ECB Launches “Lift Off” After 11 Years: Hikes 50bps As It Also Unveils italy-Specific QE

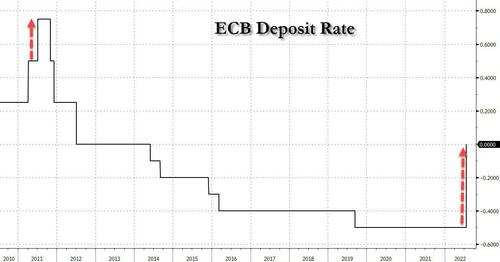

In keeping with media leaks, the ECB did a carbon copy of what the Fed did, and crushed its forward guidance credibility opting to hike 50bps instead, which was to be expected considering Europe’s record inflation. In any case, after almost exactly 11 years, the ECB just hiked rates for the first time since July 2011.

Looking ahead, the ECB said that “further normalisation of interest rates will be appropriate” adding that “the frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions.” This is notable because, as Bloomberg’s Ven Ram writes, the explicit guidance from the European Central Bank as we knew it is gone for now: “apart from saying that further normalization of interest rates will be appropriate, it also had this to say: The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions. This approach makes a lot more sense in the current milieu where inflation is running amok.“

According to ING, the softening forward guidance shows that the ECB thinks the window for a series of rate hikes is closing quickly.

Hiking rates by 50bp and softening forward guidance shows that the ECB thinks the window for a series of rate hikes is closing quickly, writes @carstenbrzeskihttps://t.co/xMH79EGHj9

— ING Economics (@ING_Economics) July 21, 2022

In any case, “the Governing Council’s future policy rate path will continue to be data-dependent and will help to deliver on its 2% inflation target over the medium term. In the context of its policy normalisation, the Governing Council will evaluate options for remunerating excess liquidity holdings.”

Here are the highlights from the decision:

The Governing Council judged that it is appropriate to take a larger first step on its policy rate normalisation path than signalled at its previous meeting

This decision is based on the Governing Council’s updated assessment of inflation risks and the reinforced support provided by the TPI for the effective transmission of monetary policy.

At the Governing Council’s upcoming meetings, further normalisation of interest rates will be appropriate.

It will support the return of inflation to the Governing Councils medium-term target by strengthening the anchoring of inflation expectations and by ensuring that demand conditions adjust to deliver its inflation target in the medium term.

The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilises at its 2% target over the medium terni.

Perhaps more importantly, the ECB unveiled the much anticipated Transmissions Protection Mechanism (TPI) whose purpose is to “safeguard the smooth transmission of its monetary policy stance throughout the euro area”, and will “allow the Governing Council to more effectively deliver on its price stability mandate”, although as expected, there was not much information provided as the ECB knows the bond market will immediately test any ECB-set thresholds, which is why the central bank was quick to say that “purchases are not restricted ex ante.”

The Governing Council assessed that the establishment of the TPI is necessary to support the effective transmission of monetary policy. In particular, as the Governing Council continues normalising monetary policy, the TPI will ensure that the monetary policy stance is transmitted smoothly across all euro area countries. The singleness of the Governing Council’s monetary policy is a precondition for the ECB to be able to deliver on its price stability mandate.

The TPI will be an addition to the Governing Council’s toolkit and can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area. The scale of TPI purchases depends on the severity of the risks facing policy transmission. Purchases are not restricted ex ante. By safeguarding the transmission mechanism, the TPI will allow the Governing Council to more effectively deliver on its price stability mandate.

In any event, the flexibility in reinvestments of redemptions coming due in the pandemic emergency purchase programme (PEPP) portfolio remains the first line of defence to counter risks to the transmission mechanism related to the pandemic.

The details of the TPI are described in a separate press release to be published at 15:45 CET.

Putting it all together: the ECB hikes rates at the same time as it unveils an unrestricted bond purchasing mechanism. Brilliant.

There were some more details on PEPP…

In any event, the flexibility in reinvestments of redemptions coming due in the pandemic emergency purchase programme (PEPP) portfolio remains the first line of defence to counter risks to the transmission mechanism related to the pandemic

Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. The future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance

… and TLTRO:

The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy.

The Governing Council will also regularly assess how targeted lending operations are contributing to its monetary policy stance

Finally, with Europe now in a recession it’s not a surprise that the bigger than expected rate hike today means less rates hikes in September.

The real question is when will the ECB be forced to cut back to negative. As a reminder, back in July 2011, the central bank lastest about 3 months before it was forced to cut.

The full press release from the ECB is below:

Monetary policy decisions

Today, in line with the Governing Council’s strong commitment to its price stability mandate, the Governing Council took further key steps to make sure inflation returns to its 2% target over the medium term. The Governing Council decided to raise the three key ECB interest rates by 50 basis points and approved the Transmission Protection Instrument (TPI).

The Governing Council judged that it is appropriate to take a larger first step on its policy rate normalisation path than signalled at its previous meeting. This decision is based on the Governing Council’s updated assessment of inflation risks and the reinforced support provided by the TPI for the effective transmission of monetary policy. It will support the return of inflation to the Governing Council’s medium-term target by strengthening the anchoring of inflation expectations and by ensuring that demand conditions adjust to deliver its inflation target in the medium term.

At the Governing Council’s upcoming meetings, further normalisation of interest rates will be appropriate. The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions. The Governing Council’s future policy rate path will continue to be data-dependent and will help to deliver on its 2% inflation target over the medium term. In the context of its policy normalisation, the Governing Council will evaluate options for remunerating excess liquidity holdings.

The Governing Council assessed that the establishment of the TPI is necessary to support the effective transmission of monetary policy. In particular, as the Governing Council continues normalising monetary policy, the TPI will ensure that the monetary policy stance is transmitted smoothly across all euro area countries. The singleness of the Governing Council’s monetary policy is a precondition for the ECB to be able to deliver on its price stability mandate.

The TPI will be an addition to the Governing Council’s toolkit and can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area. The scale of TPI purchases depends on the severity of the risks facing policy transmission. Purchases are not restricted ex ante. By safeguarding the transmission mechanism, the TPI will allow the Governing Council to more effectively deliver on its price stability mandate.

In any event, the flexibility in reinvestments of redemptions coming due in the pandemic emergency purchase programme (PEPP) portfolio remains the first line of defence to counter risks to the transmission mechanism related to the pandemic.

The details of the TPI are described in a separate press release to be published at 15:45 CET.

Key ECB interest rates

The Governing Council decided to raise the three key ECB interest rates by 50 basis points. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 0.50%, 0.75% and 0.00% respectively, with effect from 27 July 2022.

At the Governing Council’s upcoming meetings, further normalisation of interest rates will be appropriate. The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions. The Governing Council’s future policy rate path will continue to be data-dependent and will help to deliver on its 2% inflation target over the medium term.

Asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)

The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.

As concerns the PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Redemptions coming due in the PEPP portfolio are being reinvested flexibly, with a view to countering risks to the transmission mechanism related to the pandemic.

Refinancing operations

The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy. The Governing Council will also regularly assess how targeted lending operations are contributing to its monetary policy stance.

***

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilises at its 2% target over the medium term. The Governing Council’s new TPI will safeguard the smooth transmission of its monetary policy stance throughout the euro area.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:45 CET today.

Watch Lagarde’s press release here:

Tyler Durden

Thu, 07/21/2022 – 08:25