Home Price Growth Suffers Largest Monthly Decline Since 1970s

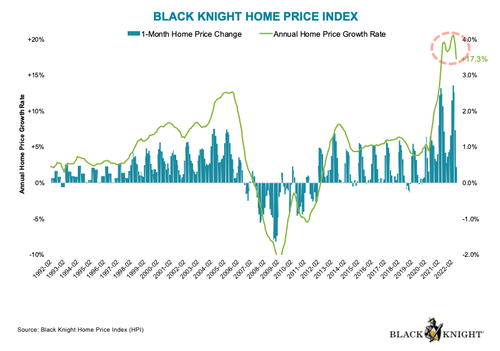

We recently warned there were emerging signs the housing market had peaked. More evidence has been published today that suggests June was likely the turning point following the most significant annual home price growth decline since before Paul Volcker became Fed Chair.

Black Knight, Inc.’s Data & Analytics division published its Mortgage Monitor Report showing June was “the greatest deceleration in home price growth on record.”

Black Knight Data & Analytics President Ben Graboske said June was a record-breaking slowdown of nearly two percentage points from 19.3% to 17.3% annual home price growth and coincided with the largest single-month increase in homes listed for sale in 12 years.

“The pullback in home price growth in June marked the strongest single month of slowing on record dating back to at least the early 1970s,” said Graboske

For some context, two years before the housing crash of 2008, in 2006, the biggest single-month deceleration was 1.19 percentage points. The rapid slowdown in June comes as the Biden administration aims to crush the housing market (with the help of the Fed’s rate hikes) to lower inflation. They’ve already managed to trigger a technical recession.

The slowdown was nationwide and across all top 50 markets, with some areas slowing father than others. A quarter of US markets saw growth slow by three percentage points in June, with four decelerating by four or more points in that month alone. Slowing could be accelerated as it takes about five months for interest rate shocks to be reflected in home price indexes.

A sudden drop in home price growth in June is no surprise, as we warned back in March that housing affordability, measured by Goldman Sachs, has deteriorated to its worst level on record.

We also pointed out last month a housing crash was imminent as “Mortgage Rates Explode Price Cuts Soar And Buyer Demand Collapses.”

Black Knight’s Graboske continued: “We’re also seeing significant shifts in the demand-supply equation, though that too has quite a way to go before normalization.”

The report finds the average San Jose home value has plunged 5.1% (-$75K) in the last two months, marking the largest decline from highs among any metro area in the country. Seattle had the second largest drop of 3.8% over the same period of $30k. San Francisco (-2.8%, -$35K), San Diego (-2%, -$19.5K) and Denver (-1.4%, -$8.7K) round out the top five.

For people who panic-bought homes at record highs over the last two years, a further pullback in price growth is expected through the year’s second half. A slowing housing market could leave many underwater when prices start gapping lower.

Tyler Durden

Mon, 08/01/2022 – 22:00

Recent Comments