Futures Slide, Oil Tumbles After Dismal Chinese Data

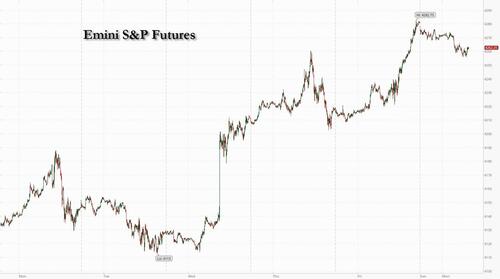

US equity futures stocks were mixed and commodities from oil to iron ore tumbled as the latest round of terrible data from China further clouded the outlook for the global economy, an unexpected rate cut from the PBOC notwithstanding. Contracts on both the S&P 500 and Nasdaq 100 were lower by about 0.5% follows gains last week that sent the tech-heavy index up 22% from June to the highest since April, suggesting a four-week stocks rally – the longest since November 2020 – may stall at least until the $13Bn in daily buying from systematic funds and buybacks kicks in.

Europe’s equity benchmark advanced about 0.2%, as corporate news buoyed healthcare stocks while miners and carmakers declined. Asian stocks added less than 0.1% and emerging-market stocks dropped. The dollar jumped as the Euro and yuan tumbled, crude oil plunged, the downside accelerating after Iran’s foreign minister said that a “basis exists for signing an agreement “in the very near future” to revive the 2015 nuclear deal. After hitting $25K, a bout of aggressive shorting and dollar strength sent bitcoin back to $24K.

In premarket trading on Monday, tech giants including Apple Inc. and Amazon.com declined, alongside the broader tech sector as growth fears reemerged. US-listed Chinese electric-vehicle makers slid in premarket trading Monday after Li Auto (LI US) forecast revenue for the third quarter that fell short of analysts’ estimates.

Cisco Systems (CSCO US) traded 0.6% lower after Citi says the company is losing market share as supply chain issues hurt the network gear maker more than its peers.

Lufax (LU US) shares rose as much as 3.5% amid a report that the Chinese fintech firm is planning to file for a listing in Hong Kong as soon as the second half of the year.

PlayAGS (AGS US) shares gained 7.5% to $8.08 after the company said it got a non-binding indication of interest valued at $10 a share in cash.

UNITY Biotechnology (UBX US) shares rose 15% after Citigroup analyst Yigal Nochomovitz (buy) said the data for UBX1325 in in patients with diabetic macular edema were better than expected.

Illinois Tool Works (ITW US) was downgraded to sell from hold at Deutsche Bank, which struggles to sees the equipment manufacturer’s valuation as justified.

Equity markets in recent weeks have been propelled higher by signs of slowing price pressures, which stirred hopes of a shift by the Fed to less aggressive rate hikes. But China’s faltering economy shows many hurdles still lie ahead for a near-13% rebound in global stocks from June bear-market lows. Sentiment took a hit after Chinese retail sales, industrial output and investment all slowed and missed economist estimates in July. An unexpected cut to the nation’s interest rates is unlikely to turn things around as a worsening property slump and coronavirus lockdowns continue to weigh on the economy.

“Bad data from China also weighs on recession worries for the rest of the world,” said Ipek Ozkardeskaya, a senior analyst at Swissquote. “It’s too early to uncork the champagne, and call the end of the market selloff,” especially as the Fed continues to warn that inflation is still high, she said.

Equities have been rallying as data pointed to softer US inflation, bolstering bets of a pivot by Federal Reserve policy makers before the economy dives into a significant recession. While there is a thin calender of Fed speakers before the conference in Jackson Hole later this month, investors will be assessing minutes from the last Federal Open Market Committee meeting that are due on Wednesday.

In the ongoing feud between Wall Street permabulls and bears, Morgan Stanley’s Michael Wilson reiterated his weekly mantra that the sharp rally since June is just a pause in the bear market, predicting that share prices will be pulled down in the second half of the year as profits weaken, interest rates keep rising and the economy slows. On the other side, strategists at JPMorgan also unleashed their weekly dose of unicorns and rainbows, saying the rally could continue.

European stocks softened since a stronger open, with energy and basic resources weighing on market. Health care, construction and chemicals are the strongest-performing sectors. The risk of a euro-area recession has reached the highest level since November 2020, according to economists polled by Bloomberg. Here are some of the biggest European movers today:

HelloFresh shares jump as much as 10%, the most since May, after the meal-kit maker confirmed results published in a preliminary report on July 20 and reiterated its full-year outlook

Encavis rises as much as 5.4% after the renewable energy company confirmed preliminary 2Q results and a guidance raise for FY22, which were originally reported earlier this month

RS Group climbs as much as 7.1% after The Times noted “growing speculation” that the company is preparing to bolster its defenses in the event of a takeover approach

Henkel gains as much as 1.5% after the firm posted a 1H beat and guidance raise, which Jefferies says was due to the company’s strong pricing and a managed impact on volume

Nordex swings between gains and losses after mixed results. While the company confirmed its FY22 guidance, the top- line was weaker-than-expected amid higher costs, analysts said

Phoenix Group drops as much as 1.2%, reversing initial gains, after reporting interim results that Citi said contained few surprises

GSK and Haleon fall, extending recent losses amid concerns over possible litigation risks related to antacid drug Zantac. Morgan Stanley says “considerable uncertainty” surrounds the litigation

Treatt tumbles as much as 34% after cutting FY estimates. Peel Hunt said the update was disappointing in the short-term, and cut its price target on the stock to a Street low

Earlier in the session, Asian equities eked out gains with Japanese stocks giving a boost, while investors weighed China’s unexpected policy rate cut against disappointing economic data. The MSCI Asia Pacific Index was up less than 0.1% erasing the bulk of its 0.6% rise driven by health care and tech shares. Japan’s Nikkei 225 led gains in the region, with the benchmark turning positive for the year helped by a weaker yen and continued stimulus by Bank of Japan. China stocks turned lower after retail sales, industrial output and investment all missed estimates, erasing a gain caused by the country’s central bank lowering the rate on its one-year policy loans. The undershoot in data highlighted the growing toll of the nation’s Covid restrictions, casting a pall over the market’s outlook. Hong Kong shares were the worst performers in Asia. “The cuts by themselves may not be material enough to stimulate the economy given monetary policy is increasingly loosing its teeth in China – but on the margin – I feel this is positive for Chinese stocks,” said Chetan Seth, Asia Pacific equity strategist at Nomura Holdings.

The MSCI Asia gauge is trading close to a two-month high after capping its fourth weekly advance, with further gains dependent on the ongoing earnings season and whether global appetite can further improve. Still, China’s economic slowdown, worsened by virus curbs and a property crisis, and the Fed’s tightening trajectory continue to be bugbears for investors. Thai stocks rose even after data showed the domestic economy grew at a slower pace than economists estimated last quarter. India and South Korea were closed for holidays on Monday.

In Australia, the S&P/ASX 200 index rose 0.5% to close at 7,064.30, with materials and real estate stocks contributing the most to its move. Core Lithium was the top performer after an update on its exploration activities in the Northern Territory. Beach Energy was the biggest decliner after its FY underlying profit missed estimates. In New Zealand, the S&P/NZX 50 index rose 0.5% to 11,789.03

In FX, the Bloomberg Dollar Spot Index jumped about 0.5%, gaining for a second day as the currency climbed against all of its Group-of-10 peers except the yen amid demand for havens. Euro falls to week’s low versus USD, the Chinese yuan also slumped after the latest terrible economic data. Australian and New Zealand dollars slid after China’s central bank unexpectedly cut a key policy interest rate for the first time since January as it ramped up support for an economy struggling to recover from Covid lockdowns and a property downturn. Separately, China’s retail sales for July undershot estimates, as did industrial production. The yuan slumped and China’s benchmark 10-year China bond yield slid to the lowest since May 2020. Iron ore, copper and other metals declined. The yen held up against the dollar in thin summer trading, with traders waiting to see if US yields can vault higher on the back of aggressive Federal Reserve rate hikes. Japanese government bonds were mixed.

In rates, Treasuries were narrowly mixed with the curve slightly flatter; gains led by 20-year sector where yields are richer by around ~1bp on the day. Bunds, gilts both outperform vs Treasuries amid thin liquidity with Assumption Day holiday observed in many parts of Europe. 10-year TSY yields were around 2.83%, slightly richer and underperforming bunds and gilts in the sector by ~3bp; curves slightly flatter although spreads broadly remain within 1bp of Friday’s close. Italian bonds twist flattened, while bunds advanced and the German curve bull flattened. Treasury moves were small and the curve twist flattened slightly. IG dollar issuance slate empty so far; this week’s Treasury coupon auctions include 20-year new issue Wednesday and 30-year TIPS reopening Thursday. The latest CFTC positioning data shows hedge funds were aggressive net sellers of 10-year note contracts over the week.

In commodities, WTI drifts 3.5% lower to trade around $88. Spot gold falls roughly $20 to trade near $1,782/oz. Spot silver loses 2% near $20. Most base metals trade in the red; LME nickel falls 4.6%, underperforming peers.

US economic data slate includes August Empire manufacturing (8:30am), NAHB housing market index (10am) and June TIC flows (4pm); industrial production, retail sales and FOMC meeting minutes are ahead this week

Market Snapshot

S&P 500 futures down 0.4% to 4,263.25

STOXX Europe 600 up 0.3% to 442.36

German 10Y yield little changed at 0.96%

MXAP up 0.1% to 163.32

MXAPJ down 0.3% to 529.88

Nikkei up 1.1% to 28,871.78

Topix up 0.6% to 1,984.96

Hang Seng Index down 0.7% to 20,040.86

Shanghai Composite little changed at 3,276.09

Sensex up 0.2% to 59,462.78

Australia S&P/ASX 200 up 0.5% to 7,064.34

Kospi up 0.2% to 2,527.94

Euro down 0.3% to $1.0229

Gold spot down 0.9% to $1,786.91

U.S. Dollar Index up 0.32% to 105.97

Top Overnight News from Bloomberg

Fund managers are warning the market is turning complacent over the outlook for inflation in Europe, where the prospect of recession has stoked the appeal of sheltering in bonds

Hedge funds have turned bearish on the dollar for the first time in a year in a wager the US currency’s best days may be over

Russian President Vladimir Putin offered to expand relations with North Korea, reaching out to his neighbor as the Kremlin scours the globe for weapons for its war in Ukraine

The Rhine River’s water level continued to decline, hitting a new threshold as a climate crisis exacerbates Europe’s energy-supply crunch

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mixed with markets focused on China, as the PBoC’s surprise 10bps rate cuts to its 1-year MLF rate and 7-day Reverse Repo was overshadowed by the latest activity data from China in which both Industrial Production and Retail Sales fell short of market expectations. ASX 200 was positive with upside led by tech and miners amid a busy schedule of earnings this week and with Bluescope Steel firmly higher after its FY net more than doubled. Nikkei 225 outperformed and was unfazed by the Japanese GDP data for Q2 which printed weaker-than-expected but returned to expansion territory. Hang Seng and Shanghai Comp swung between gains and losses with early support after the PBoC delivered surprise 10bps rate cuts for the 1-year MLF and 7-day Reverse Repo rates, although Chinese stocks then slipped back into the red after disappointing Chinese activity data

Top Asian News

PBoC injected CNY 400bln vs CNY 600bln maturing via 1-year MLF with the rate cut by 10bps to 2.75% (exp. 2.85%), while it conducted CNY 2bln of 7-day reverse repos with the rate cut by 10bps to 2.10%.

China’s local COVID-19 cases topped 2,000 on Friday despite the recent tighter restrictions and lockdowns, according to Bloomberg.

Shanghai extended the weekly COVID-19 testing requirement until end-September, although it was also reported that Shanghai announced primary schools, middle schools, kindergartens and nurseries will be permitted to reopen on September 1st, according to a statement cited by Reuters.

China’s stats bureau said China’s economy continued a recovery trend in July but the foundation for a recovery is not solid and said the momentum of China’s economic recovery slowed in July, while it added that the economy remains resilient despite facing difficulties and they expect China’s economy to continue to recover, according to Reuters.

“Rivers in multiple provinces, regions across China have dried up due to persistently high temperature and far below average amount of rainfall, posing threat to drinking water resources and agriculture productions”, according to Global Times.

China’s Sichuan province order industrial plants to shut down between Aug 15-20th to ensure residential power supply, according to a document cited by Reuters.

Major bourses in Europe kicked off the session with modest broad-based gains before trimming gains amid a cautious tone. US equity futures have been subdued since the resumption of trade following the gains on Wall Street on Friday, and with retailers such as Walmart set to round off the Q2 earnings season whilst FOMC minutes are due on Wednesday. Regional sectors are now mixed (vs mostly positive at the open), with the theme more of a defensive one as Healthcare, Personal Goods, Food & Beverages, and Utilities among the top performers German gas levy set at 2.419cents/kWh, via Trading Hub Europe. Additionally, German Finance Ministry spokesperson said there is no response yet from the EU commission on the proposed VAT exemption for gas levy. Panasonic (6752 JT) is to boost its EV battery output for Tesla (TSLA) by 10%, according to Nikkei.

Top European News

BoE Governor Bailey told Chancellor Zahawi that he would be “open to a review” of the Bank’s mandate, following Liz Truss’s criticism of its approach to inflation, according to The Telegraph.

Reuters poll showed 30 out of 51 economists expect the BoE to hike rates by 50bps to 2.25% next month and the remaining 21 economists expect a 25bps increase.

UK Treasury plans a government-backed lending scheme for suppliers which would reduce energy bills for households by an extra GBP 400 this winter, according to The Times.

Two of the biggest UK energy suppliers are calling for a special fund that would allow the industry to freeze customers’ bills for two years and spread the cost of the gas-price crisis over a decade or more, according to The Times. It was also reported that UK energy suppliers called for the UK government to scrap levies and charges on bills, according to FT.

SAS Shares Jump as Apollo Provides $700 Million Loan to Airline

Russia Opens Trading to Some Foreign Investors

Turkey Budget Remains in Deficit on Increased Spending in July

FX

Dollar back in favour as safe haven with Yuan down on disappointing Chinese data and unexpected PBoC easing, DXY up to 106.340 from 105.540 low, USD/CNH tops 6.7850 and USD/CNY through 6.7700 from 6.7410 midpoint fix.

Yen holds up better than others irrespective of sub-forecast Japanese GDP, USD/JPY mostly sub-133.50.

High beta and commodity currencies hit hardest, while Euro, Franc and Sterling also retreat vs Greenback

NZD/USD sub-0.6400, AUD/USD under 0.7050, USD/CAD over 1.2900, EUR/USD below 1.0200, USD/CHF 0.9460 and Cable close to 1.2050.

Norwegian Crown undermined by slide in Brent to extent that wider trade surplus shrugged off, but Turkish Lira unable to benefit from cheaper oil as budget deficit blows out, EUR/NOK nearer 9.9000 than 9.9800, UDY/TRY nearer 18.0000 than 17.9000.

Fixed Income

Bonds bounce strongly from early lows amidst China-related risk aversion and holiday-thinned turnover.

Bunds top 156.00 from just above round number below, Gilts reach 116.66 from 115.94 and T-note nearer 119-16 top than 119-04+ bottom.

UK STIRs contracts underperform as poll predicts another 50bp BoE hike before reversion to 25bp and then pause.

Commodities

Crude markets have been selling off since the start of European trade alongside constructive developments on the Iranian Nuclear deal front.

The firmer Dollar has hit the metals market – spot gold back under USD 1,800/oz, LME copper has been extending on losses back under USD 8,000/t.

Saudi Aramco’s CEO said they are working to increase production from multiple energy sources and they will invest in the reliable energy and petrochemicals that the world needs, while he added that global oil demand is healthy in which he expects the recovery in oil demand to continue for the rest of the decade and said that global spare capacity is under 2mln bpd and declining fast. Saudi Aramco’s CEO also stated that Saudi oil production capacity increase will come gradually with a limited increase in 2024 and in 2025 they should go to 12.3mln bpd, as well as noted that they are confident in their ability to ramp up to 12mln bpd whenever there is a call from the government or Energy Ministry, according to Reuters.

Ukrainian state gas transit operator said Gazprom booked transit capacity of 41.82mcm for August 15th (prev. 40.81mcm on August 14th), according to Reuters.

Iran set September Iranian light crude prices to Asia at Oman/Dubai + USD 9.50/bbl, according to the National Iranian Oil Company.

The damaged pipeline at the Louisiana port has been repaired, according to a port spokesman cited by Reuters.

Germany’s top network regulator warned that Germany must cut gas use by 20% to avoid winter rationing, according to FT.

US Event Calendar

08:30: Aug. Empire Manufacturing, est. 5.0, prior 11.1

10:00: Aug. NAHB Housing Market Index, est. 55, prior 55

16:00: June Total Net TIC Flows, prior $182.5b; June Net Foreign Security Purchases, prior $155.3b

DB’s Henry Allen concludes the overnight wrap

Whilst the global economy looks to be heading towards a very difficult winter ahead, for markets the summer rally has shown few signs of abating. Indeed, the MSCI World Index has now advanced for 4 weeks running for the first time this calendar year, and the S&P 500 has recovered by a significant +16.5% in less than two months.

That run of gains has been turbocharged over the last couple of weeks by a number of good news stories that have fed into a narrative about whether we might have seen “peak inflation” now, raising hopes that central banks might not need to be as aggressive as feared about raising rates. We’ve raised questions about whether this optimism can hold, not least given Fed officials themselves are discussing a much more hawkish path for rates than what markets are pricing in, but for now there’s been little sign of a reversal, even as an increasing number of recessionary signals like the 2s10s Treasury curve have been flashing with growing alarm.

Overnight in Asia however, we’ve seen a slight loss of momentum after Chinese economic data for July came in weaker than expected. Industrial production was up by +3.8% on a year-on-year basis (vs. +4.3% expected), whilst retail sales were up +2.7% year-on-year (vs. +4.9% expected). In turn, that’s prompted the central bank to cut their one-year policy loan rate by -10bps to 2.75%, and yields on 10yr Chinese government debt are down -6.3bps this morning to 2.68%. Equity markets have also lost momentum, with the Shanghai Comp (-0.06%) and the CSI 300 (-0.07%) seeing modest declines, unlike elsewhere in Asia, where the Nikkei (+1.15%) and the Kospi (+0.16%) have both advanced this morning. In fact, that advance for the Nikkei puts it at a 7-month high, and back in positive territory on a YTD basis.

Looking forward now, the week ahead is a quieter one on the market calendar as we await the traditional late summer gathering of central bankers at Jackson Hole next week. However, we do have a few events to watch out for, including the expected signing by President Biden of the Inflation Reduction Act, which passed the House of Representatives on Friday by a margin of 220-207 following its earlier tie-breaking path through the Senate. The legislation includes funds for clean energy provisions, a 15% minimum tax for corporations with more than $1bn in revenue, and a 1% excise tax on stock buybacks. It also offers a political win for the Biden administration ahead of the mid-term elections in early November, and if you look at FiveThirtyEight’s average then President Biden’s approval rating is now running at its highest in a couple of months now, at 40.3%.

On the central bank side, we don’t have much in the way of decisions or speakers over the week ahead, which will mean this Wednesday’s release of the FOMC minutes from July will take on added importance. That meeting saw the Fed hike rates by 75bps again, following up their similar move in June, but investors interpreted the meeting in a dovish light as they latched onto comments that the Fed would move away from 75bp moves “at some point”. However, officials then moved to push back on that dovish interpretation, and by the close on Friday futures were almost evenly split between whether the Fed would hike by 75bps for a third time or whether they’ll step down to a 50bps pace. Our US economists write that these minutes could well provide some clues about how officials are likely to determine whether a downshift in the pace of rate hikes is warranted, and these signals from the minutes and other Fedspeak will become more important as the Fed moves towards greater data dependency when making decisions.

Staying on the US, the week ahead will also see an increasing amount of hard data for July come out. What we’ve had so far from the jobs report and the CPI has been very positive for markets, with investors growing more hopeful about a soft landing after more than half a million jobs were added and inflation came in beneath expectations. But in terms of what’s still ahead, we’ve got retail sales on Wednesday, where our economists expect that headlines sales should be boosted by the rebound in unit motor vehicle sales last month, as well as industrial production, housing starts and building permits on Tuesday. Also keep an eye out for the weekly initial jobless claims on Thursday, which have been on a fairly consistent path higher over recent months. Furthermore, our US economists have previously found that an 11.5% rise in the 4-week moving average of continuing claims relative to the minimum over the past year provides the most accurate recession signal. So a further move higher this week would only add to the recessionary signals we’ve seen like the 2s10s curve that’s been moving deeper into inversion territory over recent weeks.

On the inflation front, the week ahead will also bring us a number of countries’ CPI releases. One of them will be the UK, where our economist expects headline CPI to have risen to 9.8% in July, which would be its fastest pace in four decades. Meanwhile in Japan, our economist expects that core inflation excluding fresh food should rise to +2.4%, the highest since late-2014. Finally in Canada, the consensus expects that CPI will fall back from its multi-decade high of +8.1% in June to +7.6% in July, echoing what we saw in the US where year-on-year inflation has now begun to fall back from its June peak.

When it comes to earnings, this week will see the current season continue to wind down, with 455 of the S&P 500 having already reported results by now. However, we’ll still get a number of US retailers including Walmart (Tuesday) and Target (Wednesday). Both have cut their profit forecasts over the last couple of months, so it’ll be interesting to see what their earnings have to tell us about the strength of the US consumer right now.

Recapping last week now, it was yet another positive one for risk assets, with the S&P 500 (+3.26%) gaining for a 4th week running for the first time since November. It was a similar pattern across the major global indices, with the STOXX 600 (+1.18%) and the Nikkei (+1.32%) both moving higher as well. Small-cap stocks were a particular beneficiary, with the Russell 2000 seeing a +4.93% advance, but the moves were fairly broad-based, and the S&P 500 now stands “only” -10.20% lower on a YTD basis.

A key driver behind that optimism were the weaker-than-expected US CPI and PPI inflation readings last week. That led to a growing belief that the Fed might not hike by 75bps again at their next meeting in September, with the hike priced in by futures coming down from 69.0bps to 62.2bps by the end of the week. However, at the same time we saw the rate priced in by end-2023 move higher again as Fed officials struck a more hawkish tone on the future policy path than markets were already pricing, sending the December-2023 implied rate up from 3.08% to 3.20%. In turn, that sent government bond yields higher, with those on the 10yr Treasury up by +0.4bps to 2.83%, whilst those on 10yr bunds rose +3.2bps to 0.99%.

Finally, a major area of continuing concern was the European energy situation. Natural gas futures rose by +4.99% over the week to €206 per megawatt-hour, having been trading around €80 as recently as early June. Power prices for next year have also continued to make significant gains, with French power for 2023 up +14.64% on the week to €617 per megawatt-hour, which also marked its 9th consecutive weekly rise. German power was also up by +13.16% to a record €460 per megawatt-hour.

Tyler Durden

Mon, 08/15/2022 – 07:51