Pelosi Plane & Powell’s Pals Prompt More Market Mayhem

Today’s price action was driven by Pelosi (and China’s lack of starting WW3) and hawkish FedSpeak, jawboning back the market’s perception that we are past ‘peak tightening’… returning to ‘forward guidance’.

SF Fed’s Mary Daly jawboned the doves back by stating that The Fed is “nowhere near done” on fighting inflation, adding that “we have made a good start, and I feel really pleased with where we’ve gotten to by this point,” but inflation is “far too high.”

“It really would be premature to unwind all of that and say the job is done,” she said.

“I also think that we’ve been with this high inflation for a while, and really getting too confident that we’ve already solved the problem,” Daly said, adding that the Fed needs to “keep committed until we actually see it in the data.”

Chicago Fed President Charles Evans said he is hopeful that reaching 3.5% by the end of the year is “still reasonable.”

“I think that there’s enough time to play out that 50 is a reasonable assessment, but 75 could also be okay” at the September meeting, he said.

“I doubt that more would be called for” at that meeting, Evans added. But, Evans warned that “if we don’t see improvement before too long, we might have to rethink the path a little bit higher.”

Cleveland Fed’s Loretta Mester said she saw “no signs of a recession” offering no dovish pivot signal by noting that “we have to get inflation under control.”

To really drive the point home, Mester concluded that she “hasn’t seen anything suggesting inflation is leveling off.”

So much for the whole “we are done with forward guidance” narrative.

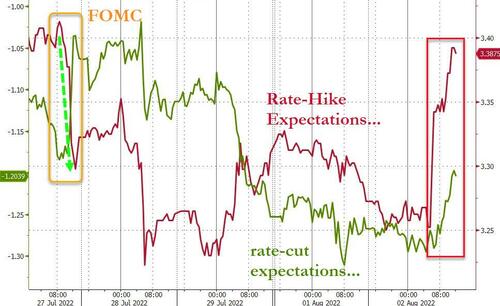

And the market reacted with rate-hike (and rate-cut) expectations shifting hawkishly today. In fact, rate-hike expectations have erased all of the post-Powell-presser easing…

Source: Bloomberg

And expectations for a Q1 2023 rate-cut are falling fast…

Source: Bloomberg

As Speaker Pelosi’s plane landed in Taiwan, a wave of buying appeared in US equities (because hey, BTFWW3) as it appeared that JPMorgan’s thesis played out – no immediate (major) reaction by China means ‘all clear’ (even though China is beginning a completely encircling military drill around the island). However, after Mester spoke, stocks dumped it all back. The last few minutes saw more selling take The Dow and S&P to the lows of the day…

Today’s meltup move was sponsored by a massive short-squeeze from the opening gap down but once Mester spoke the spell was broken…

Source: Bloomberg

Bonds were an utter bloodbath today with the belly of the curve getting absolutely crushed as we shifted from “no forward guidance” back to “forward guidance”. 5Y yields were up 22bps today!…

Source: Bloomberg

That is the biggest daily rise in 5Y yields since 3/17/20, erasing all of the post-Powell-presser dovish yield drop…

Source: Bloomberg

Perhaps most notably, the 3M10Y spread actually inverted today briefly…

Source: Bloomberg

Remember this is the spread that elites told you to focus on when the rest of the curve inverted.

2s10s inverted even further today…

Source: Bloomberg

Chinese Yuan rallied back higher – erasing yesterday’s Pelosi anxiety selloff…

Source: Bloomberg

The dollar also rallied against its broad fiat peers, but remain below pre-FOMC levels…

Source: Bloomberg

Bitcoin ended practically unchanged today after surging on WW3 fears and falling back as the FedSpeak began…

Source: Bloomberg

Gold topped $1800 briefly today before Mester’s chatter hit and the barbarous relic was monkeyhammered lower…

Oil prices were as choppy as every other market today with WTI topping $96 before fading back and ending marginally higher…

Finally, as Bloomberg reports, company executives are getting much more worried about economic growth, judging by their earnings conference calls, even as stocks staged a furious rebound in July.

Source: Bloomberg

Executives and analysts are on track to use phrases related to an economic slowdown three times more on second-quarter calls than they did during first-quarter results, according to a Bloomberg analysis of transcripts for companies in the S&P 500, the Nasdaq 100 and the Stoxx Europe 600 indexes. A Bank of America Corp. tracker also showed corporate sentiment during earnings calls has plummeted even as analysts are still expecting earnings growth to accelerate into next year.

And then there’s this utter shitshow – AMTF Digital (Ticker HKD). As we detailed earlier, this Hong Kong tech company IPO’d at $7.80 two weeks ago with around $25mm in revenues… today at its peak it traded with a market cap over $400 billion (on par with META!!)…

But hey Gary Gensler and his gang are busy worried about ‘speculation’ and ‘losses’ in crypto?

Tyler Durden

Tue, 08/02/2022 – 16:00