Stellar Demand For 5Y Auction As Yields Slide Shows Bonds Convinced Powell Hiking Into Recession

After soaring last month to 3.27%, the highest level since July 2008, in what was an ugly auction that tailed by a whopping 3.5bps, moments ago the US Treasury sold $46 billion in a much more solid auction.

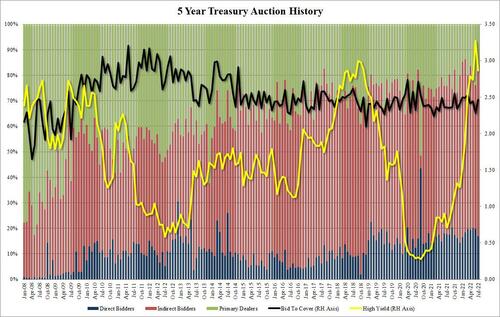

The high yield of 2.860% tumbled from last month’s 3.271%, the biggest one month drop since the Covid crash. It also stopped through the When Issued 2.870% by 1 basis point, a spike in demand which was no doubt facilitated by the concession during this morning’s modest selloff.

The bid to cover jumped from June’s dismal 2.28 to 2.46, the highest since March and above the six-auction average of 2.44.

The internals were also solid with Indirects, or foreign buyers, taking down a whopping 66.37%, the highest since February and well above the six-auction average of 63.4%. The balance was split evenly between Directs (16.8%, down from last month’s 19.7%) and Dealers $16.8%, also down from last month’s 23.8%).

Overall, this was a solid, if not imrpessive auction, which showed little jitters ahead of tomorrow’s 75bops rate hike by the Fed which the bond market now clearly believes will be a trigger for a recession, and thus any and all duration is to be bought with bond hands.

Tyler Durden

Tue, 07/26/2022 – 13:22