Bonds Celebrate CPI Miss With One Of The Strongest 10Y Auctions In History

One day after a stellar 3Y auction saw the lowest dealer award on record, which many said (correctly) hinted at a big CPI miss, moments ago we got the follow through to today’s massive CPI miss when the Treasury sold $35BN in 10Y paper in one of the strongest auctions on record.

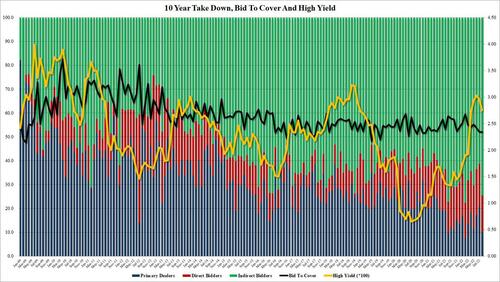

The high yield in today’s sale of $35BN in paper came in at 2.755%, down from 2.94% in July and the 2nd consecutive decline; the yield also stopped through the 2.7610% When Issued by 0.6bps, the first stop through for the 10Y tenor since February!

The internals were just as strong, with Indirects awarded a whopping 74.5%, the third highest on record, the highest since February’s 77.6% and way above the six-auction average of 67.7%. And with Directs taking down 15.6%, below the recent average of 17.6%, Dealers were left holding just 9.9%, the lowest since February (7.4%) and the second-lowest Dealers award on record.

Overall, this was a 2nd consecutive stellar 10Y auction which just like inflation, has seen yields top and are now sliding fast as the US economy is headed for a recession, an outcome which will send 10Y yields far lower from here even as the curve inverts to even more grotesque levels.

And as refunding week concludes tomorrow with another 30Y auction, expect nothing but fireworks as the scramble for duration kicks into high gear.

Tyler Durden

Wed, 08/10/2022 – 13:20