FOMC Preview: Here’s What The Fed Will Do Tomorrow

Submitted by Newsquawk

SUMMARY: The Federal Reserve is widely expected to hike rates by 75bps on Wednesday, taking the target range for the Funds rate to 2.25-2.50%, a level considered neutral. There is no Summary of Economic Projections at this meeting thus attention will turn to any guidance the FOMC provides on future tightening increments. Current expectations, based on the current outlook, are for a 50bp move for September, before moving to 25bp moves in November and December to see a year-end rate of 3.25-3.50%, in line with market pricing. Nonetheless, the Fed will likely reiterate that any future rate decisions will depend upon their assessment of the economic outlook, particularly inflation. The latest June CPI report was hotter than expected which saw markets price in another 75bp move in July before accelerating to start pricing in over a 70% probability of a 100bp hike instead. However, pricing has now pared back in wake of several Fed speakers, including hawks Bullard and Waller, vocally supporting a 75bp hike in July while the latest UoM consumer inflation expectations also cooled for both the 1yr and 5yr horizons. Currently, markets only see a 10% chance of a 100bp move, as opposed to above 70% at the peak.

EXPECTATIONS/GUIDANCE: The Fed is expected to hike rates by 75bps to 2.25-2.50%, according to 98/102 economists surveyed by Reuters between July 14-20th, although the remaining four still expect a 100bp move. However, markets are in favor of a 75bp hike with only a 10% chance of a 100bp move on Wednesday. Looking ahead, the majority of those surveyed expect the Fed to hike by 50bps in September, before slowing further to 25bp hikes in November and December leaving the Fed funds rate at 3.25-3.50% in December.

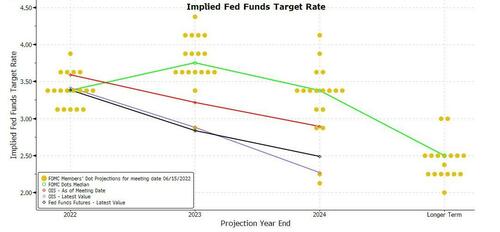

The expectations on the Fed rate path through year-end are similar to market pricing, although looking ahead analysts expect rates to peak at 3.50-3.75% in February, before cutting to 3.00-3.25% in December 2023. This is at odds with market pricing which starts factoring in rate cuts earlier in 2023 as markets start to incorporate ongoing growth concerns and the impact of tighter policy with markets implying a rate of 2.75-3.00% in November 2023. Meanwhile, the median in the Fed’s June SEPs sees the terminal rate between 3.75-4.00% in 2023, before cutting to 3.25-3.50% in 2024.

Therefore, there is a disconnect between markets and the Fed’s forecasts as the former prices in risk of a growth/employment slowdown later this year /early next year while Fed officials are conducting policy on the knowns: solid job growth and consumer spending that is fuelling consecutive increases in inflation. The Fed has said it will remain undeterred in its tightening path until inflation shows signs of returning to target, so to expect anything otherwise at the July FOMC appears unlikely.

LANGUAGE/RECESSION: In the June meeting, the Fed changed its language to focus more on inflation, stating “The Committee is strongly committed to returning inflation to its 2 percent objective”, from the prior “with appropriate policy the Fed expects inflation to return to 2% target and the labour market to remain strong” therefore there will also be a focus on whether there are any further adjustments to this or whether it is maintained. With growth concerns mounting, the latest poll saw a 40% probability of a recession within the US over the coming year, and a 50% chance of a recession within two years, although the vast majority suggested it would be either mild or very mild. The latest meeting and minutes gave no mention of a potential recession, but the Fed has been dismissive of one in recent speeches saying it is not within their base case – something they will likely repeat, but it will be worth paying attention to given the mounting growth concerns to see if their view has changed, but given a continued strong labour market, the Fed will likely not be overly concerned.

PRESS CONFERENCE: Given a lot of the focus will be on future guidance, Powell may leave it to the press conference to give clues on the increments of future rate hikes while he will also likely once again say it is too early to declare victory on inflation given the hot June CPI report. Powell will also likely repeat they want to see a series of declining monthly inflation prints and for inflation to be headed down, but the current data does not support this view. Therefore, Powell is expected to maintain the FOMC language that they will hike rates expeditiously to return inflation to target, although he will probably welcome the decline in UoM inflation expectations. Analysts at Pantheon Macroeconomics note by September the “Fed’s first pre-condition for slowing or stopping the pace of rate hikes will have been met, because the headline month-to-month CPI and PCE prints for July and August will be much lower than in the past couple months” and therefore expect the Fed to hike by no more than 50bps in September, in line with the consensus.

Want more? Pro subscribers have access to FOMC previews from Goldman, Morgan Stanley, DB, UBS and more.

Tyler Durden

Tue, 07/26/2022 – 22:50