a family office with all those billions collected over the years for generating what turns out was never alpha but merely levered beta.

Tyler Durden

Tue, 08/16/2022 – 10:57