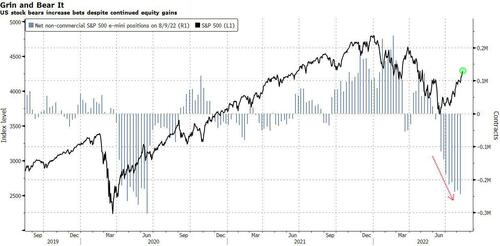

US Stock Bears Refuse to Budge Even as Rally Continues

By Cormac Mullen, Bloomberg markets live reporter and commentator

The US equity rally may be confounding bears, but they ain’t for turning.

Net-short non-commercial positions in S&P 500 futures — a gauge of bearish bets on the US stock benchmark — grew again last week and remain at the highest since June 2020.

The data is to Tuesday, so just before the S&P 500 hit a closely-watched milestone on Friday, retracing half the losses from its steep decline this year, a move which some see as a bullish signal for the recovery.

A slew of positive economic data helped US shares to a fourth straight weekly gain, even as hawkish Federal Reserve commentary filled the air about the potential for even higher interest rates.

That will give bulls confidence. But question marks remain about the risks of a US recession and until they are answered, there’s every chance the bears will hold their ground.

Tyler Durden

Mon, 08/15/2022 – 11:41