Treasury Yields Are Collapsing…

A combination of perceived dovishness from The Fed (seemingly re-engaging its ‘bad news is great news’ narrative) and this morning’s dismally worse than expected negative GDP print has prompted a collapse in Treasury yields.

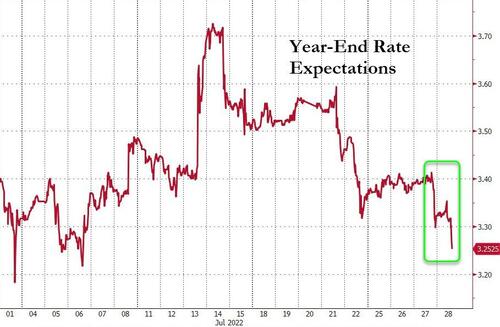

Rate-hike expectations are sliding fast (implying less than 90bps of additional hikes by year-end)…

Sending the 2Y Yield tumbling…

10Y Yields are crashing even harder, now at 2.75% – its lowest since mid-April…

As Nomura’s rates strategist warned earlier:

“However, the near team is going to still be a hawkish Fed. Just a reminder that what goes up must come down in our view, which is why the near term reaction function of hawkishness against inflation will ultimately be the driver for slower economic output in longer dated forwards. The bottom line is the economy is far too fragile to handle this type of tightening in the medium term as the Fed keeps the pedal down.”

However, ignore Nomura, ignore the bond market, and brace for an avalanche of talking heads to ‘splain’ how this is not a recession…

All of the economists who one year ago promised inflation was transitory agree: this is not a recession

— zerohedge (@zerohedge) July 28, 2022

Tyler Durden

Thu, 07/28/2022 – 09:27