Bear Traps: Traders Believe The Dream Is Still Alive. It’s Not Today

By Larry McDonald, as excerpted from his latest Bear Traps report

“They Turned the Machines Back On” shouted the man on CNBC. When you are in the middle of a significant secular shift in investor psychology one of historic proportions, there will always be those moments where market participants still believe “the dream is still alive.” It’s NOT today, “it´s still yesterday” is the thinking.

The “buy the dip” crowd rushes back into a short covering bonanza and stocks make an extremely unhealthy vertical move higher. That is NOT how real bottoms are formed. Think of Apple – AAPL equity just experienced its largest 9 day move higher in at least ten years up close to 17%. With the S&P 500 up nearly 10% in nine days we file this under Q2 2000 action .

The index closed at 4543 on Friday – right on the ominous 61.8% retracement of the recent decline. With HEAVY resistance at 4600 and wheel barrels full of supply – the “get me even and get me out” crowd is lurking.

The market dynamic looking forward is simple – any new capital coming to play has chosen to “fight the Fed.” The central bank is promising the same accommodation withdrawal speed in 12 months that took them 36 months in the last cycle. Those vertical short covering rallies give investors the appearance that “all is well” but they are staring at a mirage with thirst quenching water and palm trees off in the distance.

Yesterday is gone, tomorrow is on the menu – complete with the most sustainable inflation path investors have experienced in 30 years. Wise men and women are starting to realize – they need a whole new portfolio – designed for an entirely different decade. With nearly 30% of the S&P 500 market capitalization positioned – exclusively for yesterday, the rallies MUST NOT be trusted – especially those of the high speed, South-North variety. Hard assets — gold, silver, uranium, “oil and gas” plays are still under-owned with a Great Wall of capital looking for a new home. Commodity-producing countries like Brazil EWZ (+34%YTD) have made a significant – sustainable move vs. crowded U.S. growth equities, and former index leadership. We must look forward – NOT back – as we turn the next corner.

What is Driving Price Action Higher?

“I will never forget my 2010 NY dinner with Ralph Cioffi – he ran the ill fated Bear Stearns hedge fund in 2007 when it collapsed in the summer of that year. One thing that struck me was he said that Bear Stearns actually failed in Q3-Q4 2007. We must remember there was a face ripping counter trend rally in September (S&P 500 +15 % from August to October ) that forced a lot of players out of their hedges (and mortally wounded Bear Stearns).

There is NOTHING worse than having a liquid high vol hedge rip HIGHER vs. an illiquid asset. It´s a classic liquidity mismatch, the losses can be colossal and of course the risk manager will always walk over, forcing new hedges onto traders at the worst possible time, without fail. This is what took place in banks around the world from March 8-14th! Banks are levered, they cannot afford risk at a certain point, in their view, they MUST hedge even if it’s at the absolute wrong time. As the WW3 threat receded over the last 6 days, we can see those hedges coming off in spectacular fashion. They´re jumping over the seats swinging on the chandeliers trying to get long and get out of their index hedges.”

* * *

What happens is that the risk management team walks over to the trading desk and tells them they need to hedge and asks the traders what they can hedge with; the traders always come up with the most liquid thing they can think of because they want to be able to lift the hedges once given permission to so do; the risk management team never asks about the liquidity of the hedge and if the liquidity matches because their whole view is the firm is stuck in something liquid so the last thing they want to see is another NON liquid line item. In effect, neither the traders nor the risk team has a decent choice this discussion ABOVE meant NOTHING 5 months ago now it means everything we suspect.

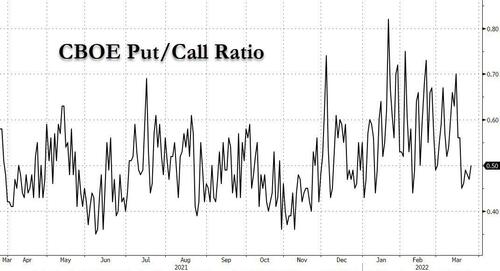

The put/call ratio collapsed last week bears are on the run, gone. The ratio hit one of its lowest levels of the year mid week. The last 3x it got this low since January, the market resumed its downtrend. Either the countertrend rally loses some steam here or maybe we just saw major regime change last week. We say the former…

Tyler Durden

Mon, 03/28/2022 – 08:21