UMich Sentiment Jumps But Long-Term Inflation Expectations Unexpectedly Rise

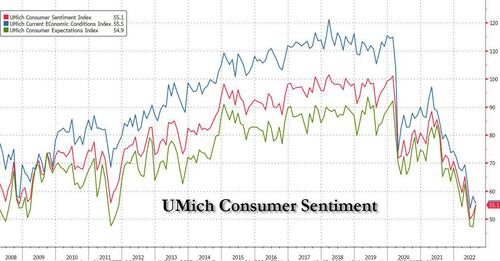

On the surface, today’s UMichigan consumer sentiment print came well above expectations (as one would expect with the midterm elections just 3 months away): the headline sentiment index jumped to 55.1 from 51.5 and beating expectations of 52.5, driven by a surge in expectations from a decade low of 47.3 to 54.9, beating expectations of 48.5 even as current conditions actually dropped from 58.1 to 55.5, missing expectations of 57.8.

Contrary to expectations, it was actually Republican and Independent sentiment that improved in July, while Democrat sentiment tumbled to a fresh two-year low.

While optimism may have improved, buying conditions did not and as the chart below shows, buying conditions for most major purchases – house, car, large durables – remain mired at or near all time lows as inflation continues to crippled consumers’ shopping mood:

Below are some of the key comments from the report: as noted above, they underscore the schism between growing optimism about the future and deteriorating current conditions:

“All components of the expectations index improved this month, particularly among low and middle income consumers for whom inflation is particularly salient.”

“High income consumers, who generate a disproportionate share of spending, registered large declines in both their current personal finances as well as buying conditions for durables.”

“While consumers’ views of their personal finances are essentially unchanged from last month, when asked specifically about the trajectories of their incomes over the next year the median expected change was 2.1%, up from 1.1% the past two months.”

But while the headline UMich numbers were decidedly mixed, what may spook markets is that unlike the recent record collapse in inflation expectations documented by the NY Fed Consumer Survey earlier this week…

… the UMich inflation expectations actually increased over the long run and while inflation over the next year dropped from 5.2% to 5.0% (vs 4.6% one year ago), below the 5.1% forecast, median inflation expectations for the 5-10 year period jumped to 3.0% from 2.9% and well above the expectations of 2.8% (while the 5-10 year mean expectation, meanwhile, rose from 3.4% to 4.0%, and back to its all time high). So much for lower gas prices taking inflation expectations lower

As a reminder, it was the 3%+ print (subsequently revised well lower) two months ago that prompted Powell to hike by a higher than expected 75bps in June. Which is why today’s 5-10Y inflation forecast was closely watched and hints at a continuation of tightening by the Fed.

As Bloomberg notes, “this is not a report that will comfort the Fed, and while it won’t swing the balance of risk for September to 75 bps, it does suggest that declaring victory over inflation is decidedly premature.”

Tyler Durden

Fri, 08/12/2022 – 10:22