Solid 2Y Auction Stops Through As Yield Dips

Just over a week after the US Treasury held a stellar 30Y auction, which saw massive buyside demand as foreign buyers concluded that with a recession looming the best trade is to go long duration, moments ago the Treasury sold $45 billion in 2Y paper in what was another very solid auction, and a mirror image of last month’s disappointing 2Y sale.

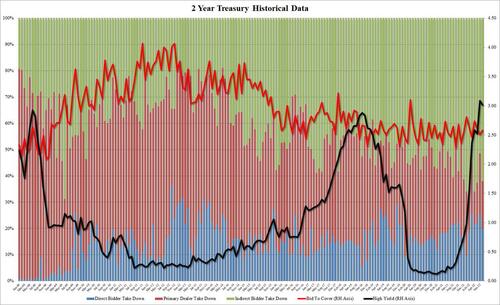

Printing at a high yield of 3.015%, the auction saw the first drop in yields since May and only the second one in the past year. It also stopped through the When Issued 3.021% by 0.6bps.

The bid to cover of 2.583 was higher than last month’s 2.509 if below the 6-auction average of 2.628.

The internal were more impressive, with Indirects awarded 62.04%, well above last month’s 51.5% and just above the six-auction average of 61.1%. And with Directs taking down 20.01% which was also in line with recent average, Dealers were left holding 17.95%, below last month’s 23.24% and below the 6-auction average of 18.5%.

Overall, a much more solid 2Y auction compared to last month, and with yields dropping perhaps the bond market has decided that this 3% is as high as the Fed will get before it is inevitably forced to start cutting rates in early 2023.

Tyler Durden

Mon, 07/25/2022 – 13:35