Italy Government On Verge Of Collapse After Coalition Members Abandon Draghi; Euro Tumbles

Since the fall of the Berlin Wall, Italy has had 19 governments, lasting on average just over 18 months. As such, Mario Draghi’s government – which is about to collapse – is about to make it 20 failed government (but at least Draghi’s 17 months lasted right in line with the average).

Moments ago, Italy’s center-right League headed by Mtteo Salvini party indicated that it will join Silvio Berlusconi’s Forza Italia in skipping a confidence vote over Prime Minister Mario Draghi’s government, assuring that Draghi’s government will collapse leading to snap elections as soon as the fall.

BREAKING:🇮🇹 ITALY

Two lawmakers from different parties confirm to CNBC that Lega, Forza Italia AND M5S are to boycott the confidence vote in Draghi’s gov.

It’s over. He cannot continue.

— Joumanna Bercetche 🇱🇧 (@CNBCJou) July 20, 2022

The news follows a speech earlier on Wednesday, in which the former Goldman partner and ECB head indicated he was willing to stay on as prime minister if his coalition partners could guarantee “sincere and concrete support” for him to continue, and sought a vote of confidence.

Well, Draghi’s partners couldn’t reach an agreement, assuring that Draghi’s government will fail the coming vote of confidence and ushering in fresh Italian elections, and sparking a fresh leg in the European government crisis, which takes place just one day before the ECB had leaked it could hike as much as 50bps.

Italian drama. Salvini maneuvers to compound the position of Conte (5Stelle) and the Draghi Government is apparently finished, regardless of the (deliberate) absence of quorum in the ongoing vote in the Senate or its possible favourable outcome. Perfect storm for the ECB tomorrow

— Vitor Constâncio (@VMRConstancio) July 20, 2022

Well, we can certainly remove that option, as there is no way Lagarde will tighten to 0% at a time when Italian bonds are about to implode on the spiking political uncertainty.

Draghi out, spread up, stocks down. Meloni in, Tremonti in, Salvini in.

— Alessandro Merli (@MerliAless) July 20, 2022

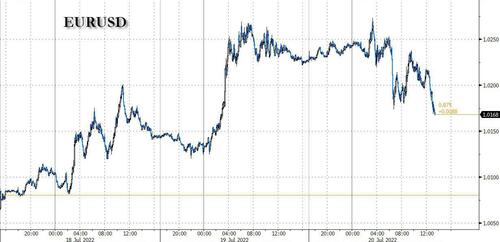

It’s also why the EUR tumbled to session lows just above 1.01 after rising above 1.02 yesterday having slumped below parity late last week.

The news was also enough to hammer the US stock rally, and undo 3 hours of gains in just minutes…

… although it appears that algos have misread this particular move, since a political crisis in Italy not only assures that the ECB will not be able to hike as much as it wants…

… but will force Lagarde to keep buying Italian bonds indefinitely, doing away with any pretense the central bank will ever be able to do away with QE, which in turn will also force the Fed to halt its tightening path unless Powell wants to send the US Dollar into deep space orbit.

Tyler Durden

Wed, 07/20/2022 – 13:37