A Defense Sector Tailwind Helped By US-China Tensions Isn’t Immune To Supply Chain Hangups

“It’s all a god damn fake, man. It’s like Lenin said: you look for the person who will benefit, and, uh, uh, you know…” – The Dude, The Big Lebowski

When looking for those who will benefit from rising tensions between the U.S. and China, look no further than defense contractors like Lockheed, Boeing and Raytheon. They will continued to stand to benefit…that is, assuming they can get the parts they need to manufacture.

According to a new report from Nikkei, the firms are scrambling to try and meet demand from a slew of new orders that are arising due to the heightened tensions.

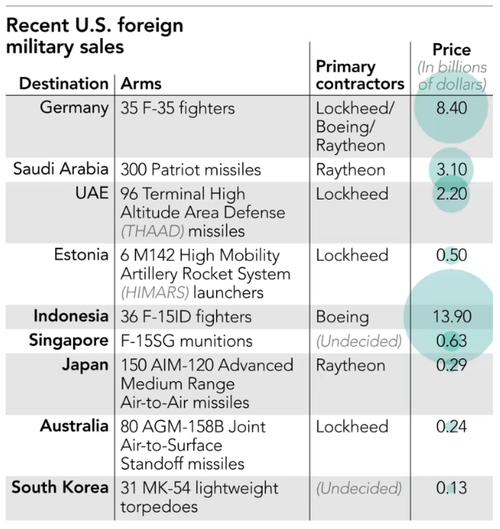

For example, Japan purchased 150 air-to-air missiles that can be loaded on its F-35 fighters from Raytheon Technologies, the report notes. The deal totalled $293 million.

Singapore bought laser-guided bombs and other munitions from the U.S. for $630 million on the very same day, the report notes.

Australia was also given the approval to buy 80 air-to-surface missiles from Lockheed Martin just days prior. That deal totaled $235 million, the report says.

Finally, South Korea is spending $130 million on 31 lightweight torpedoes to use with its MH-60R helicopters, the report says.

The Defense Security Cooperation Agency, which oversees foreign military sales, has had a “busy few months”, facilitating 44 deals that included an $8.4 billion potential sale of F-35’s to Germany.

And like everyone else in the world, these orders have been mired in supply chain hell. Lockheed, Raytheon, Boeing, Northrop Grumman and General Dynamics have all discussed that they are having difficulty securing both parts and labor during their most recent respective earnings calls.

China could (purposefully or incidentally) wind up adding complexities to the supply chain drama, should they move to infringe further on Taiwan.

Bradley Martin, director of the RAND National Security Supply Chain Institute, told Nikkei: “When disruptions don’t occur, this practice benefits producers and consumers alike. When they do occur, whether the reason is a pandemic or a natural disaster or an international conflict, there’s wide impact, sometimes in unexpected ways.”

“The Pacific is on higher alert because of the statements and actions of China recently, not to mention North Korea. The value of deterrence has never been greater,” he added.

And while Lockheed’s sales were lower than expected last quarter, the blame has been place on supply chain challenges. In fact, the firm lowered its 2022 outlook to reflect such challenges.

Brian West, Boeing’s chief financial officer, had similar concerns: “We continue to experience real constraints.”

“To stabilize production and support our supply chain, we’re increasing our on-site presence at suppliers, creating teams of experts to address industrywide shortages, utilizing internal fabrication for search capacity and managing inventory safety stock levels,” he continued.

Gregory Hayes, the chairman and CEO of Raytheon, followed suit: “We’re seeing lead times double and sometimes triple.”

Kathy Warden, CEO of Northrop, concluded, noting that the recent events could act as a tailwind for defense going forward: “We’ve seen a fundamental shift in global commitment of resources for defense and national security, particularly in Europe.”

“The geopolitical environment has highlighted an increased requirement for defense and deterrent. In the U.S., this has also resulted in strong bipartisan support for defense spending.”

Tyler Durden

Thu, 08/11/2022 – 18:40