Prince Alwaleed Invested More Than $500 Million In Russia Just Days Before The Invasion

Months before he was embroiled in the Tesla takeover feud, first claiming Musk’s $54.20 takeover offer was too low, before conceding that it’s just right, only for the world to ask if he even owns TWTR shares after the Saudi crackdown on his wealth, Saudi billionaire Prince Alwaleed Bin Talal was busy pouring money into what was soon to be a monetary black hole, having invested more than $500 million in Russian firms in the days around Moscow’s invasion of Ukraine.

Bloomberg reports that according to a stock exchange filing, in February Prince Alwaleed’s investment firm, Kingdom Holding, acquired depositary receipts issued by Gazprom PSJC, Lukoil PJSC and Rosneft PJSC.

No specific dates for the investments were given, but the window can not have been too wide: Russia invaded Ukraine on Feb. 24; after that the value of all those depositary receipts dropped rapidly when trading in Moscow was halted and western sanctions were imposed on Russia. Most Russian stocks traded offshore were wiped out in the days following the invasion.

Kingdom Holding invested 1.37 billion riyals ($365 million) in Gazprom’s American depositary receipts in February, the biggest stake of those disclosed so far this year. It also invested 196 million riyals in Rosneft’s global depositary receipts the same month, and 410 million riyals in Lukoil’s ADRs between February and March.

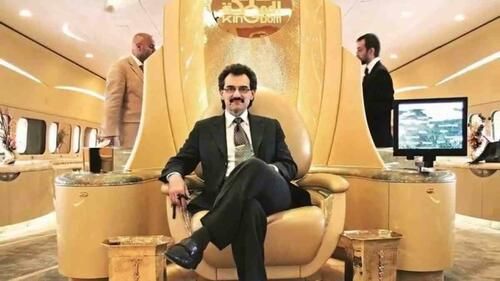

Alwaleed, whose grandfather was the founder of modern Saudi Arabia, but who ended up being a “five-star” prisoner in the Riyadh Ritz in Nov 2017 for 83 days following a decree of the new de facto ruler (and his cousing) Crown Prince Mohammed bin Salman, and was released after reaching an undisclosed “confirmed understanding” with the government (which cost him a substantial chunk of his wealth), is one of the country’s richest men and most high profile international investors. More recently he has been eclipsed by the kingdom’s sovereign wealth fund, controlled by MBS, which acquired a 16.9% stake in Kingdom Holding in May.

Kingdom Holding invested $3.4 billion in global equities and depositary receipts since 2020, based on the filing, a rare bit of disclosure by the company. The largest stake was an investment valued at 2.5 billion riyals in Spain’s Telefonica SA between April to August 2020.

It also disclosed stakes in Uber, TotalEnergies, Alibaba Group Holding and BHP Group, acquired mostly in 2020 and 2021. The most recent deal it disclosed was a 178 million riyal stake in Hercules Capital made in June. The venture capital firm’s shares have risen 17% since the start of July.

As Bloomberg reports, Prince Alwaleed, 67, became one of the highest profile Saudi investors after taking stakes in companies such as Citigroup and Apple. He’s supported Prince Mohammed’s modernization efforts, including giving women the right to drive. More recently he’s announced the sale of a stake in his Rotana Music label to Warner Music Group, and he raised $2.2 billion by selling part of his stake in the Four Seasons hotel chain to Bill Gates’ Cascade Investment LLC.

Alwaleed is known for long-term investments and is a fan of famed investor Warren Buffett. He once called himself the Oracle of Omaha’s Arabian equivalent.

Tyler Durden

Mon, 08/15/2022 – 04:15