Futures Rise Ahead Of Closely Watched CPI Report

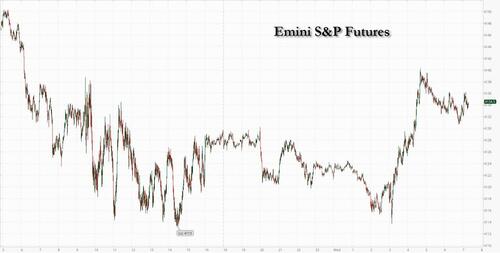

US equity futures reversed earlier losses and traded modestly in the green in cautious, muted overnight action before US inflation data which is expected to show headline US CPI cooled but stayed elevated in July, and which will shape investor expectations for further Fed rate hikes. S&P 500 contracts climbed 0.2% as of 715am ET, following a fourth day of declines in the underlying index Tuesday after Micron Technology followed Nvidia, and become the latest chipmaker to warn of slowing demand. Nasdaq 100 futures also rose 0.3% as Tesla hilariously gained in pre-market after CEO Elon Musk vowed an unexpected $6.9 billion sale of Tesla stock – his biggest on record – would be his last (which would be at least somewhat credible if he didn’t say that after every previous stock sale). Europe’s Stoxx 600 Index erased an initial drop, while the dollar slumped, and 10Y Treasury yields traded flat around 2.79%, while the 2s10s curve remained inverted by a massive 50bps. Crude oil dropped below $90 a barrel as a major pipeline from Russia to central Europe was set to resume flows in the coming days, and industry estimates showed an increase in US inventories. Gold and Bitcoin edged lower.

As noted above, Tesla paradoxically rose 2.7% in premarket trading, after Elon Musk sold $6.9 billion in shares, the billionaire’s biggest sale on record, saying he needs cash in the “hopefully unlikely” event he’s forced to buy Twitter and equity partners pull out. He’s offloaded a record $32 billion of the stock in the past 10 month. The billionaire also said he was done selling shares in the electric-car maker and would buy stock if the Twitter deal doesn’t close (narrator: he won’t). Bank stocks are also mostly higher in premarket trading Wednesday as investors await the release of key inflation data that could help determine the Federal Reserve’s rate hike path going forward. In corporate news, Coinbase posted a record $1.1 billion second-quarter loss and lower-than-expected revenue. Meanwhile, Carlyle Group’s global head of investor relations Nathan Urquhart is leaving the firm to become president at Coatue Management. Here are some other notable premarket movers:

Allbirds (BIRD US) cut to equal- weight from overweight and PT lowered to $5 from $12 at Morgan Stanley, with the broker saying the footwear retailer’s weak results make its path to profit less clear.

AMC Entertainment (AMC US) and fellow so-called meme stocks were trading lower in premarket trading as the recent surge in the cohort loses steam.

CF Industries (CF US) raised to overweight from equal- weight and PT up to $120 from $103 at Barclays as the broker refreshes its views on fertilizer stocks following the 2Q earnings season.

Coinbase (COIN US) shares fall 6.5% in premarket trading after the company narrowed its average monthly transacting users forecast for the full year. It reported a record $1.1b loss in the second quarter and revenue that fell short of expectations. Analysts were optimistic about the BlackRock partnership, but noted that benefits from that will take time to reflect. .

Plug Power (PLUG US) shares fall 2.1% in US premarket trading, after the hydrogen fuel cell maker’s net revenue for the second quarter missed analyst estimates. Brokers remained positive on the prospect of the company benefiting from the landmark tax, climate and health-care bill that was recently passed in the Senate, and raised their price targets on the stock given the longer-term outlook.

Welltower’s (WELL US) guidance missed the average estimate, with analysts expecting the stock to underperform on concerns around softer guidance and higher costs. .

Wix.com (WIX US) shares initially rise 1.8% in US premarket before giving up gains after a 3Q revenue forecast missed estimates. Jefferies notes the focus is on margin, with a $150m cost-reduction plan to hit its three-year FCF margin target.

Investors will be closely monitoring the US inflation data at 830am Wednesday to recalibrate bets on further Federal Reserve interest-rate hikes. Economists estimate consumer price inflation probably slowed last month from a quicker-than-expected annual rate of 9.1% in June. Headline consumer price inflation will soften in July from the prior month, but with the core CPI heating up that’ll be cold comfort for the Federal Reserve, according to Bloomberg Economics analysts including Anna Wong

“Today’s inflation number could set the tone for the markets for the rest of the month,” said Craig Erlam, a senior market analyst at Oanda. “A lower-than-expected number could be a major tailwind for the markets while anything around or above the June reading could trigger a big risk reversal in the markets as the debate shifts to 75 or 100 basis points, with 50 left in the rearview mirror.”

St. Louis Fed President James Bullard said the US central bank will be prepared to hold interest rates “higher for longer” should inflation continue to surprise to the upside. The Fed “will be driving those short rates higher,” said Gary Schlossberg, a global strategist for Wells Fargo Investment Institute, on Bloomberg Television. “We will be seeing a deepening inversion and a full inversion of the Treasury yield curve.”

Meanwhile, China’s military said exercises held around Taiwan in response to US House Speaker Nancy Pelosi’s visit had concluded, while pledging to continue regular patrols near the island.

In European trading, the Stoxx 50 rose 0.1% with the FTSE MIB outperforming, adding 0.3%, FTSE 100 is flat but underperforms peers. Insurance, travel and autos are the strongest performing sectors. Here are the biggest European movers:

Ahold Delhaize shares jump as much as 8.2%, the most intraday since March 2020, after the grocer reported 2Q results that beat estimates, increased its guidance for the year and said it was postponing the Bol.com IPO.

Deliveroo shares rise as much as 5% after the food-delivery company reported a smaller-than-expected adjusted Ebitda loss for 1H, following last month’s preliminary report and guidance cut.

BASF shares fall as much as 2% after Germany’s Federal Waterways and Shipping Administration reported that it expects the Rhine’s water level to drop, making shipping virtually impossible. Other companies with sites along the Rhine also fell.

Sixt shares drop as much as 8.5%, the most intraday since May, following the firm’s confirmation of guidance that analysts called “conservative.”

Shares in Norwegian seafood firms fall as Nordea cut ratings on three stocks in the sector. Leroy fell as much as 6.8% after being cut to sell.

4imprint shares jump as much as 17% in London as analysts increase 2022 EPS estimates on the back of 1H earnings that showed strong momentum.

Sika shares drop as much as 2.9% as its $5.8 billion purchase of MBCC Group faces an in-depth investigation by the UK’s CMA over concerns the deal may weaken national competition in the supply of chemical admixtures.

Demant shares fall as much as 4.7% after Danske Bank resumes coverage of the hearing-aid maker with a hold rating.

Earlier in the session, Asian stocks fell as risk-off mood prevailed. The MSCI Asia Pacific Index dropped as much as 1.1%, headed for the lowest in two weeks. Technology shares were the biggest drags after Micron Technology became the latest chipmaker this week to sound the alarm over a slowdown in demand. Chinese and Hong Kong shares led losses in the region as traders digested the policy implication of inflation accelerating in the world’s second-largest economy. Meanwhile, Xinjiang and Tibetan capitals in China remain under heavy movement controls as the nation sticks to its Covid Zero strategy.

Asian emerging markets have been under pressure as the prospect of faster monetary tightening by the Fed has stoked fears of capital outflows and forced some of the region’s central banks to follow suit. External demand from the US and Europe is “expected to weaken on the back of inflationary pressure and hawkish central bank policies, which could create headwinds for the export-driven manufacturing sector,” said William Fong, head of Hong Kong China equities at Barings. But this could also “provide some relief to commodity prices, which are expected to benefit the overall Chinese economy.”

Japanese stocks declined for a second day as investors await US inflation data. The Topix Index fell 0.2% to 1,933.65 as of the market close Tokyo time, while the Nikkei declined 0.6% to 27,819.33. Sony Group Corp. contributed the most to the Topix’s decline, decreasing 2%. Out of 2,170 stocks in the index, 1,020 rose and 1,042 fell, while 108 were unchanged. “The focus is on whether the US CPI acceleration will stop as expected,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Limited. “If acceleration continues, it will put pressure on the stocks and especially on US stocks which are likely to fall significantly.”

Indian stocks were little changed on Wednesday, after fluctuating for most of the session ahead of the US CPI report. The S&P BSE Sensex closed down 0.1% at 58,817.29 in Mumbai, while the NSE Nifty 50 Index ended up 0.1%. Infosys weighed down the Sensex by the most as the IT-services provider dropped 1.1%; ICICI Bank’s 1.4% gain provided some offset. Among the 30 shares in the Sensex index, 17 fell and 13 rose. Eleven of the 19 sectoral indexes compiled by BSE Ltd. declined, led by a gauge of software exporters. In earnings, of the 42 Nifty companies that have announced quarterly results so far, an equal number missed and exceeded analyst estimates.

In FX, the Bloomberg Dollar Spot Index fell 0.2%, falling for a third consecutive session. JPY and EUR are the weakest performers in G-10 FX, NOK and NZD outperform. Trading in other G10 currencies lacked a clear theme before the US data, with the Norwegian krone and Swiss franc leading gains, while the Japanese yen and Australian dollar lagged.

In rates, treasuries futures traded choppy and off session highs after bull-flattening move in core European bonds, which outperform. Cash yields have flipped to cheaper on the day from belly to long-end while front-end outperforms ahead of July CPI report and 10-year note auction later in the session. US 10-year yields around 2.79%, cheaper by ~2bp vs Tuesday’s close, with bunds and gilts outperforming by 3bp and 1bp in the sector; front-end outperformance re-steepens 2s10s spread (which reached -49.8bp Tuesday) by ~2bp ahead of 10-year note auction. The US refunding auction cycle continues with $35b 10-year note sale at 1pm ET, following Tuesday’s 3-year sale, which stopped through and produced record low primary-dealer award; cycle concludes Thursday with $21b 30- year bond. UK yield curve twist flattens; 2s10s curve down about 5bps to -1.1bps, inverting for the first time since BOE’s 50bp rate hike on Aug. 4. Bunds edge higher, outperforming Treasuries by 2bps.

In commodities, crude oil dropped below $90 a barrel as a major pipeline from Russia to central Europe was set to resume flows in the coming days, and industry estimates showed an increase in US inventories. WTI trades within Tuesday’s range, falling 0.7% to around $90. Gold and Bitcoin edged lower, with the yellow metal trading $2 dollars down at around $1,791.

While the likely return of Russian oil flows signaled some relief for Europe’s energy crisis, other developments were less positive: the Rhine River is set to become virtually impassable at a key waypoint in Germany on Aug. 12, with barges that haul everything from diesel to coal effectively unable to transit the river. Meanwhile, the UK is planning for several days over the winter when cold weather may combine with gas shortages, leading to organized blackouts for industry and even households.

To the day ahead now, and the main data highlight will be the US CPI release for July. Otherwise from central banks, we’ll hear from the Fed’s Evans and Kashkari, and earnings releases include Disney.

Market Snapshot

S&P 500 futures up 0.3% to 4,136.25

STOXX Europe 600 little changed at 436.09

MXAP down 0.8% to 158.80

MXAPJ down 1.1% to 518.37

Nikkei down 0.6% to 27,819.33

Topix down 0.2% to 1,933.65

Hang Seng Index down 2.0% to 19,610.84

Shanghai Composite down 0.5% to 3,230.02

Sensex down 0.1% to 58,773.55

Australia S&P/ASX 200 down 0.5% to 6,992.67

Kospi down 0.9% to 2,480.88

German 10Y yield little changed at 0.91%

Euro little changed at $1.0217

Gold spot down 0.2% to $1,790.75

U.S. Dollar Index down 0.14% to 106.22

Top Overnight News from Bloomberg

China’s military said exercises held around Taiwan in response to US House Speaker Nancy Pelosi’s visit had concluded, while pledging to continue regular patrols near the island

Hungary’s biggest refiner said it has paid Russia’s transit fee to Ukraine to resolve a dispute that has led to a halt in oil flows to central Europe.

Elon Musk offloaded $6.9 billion worth of stock in Tesla Inc., saying he wanted to avoid a sudden sale in the event he’s forced to go ahead with his deal to acquire Twitter Inc

Temperatures in Europe are climbing again as another heat wave sweeps the continent, threatening to disrupt travel and business and ratcheting up pressure on the region’s strained power infrastructure

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly subdued following the weak handover from the US where tech stocks were pressured after Micron’s warnings and with markets also cautious ahead of US CPI data. ASX 200 was lacklustre amid a spooked tech industry although the losses in the index were stemmed by strength in utilities, energy and the top-weighted financials sector which benefitted after Australia’s largest lender CBA posted higher profits. Nikkei 225 was pressured after it recently fell back beneath the 28,000 level and as the biggest movers remained influenced by earnings releases. Hang Seng and Shanghai Comp were subdued with underperformance in Hong Kong amid the tech woes, while the mainland was somewhat choppy after softer than expected Chinese inflation data.

Top Asian News

Urumqi city in China’s Xinjiang will implement a partial lockdown due to COVID, according to state TV.

Japanese Chief Cabinet Secretary Matsuno, Finance Minister Suzuki and Economy Minister Yamagiwa will remain in their roles following the cabinet reshuffle, while ex-Economy Minister Nishimura will become the new Trade Minister and ex-Defence Minister Hamada will become the new Defence Minister.

Two Chinese Among Nine Dead in Worst Seoul Storm in a Century

Thailand Signals Gradual Moves After First Hike Since 2018

European bourses are mixed and near the unchanged mark overall, Euro Stoxx 50 +0.1%,, after a softer open following a downbeat APAC/Wall St. handover. Stateside, futures have lifted off initial lows but reman in proximity to unchanged levels pre-CPI, ES +0.2%.

Top European News

UK Tory leadership frontrunner Truss has rejected calls from the CBI to meet with PM Johnson and former Chancellor Sunak to agree on a common pledge to tackle the cost of living crisis, according to FT.

German Finance Ministry wants to raise all income tax bracket thresholds apart from tax on the rich, which still kicks in at EUR 277,826 and expects the tax take to drop by EUR 10.1bln in 2023, according to Reuters sources.

German Finance Minister Lindner says the economic outlook for the nation is fragile; the economic situation is deteriorating and they are planning an inflation relief package, would be worth EUR 10bln in value.

Rhine river, Germany is seen as being effectively impassable at a key point on August 12th, via Bloomberg;

ABN Amro Flags Boost From Higher Rates After Beating Estimates

FX

DXY is softer but within a tight range and still above 106.00 vs a 106.40 high, with G10s benefitting across the board.

Antipodeans lead the charge while EUR and GBP post modest gains vs the USD.

Havens are also firmer against the Buck, albeit within narrow parameters ahead of US CPI.

Fixed Income

Decisive march higher experienced in both core and periphery counterparts with catalysts limited pre-CPI.

US yields are incrementally steeper, though the inversion/flattening theme remains intact.

German 2048 supply well received, but uneventful.

Commodities

WTI Sep and Brent Oct futures remain softer but off worse levels.

Spot gold is flat below USD 1,800/oz with the 50 DMA today seen at 1,785.31/oz and the 10 DMA seen at 1,775/oz

LME metal futures are mixed and copper fell back under USD 8,000/t.

Hungary’s MOL says transport through the Friend ship pipeline can resume “thanks to MOL”; has conducted negotiations between Ukraine and Russia to resume transport via the pipeline and has transferred the fee due for the Ukraine section.

Indian companies are using APAC currencies as payment for Russian coal imports, via Reuters citing sources/documents, in order to avoid sanctions; Yuan among the currencies becoming more popular.

US Event Calendar

7am: U.S. MBA Mortgage Applications, Aug. 5, 0.2%, prior 1.2%

8:30am: U.S. CPI MoM, July, est. 0.2%, prior 1.3%; YoY, July, est. 8.7%, prior 9.1%

8:30am: U.S. CPI Ex Food and Energy MoM, July, est. 0.5%, prior 0.7%; Ex Food and Energy YoY, July, est. 6.1%, prior 5.9%

10am: U.S. Wholesale Inventories MoM, June F, est. 1.9%, prior 1.9%

2pm: U.S. Monthly Budget Statement, July, est. -$175.0b, prior – $302.1b

Central Banks Speakers

11am: Fed’s Evans Discusses the Economy and Monetary Policy

2pm: Fed’s Kashkari Discusses Inflation

DB’s Jim Reid concludes the overnight wrap

Markets seems to be going into today’s all important US CPI a little on the apprehensive side. I’d imagine they’ll also be a lot of family holidays interrupted today by a stressed financial market worker checking their phones, portfolios and latest predictions while their families frustratingly try to compete for attention.

The nervousness is hardly surprising when you consider that these prints have coincided with some of the most volatile market reactions over the last year. Indeed, it was only two months ago that the release sent the S&P 500 to its lows for the year and contributed to the Fed accelerating its hiking pace to 75bps. Ironically that volatility and change in momentum from the Fed marked the lows in risk and the highs in bond yields. Even last week’s stronger-than-expected jobs report, which increased the probability of a third successive 75bps hike hasn’t dented the bounce back too much but the market is now waiting for direction. As we go into the print the market is pricing in around 68bps of a 75bps hike.

In terms of what our US economists expect, their view is that June’s +9.1% CPI reading was the peak in the year-on-year measure and that today’s reading for July will mark the start of a gradual move lower, with their forecasts looking for an +8.8% reading (consensus +8.7%). That’ll be aided by energy dragging on the headline CPI print, with their monthly forecast for July at +0.3% showing a significant slowing in price growth from the +1.3% in June (which itself was the fastest monthly inflation in the US since September 2005). However, they expect that core inflation will move back up on a year-on-year basis to +6.1%, bringing an end to three consecutive monthly declines since its recent peak in March. The market should care more about core if these figures are correct but it’s certainly possible that a decent fall in the headline could give a market hungry for positive inflation news a big filip. We will see.

Ahead of this, the S&P 500 (-0.43%) lost ground for a 4th consecutive session yesterday even if that totals up to “only” -0.79%. Interest-sensitive tech stocks like the NASDAQ (-1.19%) bore the brunt of the losses. That wasn’t helped by the news from Micron (-3.74%) that they were lowering their Q4 revenue forecast, as well as fears about a more aggressive pace of hikes from the Fed which rose yields and inverted the curve further. It was much the same story in Europe too, with the STOXX 600 shedding -0.67%, as other indices including the DAX (-1.12%) and the CAC 40 (-0.53%) also lost a fair bit of ground.

Those risk-off moves in Europe were given further support by yet another round of negative developments on the energy side. A key development that led oil prices higher in the aftermath were reports that Russian oil flows via the southern portion of the Druzhba pipeline were suspended on August 4. That pipeline goes through Ukraine to Hungary, Slovakia and the Czech Republic and is clearly not what policymakers want to hear when they’re already grappling with a significant price shock. On top of that, we saw French and German power prices for 2023 rise to yet further records, with French power up +2.65% to €556 per megawatt-hour, and German power up +1.10% to €411 per megawatt-hour. And if that wasn’t enough, Bloomberg went on to report that the UK government’s “reasonable worst-case scenario” included several days of organised blackouts that could see emergency measures triggered to conserve gas. It was quite a scary read.

This downbeat tone was evident across asset classes, not least among US Treasuries where the 2s10s curve (-4.2bps) moved even deeper into inversion territory at -49.6bps. That’s the most inverted it’s been since 2000, and is actually coming increasingly close to breaching that milestone, with the point to beat at -56bps, which would take it back to levels unseen since 1981. That inversion has in part been driven by growing expectations of a more hawkish Fed, with the rate priced in by December 2023 moving up +7.9bps yesterday to 3.13%. In line with the tighter expected policy, the inversion was driven by yields across the curve moving higher, with 2yr yields climbing +6.4bps to 3.27% and 10yr yields +2.0bps higher at 2.78%. European yields similarly moved higher, with those on 10yr bunds (+2.3bps), OATs (+3.1bps) and BTPs (+0.5bps) all rising on the day. This morning in Asia, yields on the 10yr USTs (+0.91 bps) are slightly up at 2.79% but the curve has resteepened a couple of basis points.

Asian equity markets are broadly lower this morning. As I type, the Hang Seng (-2.05%) is leading losses across the region dragged lower by declines in Chinese listed technology stocks with the Shanghai Composite (-0.37%) and CSI (-0.86%) also trading in negative territory following the release of China’s lower than expected consumer and producer prices data (more below). Elsewhere, the Nikkei (-0.72%) and the Kospi (-0.65%) are also weaker in early trade.

Outside of Asia, US stock futures are looking for direction with contracts on the S&P 500 (-0.05%) and NASDAQ 100 (-0.10%) only slightly lower. At the moment Elon Musk selling $6.9bn worth of Tesla shares in case he’s forced to go through with the Twitter purchase doesn’t seem to be hurting sentiment at the moment.

Early morning data showed that China’s consumer price rose +2.7% y/y in July (v/s +2.9% expected), up from +2.5% in June, recording its strongest growth since July 2020 even with the miss. Producer prices also missed and rose by +4.2% y/y in July, down from +6.1% growth in June and lower than the +4.9% gain predicted, indicating that underlying inflation pressures remain limited in the world’s second largest economy. Over in Japan, producer prices were up +0.4% m/m in July, in line with market expectations but down from the upwardly revised +0.9% increase in June (originally +0.7%).

In terms of yesterday’s data, US nonfarm productivity fell by -4.6% in Q2, in line with expectations, though unit labour cost rose by a faster-than-expected +10.8% (vs. +9.5% expected). Elsewhere, the NFIB’s small business optimism index for July came in at 89.9 (vs. 89.5 expected), which marked the first monthly increase in that reading so far this year.

To the day ahead now, and the main data highlight will be the US CPI release for July. Otherwise from central banks, we’ll hear from the Fed’s Evans and Kashkari, and earnings releases include Disney.

Tyler Durden

Wed, 08/10/2022 – 07:45