Blockbuster Demand For 20Y Auction: Record High Indirects As Foreign Buyers Scramble For Duration Ahead Of Recession

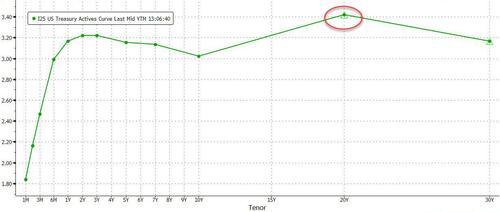

With the 20Y part of the curve still deeply kinked and inverted (due to lack of buyside liquidity for this tenor) and offering the highest absolute yield of any US treasury, moments ago a $14 billion auction for 20Y paper (19-year, 10-month reopening of cusip TH1), showed that there was blockbuster demand for duration.

Pricing at a high yield of 3.420%, this was not only the first drop in yield since December 2021, but also stopped through the When Issued 3.447% by 2.7bps, the 2nd highest on record with only April’s 3.0bps higher.

The bid to cover of 2.65 was above last month’s 2.60 and the highest since April.

But it was the internals that were absolutely stellar, with Indirects taking down a record 78.0%, and with Directs awarded 14.1%, meant that Dealers were left holding just 7.9%, the lowest on record.

Overall, this was another stellar auction, and the latest confirmation that demand for duration – now that a recession is just a matter of time – is a matter of when not if, and it will collapse yields once it has been recognized.

Tyler Durden

Wed, 07/20/2022 – 13:17