Morgan Stanley Fears Soaring Lithium Prices Could Spark Demand Destruction For EVs

Prices of lithium carbonate, a key ingredient in the manufacturing of electric vehicle batteries, have jumped so significantly over the past year that EV manufacturers are beginning to raise vehicle costs. Morgan Stanley points out that demand destruction could be possible if EV prices increase too much in response to soaring commodity prices.

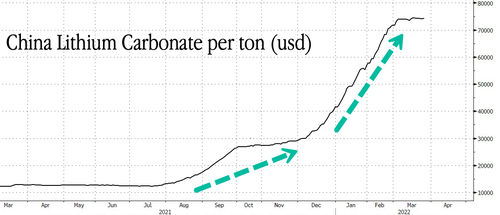

Morgan Stanley’s Jack Lu told clients Thursday that the cost of lithium carbonate has jumped fivefold over the past year. Bloomberg data shows lithium carbonate per ton costs around $74k.

Lu said that because of high lithium carbonate prices, EV manufacturers are set to raise vehicle prices by as much as 15%, which could hurt demand as the cost of ‘going green’ gets more expensive.

“Historically, the battery price cost curve had been declining at a pace of 3% to 7% annually for so many years in a row it almost seemed inevitable.

“But molecules don’t play by the same rules as Moore’s Law. The world has changed, and along with it is a new paradigm of input costs,” Lu said.

The analyst said lithium demand outstrips supply.

“The price explosion tells you that lithium supply is simply nowhere near enough to feed this demand surge,” OilPrice.com reported.

And it’s not just lithium. Nickel, another critical metal for lithium-ion batteries, surged in recent weeks, making the overall cost of batteries more expensive.

Tesla has raised vehicle prices twice this month in response to soaring commodity prices. Tesla also raised prices for its megapack battery.

To counter some of the costs, Tesla recently announced some of its vehicles would use cheaper iron-phosphate battery cells.

According to Kelley Blue Book, EVs cost an average of $56,437, much higher than the average new combustion engine car. Rising commodity prices will only make EVs more out of reach for average Americans as the Biden administration continues pushing its going green agenda.

Tyler Durden

Mon, 03/28/2022 – 02:45