Markets Take Pelosi’s Taiwan Visit Talk In Stride

By George Lei, Bloomberg Markets Live reporter and analyst

A possible visit to Taiwan early next month by US House Speaker Nancy Pelosi — as part of her Asia tour — has stirred a fair bit of diplomatic tension between Beijing and Washington.

Financial markets in Taiwan, however, have so far taken the political turmoil in stride. If history offers any guidance, any selloff on concerns about a military confrontation would provide golden opportunities for buy-and-hold investors.

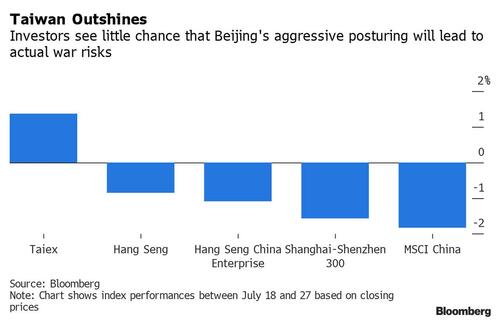

The Financial Times first reported the trip on July 19 during Asian trading hours, eliciting an immediate warning from Beijing. Having had enough time to absorb the news and likely repercussions, Taiwan’s benchmark index managed to climb 1.4% on a closing basis between July 18 and 27, handily beating major stock gauges in Hong Kong and mainland China. Investors seem to have concluded the aggressive rhetoric from mid-level Chinese foreign ministry and defense officials poses little actual risk of war.

Beijing might respond to the visit in a couple of ways, Bloomberg reported last week. Reactions range from relatively mild ones such as fighter jet incursions into Taiwan’s air-defense identification zone or crossing the Taiwan Strait’s median line, to something more aggressive like a missile test near the island or even unprecedented tensions such as warplanes shadowing Pelosi’s flight.

Chinese forces even could intercept Pelosi’s aircraft and prevent her from landing. Such a scenario, however, is unlikely since it would mark a dramatic escalation, according to Gabriel Wildau, New York-based managing director at Teneo, a global CEO advisory firm. Beijing could be less confrontational yet still set a new precedent, such as flying into Taiwanese airspace. That would stop “short of a hostile act against US military aircraft,” Wildau wrote in a July 26 note.

Teneo believes Beijing’s response cycle could be “months-long” if the missile crisis more than two decades ago serves as an accurate reference point. On May 22, 1995, Washington green-lit a “private visit” by Taiwanese leader Lee Teng-hui. That decision, on top of the island’s first direct presidential election the following year, prompted Beijing to order live-fire military exercises and test-fire ballistic missiles. In December 1995, President Clinton sent the US aircraft carrier Nimitz through the Taiwan Strait. In March 1996, two aircraft carrier battle groups — centered around the Nimitz and the USS Independence — plied the waters near Taiwan.

The island’s equity gauge initially sold off back then, lagging the MSCI China and Hong Kong’s Hang Seng China Enterprise indexes, before bottoming in August 1995. By May 20, 1996, when Lee was sworn in as Taiwan’s first popularly-elected president, the benchmark index has recovered all lost ground, outperforming peers by a wide margin.

For long-term investors, other risks are far more relevant than the Pelosi saga, which will eventually come to an end. China’s resurgent Covid cases have once again threatened manufacturing and warehousing operations in Shenzhen and Shanghai. And the lockdowns will weigh on Taiwanese producers through supply chain channels at a time when the island’s industrial output grew at the slowest pace since January 2020, according to DBS Group.

Concern over falling global semiconductor demand means capital outflows from the island are unlikely to turn around anytime soon, the selling pressure on Taiwanese stocks will likely persist and the currency will come under pressure, wrote Iris Pang, chief economist for Greater China at ING Bank N.V. in Hong Kong.

Tyler Durden

Wed, 07/27/2022 – 19:35