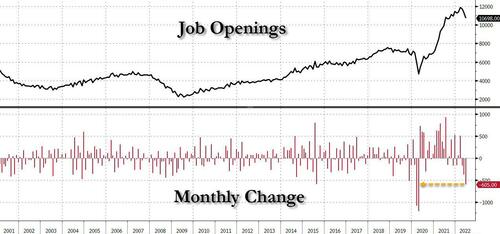

Labor Market Cracks As Job Openings Suffer Third Biggest Plunge On Record

After months of stubbornly refusing to budge, and putting the Fed in an increasingly more awkward place, forcing the central bank to keep hiking even as the economy entered a technical recession, moments ago the BLS reported that the June JOLTS (Job Openings and Labor Turnoover) finally cracked as the number of job openings, while still elevated at 10.698MM, plunged by a near record 605K in June, the 3rd biggest drop on record with only the covid crash seeing bigger drops, and badly missing the median consensus forecast of 11.0MM.

What is notable about this particular JOLTS print is that it comes in the same month as the jobs report – traditionally it is one month delayed. However, that will change in just 3 days when the BLS reports the July payrolls numbers which we are confident will also be a huge miss compared to consensus expectations of 250k.

Anyway, back to the report where the BLS adds that the largest decreases in job openings were in retail trade (-343,000), wholesale trade (-82,000), and in state and local government education (-62,000).

It wasn’t just the deterioration in job openings: the number of hires in June also slumped by 133K to 6.374MM, the lowest since May 2021, and the 4th consecutive decline as the labor market is clearly slowing down.

The picture was slightly less exciting in terms of quits, which dipped by 37K to 4.237MM, the lowest since Oct 2021.

Bottom line: whereas until May, the JOLTS report continued to paint an almost uncomfortably strong picture of the US labor market, in June it finally cracked, with job openings plummeting at the 3rd fastest pace on record (with only the Covid crash months worse) and since the US is now in a technical recession, we expect that July and subsequent months will be far worse. We will get confirmation of this as soon as Friday when the BLS reports the July jobs report where consensus expects a 250K print but where the final outcome will be far worse. The only question then is what happens to wages and how much longer will the wage-price spiral continue now that Biden and Powell have officially pushed the economy into a recession.

Tyler Durden

Tue, 08/02/2022 – 10:31

Recent Comments