The ECB “Bought Lots Of Italian Gov’t Bonds And Sold Lots Of German Bunds” To Reverse Spread Blowout

It appears that while the ECB was busy coming up with its latest alphabet soup acronym – the Transmission Protection Instrument or TPI – meant to prevent an Italian bond implosion similar to 2011, the central bank was busy doing everything in its power to prevent “lo spread” from exploding.

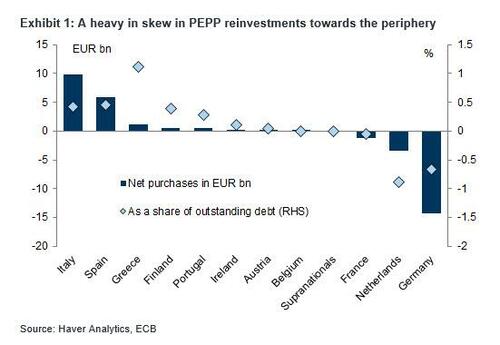

In the first data release since the ECB activated PEPP reinvestment flexibility, we find a heavy skew in country allocation, away from core countries like Germany and towards the periphery, especially Italy and Spain, over the month of July 2022.

This clear relative-value market “nudging” by the central bank, meant to make German bonds appears weaker and Italian bonds stronger, was described by the IIF’s Robin Brooks as follows:

The ECB bought lots of Italian gov’t bonds in June & July and sold lots of German Bunds. This is the ECB steering proceeds from maturing government bonds in core countries like Germany and the Netherlands to benefit Italy.

As the former Goldman FX trader correctly concludes, “Lo Spread” would be a lot wider without this going on.“

The ECB bought lots of Italian gov’t bonds in June & July and sold lots of German Bunds. This is the ECB steering proceeds from maturing government bonds in core countries like Germany and the Netherlands to benefit Italy. “Lo Spread” would be a lot wider without this going on… pic.twitter.com/XtD7h7iBWD

— Robin Brooks (@RobinBrooksIIF) August 2, 2022

While one can debate the semantics of what exactly the ECB is doing with PEPP maturity proceeds, the clear intention is to narrow the spread even if, as Goldman notes, “stability in the maturity of purchases suggests the ECB does not intend to lean against a repricing at a particular point of the yield curve.” Right: not a particular point of the curve – the entire curve.

Here are some more point on this latest unexpected attempt by the central bank to manipulate market sentiment, courtesy of Goldman’s Simon Freycenet:

1. The bi-monthly breakdown of PEPP holdings for the months of June and July 2022 represents the first data release since the ECB activated PEPP reinvestment flexibility as a first line of defence against fragmentation, as of July 1st.

2. The country allocation of net purchases shows a heavy skew in allocation, away from core countries and towards the periphery, for an aggregate stability in holdings (Exhibit 1). Indeed, though the ECB does not provide a country breakdown of redemptions, we estimate that about 75% of securities maturing in July were issued by Germany or the Netherlands (Exhibit 2).

In contrast, the data release shows that out of the EUR18bn-worth of securities maturing, about EUR10bn and EUR6bn were allocated to Italy and Spain respectively. PEPP holdings of semi-core securities are stable, suggesting the ECB has prioritized a reduction in holdings in core markets (where the free-float of debt is low, as we showed here).

3. The allocation of PEPP holdings across asset classes is stable, however (Exhibit 3), with holdings of private assets unchanged.

4. The weighted average maturity (WAM) of PEPP holdings is largely unchanged since March 2022 (Exhibit 4). This suggests to us that the ECB continues to purchase fairly evenly across the curve, and does not intend to lean against a repricing at shorter maturities in particular (which is typically seen as indicative of market stress).

5. Today’s data release, with reinvestments of a similar magnitude to our estimated redemptions for the month of July, indicates the ECB is not pulling forward future reinvestments. Rather, in line with reports, the ECB seems to be making country allocation choices as securities gradually mature.

* * *

Bottom line, for now it’s a non-issue as the sharp leak wider in “lo spread” has been contained (now that the market has instead convinced itself that the coming European recession will end the ECB’s rate tightening well in advance of schedule) but once the spread between Germany and Italy explodes again, probably around the time of the next elections in September, don’t be surprised if a whole lot of German are rightfully angry at why their borrowing costs are being manipulated higher by the “impartial” central bank, just so Italy doesn’t crash and burn yet again.

Tyler Durden

Wed, 08/03/2022 – 04:15