Futures Reverse Overnight Losses As More Curves Invert, Yen Plummets To 7 Year Low

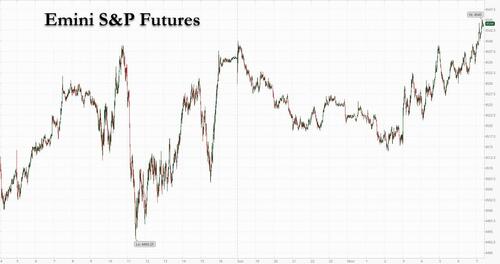

After initially sliding lower, US equity futures reversed and erased earlier declines, climbing 0.2% along with Nasdaq futures as Stoxx Europe 600 extends gains to 1.1%, a move that found added inertia after Tesla, one of the world’s biggest companies, soared 6% after hinting it too would pursue a stock split weeks after Amazon did the same. Most Asian shares lost ground earlier, with Chinese stocks falling as a virus flareup led to a lockdown in financial hub Shanghai, and raised worries over fresh supply chain disruptions while even higher yields led to growing recession fears. Cryptocurrency-exposed stocks gains as Bitcoin turned positive for 2022; gold and oil retreated.

The early weakness in risk was driven by today’s extension of last week’s yield surge which saw 10Y yields rise as high as 2.55% and 2Y yields surge as high as 2.41%, and which dented sentiment toward growth sectors with investors concerned about economic risks from inflation and tightening monetary policy. Following recent inversions in the 3s10s and 5s10s, another key part of the Treasury curve also inverted for the first time since 2006, as the yield on the five-year note rose above that on the 30-year bond.

Overnight, bonds slid from Australia to the U.K., while Japan’s 10-year rate extended gains even after the country’s central bank announced two unlimited buying operations to keep yields below the top of its allowed range. The BOJ intervention also sent the yen plunging to a seven-year low and on its way to USDJPY 130, while the dollar jumped. The relentless bond rout suggests fixed-income investors (unlike their permabullish equity colleagues) anticipate an economic downturn and even a recession as the Federal Reserve hikes interest rates.

“The flattening and the inversion of the yield curve bring about the worries of a recession in the U.S.” said Ipek Ozkardeskaya, an analyst at Swissquote.

In premarket trading shares in big U.S. energy companies declined as crude prices drop after China’s virus resurgence raised concerns about demand, while rebels in Yemen announced a temporary pause in hostilities against Saudi Arabia. Exxon Mobil (XOM US) -1.4%, Chevron (CVX US) -1.4%. Apple also dropped, sliding 1.8% in premarket trading, after a Nikkei report that the tech giant plans to cut production of the iPhone SE model next quarter amid lower demand for consumer electronics. Beyond Meat slumped 4.9% following a downgrade to underweight from neutral at Piper Sandler. Cryptocurrency-exposed stocks gained in U.S. premarket trading and in Europe as Bitcoin continues its recent rally to climb above the $47,000 level and wipe out losses for the year. Riot Blockchain (RIOT US) +7.5%, Marathon Digital (MARA US) +9.8%. Other digital assets are also higher this morning, with Ether gaining as much as 3.7%. Crypto stocks rising include Riot Blockchain +6.9%, Marathon Digital +8.2%, Bit Digital +5.5%, Coinbase +4.2%, MicroStrategy +6.1%, BitNile +36%, Hive Blockchain +5.7%, Core Scientific +5.1%, Silvergate +4.3%, Eqonex +3.3%, Stronghold Digital +6.2%, Hut 8 Mining +6.8%, Bakkt +6.3% and Ebang +5.3%. Other notable premarket movers:

Microchip, Qorvo and Teradyne shares are downgraded to neutral at Goldman Sachs, as firm reduces estimates across its coverage of chip stocks amid a more challenging macro backdrop. Qorvo (QRVO US) shares fall 2.4%.

Staar Surgical (STAA US) shares surge 18% after the maker of implantable lenses received FDA approval for its EVO Visian lenses.

Beyond Meat (BYND US) shares drop 5.2% following a downgrade to underweight from neutral at Piper Sandler, with broker saying that there are still fundamental risks.

U.S.-listed casino operators with exposure to Macau could be in focus amid rising worries over the spread of Covid-19 in China. Watch stocks including Melco Resorts & Entertainment (MLCO US) and MGM Resorts (MGM US).

The war in Ukraine continues to disrupt supplies of key commodities, stoking inflation risks that are contributing to expectations of more aggressive Fed tightening. Mobility restrictions in China may fan worries about rising costs.

“What is happening with China, it adds to the concerns of — does this add to the supply-chain disruption?” Mary Nicola, a global multi-asset portfolio manager at PineBridge Investments, said on Bloomberg Television.

In the latest geopolitical developments, Ukrainian and Russian negotiating teams are set to resume in-person talks this week. President Joe Biden tried to temper comments calling for the removal of Vladimir Putin by saying the U.S. isn’t seeking regime change in Moscow. Here are the latest Ukraine developments courtesy of Newsquawk:

Ukrainian President Zelensky said he would like an all for all prisoner exchange with Russia and that they have handed over a list to Russia. Zelensky added that they will not sit down for talks with Russia if discussions are about “demilitarisation and some kind of denazification”. Zelensky stated that Ukraine is ready to discuss neutrality and non-nuclear status if backed by security guarantees, while he added that a deal is only possible with a troop withdrawal and that he wants a compromise with Russia regarding Donbass.

Ukrainian Interior Ministry Advisor says he expects no major breakthrough at peace discussions.

Turkish President Erdogan told Russian President Putin in a call that there needs to be a quick ceasefire with Ukraine and that they need to improve the humanitarian situation in the region, while it was also reported that the next round of face-to-face talks between Russia and Ukraine will be held in Turkey on March 28th-30th.

Senior Turkish official says that talks between Ukrainian and Russian negotiators will begin in Istanbul later today. However, the Russian Kremlin said talks are unlikely to commence on Monday, may start on Tuesday. No substantial achievements/breakthroughs in talks, no progress re. a potential Putin-Zelensky meeting.

Russian Foreign Minister Lavrov says President Putin never refuses to meet with Ukrainian President Zelensky, but since meetings must be well prepared, a (presidential) meeting to exchange views at this time would be counter-productive.

Ukraine’s Deputy PM says that no humanitarian corridors will be opened today as intelligence suggested potential Russian provocations on corridor routes.

Global shares have recovered from the lows sparked by Russia’s invasion, but questions remain about the durability of the equity market advance. It may be that what we’re seeing is “more a bear-market rally,” Chris Weston, head of research with Pepperstone Financial Pty, wrote in a note. He added that investment flows related to portfolio rebalancing at the end of March and the first quarter could lead to “big and questionable moves.”

In Europe, financial and automotive companies led the Stoxx Europe 600 Index up 1.2%. FTSE MIB outperforms slightly. Insurance, banks and autos are the strongest-performing sectors; just miners and the tech sector are in the red. BASF jumped 3.7% after HSBC raised the German chemicals group to buy from hold. Rolls-Royce slumped 10% in London, paring a 19% jump on Friday. European airlines rebound as oil prices fall further from this month’s 14-year high. Budget carriers lead gains with EasyJet up 4.4%, Wizz Air +4.1% and Ryanair +4%. Here are some of the biggest European movers today:

Swatch advances as much as 5.3%, best performer in the Stoxx 600 consumer products and services subgroup, after it launched a new, low-priced version of the Omega Speedmaster watch.

InPost shares rise as much as 33% after Bloomberg reported the Polish automated parcel-locker provider is attracting potential takeover interest from private equity firms.

BASF shares rise as much as 3.2% as HSBC upgrades to buy, noting its trading in 1Q appears to have been strong and points to upside risk on the chemicals group’s FY guidance.

Telecom Italia rises as much as 3.6% after it said discussions with KKR are still on, while the company has received a non-binding offer from CVC Capital Partners for a 49% stake in its new enterprise services unit.

Moonpig rises after being upgraded to add from hold at Peel Hunt, which said the online greeting card company has been “overly de-rated” by a market averse to online retailers.

Cloetta rises as much as 5.4% after Nordea upgraded the Swedish candy maker to buy on a continued recovery and called the stock a “good defensive play,” with a yield exceeding 4%.

Orpea trades mixed, down as much as 8.2% and up as much as 1%, after the French government said it wants the care home operator to return millions of euros in public funds. AlphaValue says the sum requested is “insignificant.”

Asian stocks fell for a third consecutive day, as a Covid-related lockdown in Shanghai and increasing infections in Taiwan renewed investor concern about the fallout of the virus on global supply chains and manufacturing. The MSCI Asia Pacific Index lost as much as 1%, with Taiwan Semiconductor Manufacturing Co. and Sony Group the biggest contributors to the retreat. Taiwan’s Taiex was among the biggest decliners among major regional gauges, while China’s CSI 300 index fell to the lowest in two weeks as Shanghai announced plans for mass coronavirus testing. “The shutdown, as you say, of such a big region is going to have a negative impact. Already the economy was slowing,” Peter Oppenheimer, chief equity strategist at Goldman Sachs, said in an interview with Bloomberg TV. Meituan jumped after strong earnings and Tencent gained on a share buyback plan, cushioning the regional benchmark and propelling an almost 3% rebound in the Hang Seng Tech Index. Still, Asian stocks are headed for their third-straight monthly loss, the worst stretch since early 2020, as concerns from China’s regulatory crackdowns to U.S. interest rate hikes and Russia’s war in Ukraine weigh on sentiment. “Global markets seem to be a bit nervous about the effectiveness of China’s zero-tolerance policy toward Covid, and the potential for more demand and supply-chain disruptions as we might be only dealing with the tip of the iceberg,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. Japanese stocks fell after two-straight weekly gains on support from a weaker yen, while shares also retreated in Vietnam. Hong Kong stocks advanced, as Meituan led a rally in tech stocks after its earnings release Friday.

Japanese equities fell, taking a breather after posting two-straight weekly gains on support from a weaker yen. Electronics makers were the biggest drag on the Topix, which fell 0.4%. Fast Retailing and Tokyo Electron were the largest contributors to a 0.7% loss in the Nikkei 225. The yen slid 0.9% to around 123 per dollar after the Bank of Japan offered to buy an unlimited amount of 10-year notes twice for the first time ever. “It seems like there’s selling to lock in profits as a reaction to last week’s big rally as well as the concerns in the Chinese markets due to rising coronavirus infections,” said Yoshihiro Okumura, a senior analyst at Chibagin Asset Management. “The situation in China may have a negative impact on Japanese stocks, especially ones that are consumption related or to China”

India’s benchmark equities index rose, snapping three sessions of decline, boosted by gains in Reliance Industries. The S&P BSE Sensex climbed 0.4% to 57,593.49 in Mumbai, reversing a drop of as much as 0.9% earlier in the session. The NSE Nifty 50 Index posted a similar gain. Of the 30 shares on the Sensex, 20 gained while 10 fell. Thirteen of 19 sectoral indexes compiled by BSE Ltd. advanced, led by a gauge of oil and gas companies. Price of Brent crude, a major import for the nation, hovered around $116 a barrel, slipping 3.9% on Monday. “Volatility will continue to be the hallmark in this week’s trading as well as Russia-Ukraine war continues to command investors’ attention,” Prashanth Tapse, an analyst at Mumbai-based Mehta Equities wrote in a note.

In rates, Treasury futures are off worst levels of the day after bear-flattening move inverted 5s30s for the first time since 2006. The 10-year ~2.47% is back to little changed after climbing to 2.553% while short-end USTs cheapen ~14bps overnight with 2y yields stalling near 2.4%. As a result, the closely watched 2s10s dropped as low as 9 bps before reversing and trading at 14bps last. Bunds and gilts keep pace. Benchmark yields reached new YTD highs. Front-end underperformance is reinforced by double auction ahead, totaling $101b of 2- and 5-year notes. Front-end yields remain cheaper by ~5bp on the day, after 2Y climbed 14bp to 2.408%; 2s10s at ~15bp is flatter by ~5bp, 5s30s is back to flat after reaching -7.1bp. Monday’s Treasury auctions include $50b 2-year at 11:30am, $51b 5-year at 1pm; cycle concludes with $47b 7-year sale Tuesday. WI 2-year yield at 2.375% is above auction stops since 2019 and ~82bp cheaper than February’s result. IG dollar issuance slate empty so far; expectations are for around $25b this week. Japanese yen steals the spotlight, weakening over 2% to briefly trade above 125/USD. In Europe, peripheral spreads are mixed, 5y Italy underperforming in the complex. Italian bonds lead euro-area declines, with the belly underperforming on the curve as money markets raise ECB tightening wagers.

In commodities, crude futures drift around the Asian lows. WTI drops over 4.5% before rising off the lows to trade near $109.77. Spot gold is under pressure, dropping close to $33 before stalling near $1,930/oz. Base metals are mixed; LME nickel drops as much as ~8%.

Looking at today’s calendar, we have February wholesale inventories, advance goods trade balance, March Dallas Fed manufacturing activity.

Market Snapshot

S&P 500 futures up 0.2% to 4,546

STOXX Europe 600 up 0.6% to 456.32

MXAP down 0.6% to 178.15

MXAPJ little changed at 583.13

Nikkei down 0.7% to 27,943.89

Topix down 0.4% to 1,973.37

Hang Seng Index up 1.3% to 21,684.97

Shanghai Composite little changed at 3,214.50

Sensex up 0.1% to 57,423.97

Australia S&P/ASX 200 little changed at 7,412.42

Kospi little changed at 2,729.56

German 10Y yield little changed at 0.62%

Euro down 0.2% to $1.0961

Brent Futures down 3.7% to $116.17/bbl

Gold spot down 1.4% to $1,929.93

U.S. Dollar Index up 0.46% to 99.24

Top Overnight News from Bloomberg

Spain plans to hand out about 16 billion euros ($17.6 billion) in aid through the end of June to mitigate the impact of the war in Ukraine. The government will offer some 6 billion euros in tax breaks and direct aid with another 10 billion in loans for small- and medium- sized companies as part of a package of policies to counter surging costs, Prime Minister Pedro Sanchez said Monday in Madrid. The package will be approved Tuesday by the Cabinet, he said

The U.K. urged all public bodies to identify contracts they have with Russian and Belarusian companies and to switch suppliers, as Boris Johnson’s government seeks to ramp up pressure on President Vladimir Putin.

The steepest global bond rout of the modern era extended Monday, with Australian and New Zealand notes sliding and the Bank of Japan stepping in to cap the rise in yields

President Joe Biden sought to clarify his call for the removal of Vladimir Putin, saying he wasn’t seeking regime change after European allies raised concern and critics said he was further inflaming tension with Russia. In-person talks between Ukrainian and Russian negotiating teams will resume this week, officials said

French President Emmanuel Macron warned against an escalation of “words or actions,” a day after President Joe Biden said Vladimir Putin “cannot remain in power.” Secretary of State Antony Blinken said the U.S. doesn’t have a strategy of regime change

Oil retreated as China’s worsening virus resurgence raised concerns about demand in the world’s biggest crude importer, while rebels in Yemen announced a temporary pause in hostilities against Saudi Arabia

The People’s Bank of China may soon need to move away from using the reserve requirement ratio as a tool to spur liquidity and growth in the economy since it’s already at relatively low levels and is becoming less effective in addressing the structural challenges facing the economy

Japan’s day traders are making record bullish bets on their home currency, just as the world turns against it

Australia’s bonds are on the cusp of a turnaround as the global inflation scare looks overdone and elevated yields promise higher income to investors, according to Janus Henderson Group

President Joe Biden’s budget release on Monday is shaping up as a direct appeal to moderate Democrats, emphasizing deficit reduction and flexibility on social spending as the White House hopes to win support for new legislation before November’s midterm elections

A more detailed look at global markets courtesy of Newqsuawk

Asia-Pacific stocks traded mostly lower with the region cautious heading into month-end and this week’s various risk events, while higher yields and a lockdown in Shanghai contributed to the headwinds for risk sentiment. ASX 200 shrugged off weak business confidence and was kept afloat by strength in mining stocks and financials. Nikkei 225 is set to snap its 9-day win streak and tested the 28,000 level to the downside. Hang Seng and Shanghai Comp. were mixed with early weakness in the mainland amid a two-stage lockdown in Shanghai after asymptomatic cases in the city rose to a record high and with data also showing a slowdown in Industrial Profits for February YTD. However, the PBoC’s liquidity boost eventually helped stem some of the losses in China, while the Hong Kong benchmark recovered into the green with advances led by Meituan Dianping and Sinopec post-earnings

Top Asian News

Sea Decides to Shut Shopee India Due to Market Uncertainty

Renewables Firm Seeks First Indian Dollar Bond Since War Began

CIFI, Country Garden USD Bonds Set for Highest Closes in Weeks

China Stocks Fall as Shanghai Lockdown Deepens Growth Concerns

European bourses are firmer, extending on the pre-open futures performance, shrugging off a downbeat APAC handover amid COVID concerns. Sectors are primarily in the green though Tech and Energy names lag amid Apple and crude benchmark action, respectively. Stateside, futures are contained/marginally softer ahead of a quiet schedule and after a mixed close on Friday; NQ, -0.3%, modestly lags amid yield action. Apple (AAPL) intends to make ~20% less iPhone SE’s next quarter than was originally planned, via Nikkei; reducing iPhone and AirPods output amid Ukraine war uncertainty. -1.8% in pre-market Tesla (TSLA) is to ask shareholders to vote on more shares for a stock split, according to Bloomberg. +3.6% in pre-market

Top European News

Deutsche Bank to Issue Additional Tier 1 Notes With Call in 2028

Spain to Spend $17.5 Billion to Offset Economic Hit From War

European Gas Falls as Nations Arrange Terminals for More LNG

U.K. Govt Investigates Cutting Contracts With Russia Suppliers

In FX, BoJ intervenes to curb JGB yield but waves green light to further Yen weakness, USD/JPY breaches barriers from 123.50 all the way up through 125.00 before easing back. DXY tops 99.000 and mid-March high to expose Y-T-D peak as US Treasuries continue to sink and the curve flattens or inverts. Aussie maintains momentum on commodity related grounds, while Kiwi is hampered by less hawkish RBNZ outlook from Westpac; AUD/USD approaches 0.7550, NZD/USD hovers under 0.6950 and AUD/NZD tests 1.0850. Euro underpinned by EUR/JPY cross demand, EUR/USD recovers from sub-1.0950 to get close to 1.1000 at best. Loonie and Nokkie undermined by hefty retreat in WTI and Brent, USD/CAD circa 1.2485 and EUR/NOK around 9.4700. Franc softer after SNB President repeats that nominal value is not the same as real and inflation differentials are impacting moves, USD/CHF circa 0.9350 and EUR/CHF above 1.0250. SNB Chairman Jordan said Swiss inflation is high for Switzerland but low in international comparison, while they will make policy adjustments to keep inflation under control if needed and consider the inflation difference between Switzerland and other countries when deciding on currency interventions. SNB Chairman Jordan added that the nominal value of CHF is different to its real value and businesses can cope with a stronger nominal CHF due to higher inflation abroad. Furthermore, he added that CHF remains highly valued and that they are ready to intervene to prevent it from becoming too strong, while parity with EUR is symbolic but not economically important and they look at all currencies and inflation differences not just at the euro.

In fixed income, bonds buckle again as the bear trend continues. Curves flatter or more inverted amidst a front-loaded and shorter-dated supply schedule. JGBs hold up a bit better as BoJ offers to buy unlimited amounts in defence of its YCT through to month/fy-end.

In commodities, WTI and Brent are clipped amid COVID measures from China and progress on the JCPOA; currently, off lows of USD 108.28/bbl and USD 115.32/bbl respectively. Saudi-led coalition said it began an operation to neutralise the targeting of oil facilities with the goal to protect global energy sources from hostile attacks and ensure supply chains, while it carried out airstrikes against sources of threats in Yemeni cities of Sanaa and Hodeidah, according to Al Arabiya. SGH Macro Advisers noted on Friday that Russia is in active talks with Asian partners about the possibility of sending further oil supplies to the Asian market, while SGH Macro understands that China will import at least 10mln tons of Russian oil on top of its original import plan for this year and Beijing sources said the price that Russia offered is equivalent to about USD 70/bbl which is to be settled directly in CNY and RUB. Qatar’s Foreign Minister said the conflict in Ukraine and its geopolitical ramifications, is spurring some countries to explore new ways of pricing oil outside of the dollar, according to CNBC. UAE Energy Minister says everyone is saying to raise production, but financial institutions are hesitant to finance many oil/gas projects globally. US, UK and Japanese banks are considering jointly extending USD 1bln in loans to Kuwait Petroleum Corp to help in increasing oil production, according to Nikkei. Spot gold/silver are hampered amid broader price action and as other havens, particularly JPY and core-debt, experience marked weakness.

US Event Calendar

08:30: Feb. Retail Inventories MoM, est. 1.4%, prior 1.9%

08:30: Feb. Advance Goods Trade Balance, est. -$106.2b, prior – $107.6b

08:30: Feb. Wholesale Inventories MoM, est. 1.1%, prior 0.8%, revised 1.0%

10:30: March Dallas Fed Manf. Activity, est. 11.0, prior 14.0

DB’s Jim Reid concludes the overnight wrap

The dam finally broke last week with yields rocketing up as markets woke up to the reality that every upcoming FOMC meeting could bring a 50bps hike. An array of Fed speakers during the week either endorsed this or didn’t rail against it too strongly.

This move has continued this morning with some big yield increases for an Asian session. US 2yr yields are +9.5bps and 10yrs +5.1bps to 2.52%, flattening 2s10s to 15.6bps. The 5s30s yield curve has inverted for the first time since 2006.

This follows last week’s big moves where 2yr treasury yields gained +33.3bps over the week, predominantly in two large chunks on Monday (+17.9bps) around Powell’s speech and on Friday (+13.5bps). This was the largest weekly advance in 2yr yields since June 2009. Markets increased the odds of a 50bp rate hike in May to 77%, while total tightening for the year increased to 239bps, up from 200bps the week before. 10yr yields modestly lagged the short end move, climbing +32.4bps (+10.1bps Friday), which sent the 2s10s yield curve to its flattest level since February 2020, closing the week at +19.7bps but hitting +13.8bp on Tuesday. The 5s30s yield curve which has inverted this morning declined -23.8bps (-10.1bps Friday) on the week. European sovereign yields also moved higher, with 10yr bunds, gilts, and OATs increasing +21.4bps (+5.5bps Friday), +19.8bps (+4.9bps Friday), and +18.6bps (+3.3bps Friday), respectively.

Given just how far the Fed is behind the curve it’s fair to say that if the post GFC cycle could be erased from people’s memory banks, then I think markets might be pricing 300-400bps of hikes this year. However the fact that the last decade was so moribund from an activity and inflation point of view means that markets still refuse to believe the Fed can get very far. The market is collectively anchored to the trends of the last cycle. Remember that before the FOMC 9 months ago in June 2021 the Fed and the market were hardly pricing in any rate moves until 2024, and only 3 hikes at the start of this year. Overall there has been a constant misunderstanding of this cycle which is totally different to the last. Clearly this is changing but the 240bps plus of total hikes now priced in for 2023 still isn’t a big year of tightening historically.

Asian equity markets are mostly weaker this morning on the back of Covid concerns in Shanghai as the city with 26 million people goes into semi-lockdown from today. The Nikkei (-0.58%) is lagging despite the Japanese yen resuming its slide after the BOJ intervened in bond markets with two offers to buy unlimited 10yr JGBs at 0.25% to defend its yield cap.

The Shanghai Composite (-0.13%) and CSI (-0.79%) are down but the Hang Seng (+1.31%) is moving higher after shares of Meituan soared over +10% after the company posted better than expected revenue in the final quarter of 2021. Stock futures in the US indicate a negative start with contracts on the S&P 500 (-0.31%) and Nasdaq (-0.41%) trading in the red.

Elsewhere, Oil prices are declining as concerns about demand in China (the world’s biggest crude importer) grow. Brent futures are -2.52% to $117.61/bbl while WTI futures are slipping -2.84% to $110.66/bbl, as I type. OPEC meet later this week so that will be a focus.

The most interesting news story over the weekend centred around the unscripted finale to Biden’s speech in Poland on Saturday. In a remark widely interpreted to endorse regime change in Russia he said, “For God’s sake, this man cannot remain in power.” White House officials immediately tried to soften or walk back the ad-lib remarks, including US Secretary of State Blinken on TV yesterday morning. Other Western countries have distanced themselves from the remarks as countries try to not inflame the situation more than it is already.

Moving on, with the rates market in prime focus, the highlight of this week is likely Friday’s payrolls print in the US but the preliminary European CPI prints (Wednesday to Friday) might pip it for excitement depending on the numbers. Germany’s is out on Wednesday. We also have US ISM on Friday which given last week’s strong preliminary global PMIs will be a focus along with the final global PMIs on the same day.

The core PCE within the US spending and income numbers on Thursday will also be of note as will the JOLTS numbers on Tuesday. This has been our favourite lead indicator of US employment over the last year or so and should continue to show an incredibly tight labour market.

Fedspeak was the defining theme last week but this week is likely to be less exciting. Nevertheless, tomorrow see’s Harker (hawk / non-voter) and Bostic (neutral / non-voter). Elsewhere Barkin (neutral / non-voter) on Wednesday, and Williams (dove) on Thursday are the only other two scheduled.

Expanding a bit on the payrolls preview, the market is expecting a +450k gain with the unemployment rate expected to drop to 3.7% from the current 3.8%. One thing to watch might be average earnings as last month the report has a slight dovish feel due to a surprisingly low earnings number. We thought this looked anomolous at the time and will find out this week whether we were right or not.

President Biden’s 2023 budget today will also be scrutinised for responses to inflation, the conflict in Eastern Europe and other topics. However given the congressional arithmetic it’s not clear how much anything he says can manifest itself into actual policy.

In corporate earnings, the spotlight will be on Chinese firms, with the largest real estate companies, including Country Garden and Evergrande, reporting earnings along with EV leaders BYD and XPeng. Results from pandemic outperformers Micron, BioNTech and Lululemon will also be due. European companies reporting will include consumer discretionary bellwethers such as Porsche and H&M. The day by day week ahead calendar is at the end as usual on a Monday.

Moving on to recap last week now and we’ve already highlighted the huge move in bonds at the top. Energy also had a decent week before this morning’s fall as brent crude oil prices advanced +11.2% (+1.36% Friday) to $120.65/bbl. European natural gas prices continued to fall though with a -6.11% dip on the week (-9.29% Friday).

The run up in oil prices helped fuel a +7.9bp increase in 10yr breakevens (+3.8bps Friday), which eclipsed 3.00% at one point before closing at 2.982%, the highest level on record.

European equities staged a modest retreat over the week, with the STOXX 600, DAX, CAC, falling -0.23% (+0.11% Friday), -0.74% (+0.22% Friday), and -1.01% (-0.03% Friday). The S&P 500, meanwhile, put in a second weekly advance despite the much tighter path of policy, gaining +1.79% (+0.51% Friday), returning it to levels from immediately before the US warned the world of an imminent Russian invasion on Friday 11th February. The Energy sector led the gains following this week’s gain in oil, increasing +7.42% this week (+2.28% Friday), extending its YTD outperformance where it is now +42.25% higher with the next closest sector being utilities at +1.70% higher.

On data Friday, University of Michigan inflation expectations were unchanged from the prior survey, with expectations for the next year at +5.4% and 5y expectations at +3.0%.

Tyler Durden

Mon, 03/28/2022 – 08:08