US Futures Rally Reverses After Europe Proposes Cuts To Nat Gas Consumption

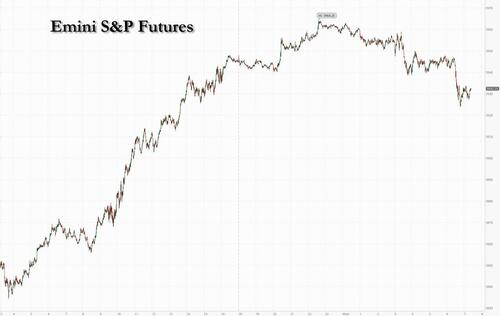

What was a solid overnight rally which pushed global markets higher and US index futures as high as 3,964 after a beat in Netflix subs helped further ease market jitters, fizzled and then reversed around 6:30am ET, when the European Union officially proposed that the bloc cut its natural gas consumption by 15% over the next eight months to ensure that any full Russian cutoff of natural gas supplies won’t disrupt industries over the winter, with Commission president Ursula von der Leyen going so far as suggesting the EU would be able to enforce a slowdown in gas consumption.

FULL DOCUMENT: The European Commission press communique on its plan to reduce gas consumption, and share supply. (💻and link here: https://t.co/c11DaoMAFO) #EnergyCrisis #ONGT pic.twitter.com/MOc3j8IGjg

— Javier Blas (@JavierBlas) July 20, 2022

The move which saw spoos slide more than 20 points from 3,947 to below 3,925 before rebounding, and sparked a reversal in haven assets, as Treasuries rose with 10Y yields dropping back under 3.0%, and the dollar index stabilizing after three days of declines…

… was driven by European stocks, with the Stoxx Europe 600 Index falling 0.1% at 12:09 p.m. in London, snapping a three-day gaining streak. Auto and insurance stocks led the declines, while technology, energy and real estate gained.

European investor sentiment had been roiled in recent day by prospects that Russian gas supplies could halt entirely, a scenario that strategists said would tip the regional economy into an immediate recession. And while on Wednesday morning Vladimir Putin signaled that Europe will start getting gas again through the Nord Stream 1 pipeline, he warned that unless a spat over sanctioned parts is resolved, flows will be curbed to at little as 20% of available inventory. There was some positive news when Italian Prime Minister Mario Draghi said he is ready to rebuild his governing coalition, helping Italian bonds rise.

Amid the broad-based swoon, European food delivery stocks rose as Citi said that Delivery Hero, Just Eat and Deliveroo’s stocks all have upside potential over the next 12 months, as the broker expects the three firms to record lower FY22 Ebitda losses than the consensus forecasts. Just Eat surges 12% as of 12:37pm CET, Delivery Hero jumps 8.8% and Deliveroo is up 3.5%. Here are some of the other notable European movers today:

Uniper shares rose as much as 21% after a report that the German government is nearing a bailout deal for the utility. Fortum, which owns 75% of Uniper, rises as much as 4.5%.

Georg Fischer shares jump as much as 7.8% after 1H earnings. Baader says the company’s resilient business model delivered a result above expectations despite headwinds from China lockdowns and supply chain disruptions.

Alfa Laval surges as much as 9.4% after the Swedish industrial equipment maker’s second quarter earnings surprised with beats on order growth, adjusted Ebita and sales.

Wise extends gains since Tuesday’s trading update, rising as much as 5.5% today. Credit Suisse boosts its price target and estimates for the money transfer firm.

Carrefour shares climb as much as 3.4% after the French grocer agrees to sell a controlling stake in its retail operations in Taiwan to local partner Uni-President for $970 million, a move welcomed by investors.

Royal Mail shares drop as much as 6.1% after the company posted what Liberum calls an “awful” 1Q trading update, though analysts see the potential separation of its two main business units providing some relief.

Telia falls as much as 5.6%, as analysts flagged weak free cash flow in its 2Q update. The Swedish telecommunications company beat estimates for net sales and adjusted Ebitda for the second quarter.

SKF shares fall as much as 3.8% after the Swedish ball bearings manufacturer reported 2Q earnings that missed the average analyst estimate.

The risk of a global downturn and Europe’s energy crisis doused optimism about the US earnings season and confidence the Federal Reserve will avoid very aggressive monetary tightening. “We don’t expect a sustained improvement in market sentiment until investors get greater clarity on the outlook for the economy, central bank policy, and political risks,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

Going back to the US, in premarket trading Netflix added about 6% after it reported better-than-feared earnings late on Tuesday and said it expects to return to subscriber growth before the end of the year. Below we list some other notable premarket movers:

VBL Therapeutics (VBLT US) slumps as much as 80% after the biotech firm’s clinical trial for ovarian cancer treatment ofra-vec, or VB-111, didn’t meet its primary endpoints.

Omnicom (OMC US) rose 6.9% on low volume after second-quarter revenue beat the average analyst estimate and the advertising firm raised its organic sales growth forecast for the year.

Oil shares could be in focus as HSBC said in a note that a recent correction has left global integrated oil stocks looking attractive again and upgraded Chevron (CVX US) to buy.

Keep an eye on Cazoo (CZOO US) shares as the stock was initiated with a sell rating at Berenberg, with the broker flagging a more competitive environment in Europe for the online used-car retailer.

Watch Apple (AAPL US) shares as their price target was lowered to $185 from $205 at Wells Fargo Securities, a move that comes ahead of the iPhone maker’s upcoming results.

Keep an eye on US home retail stocks as Morgan Stanley cut estimates and price targets on consumer discretionary-exposed retailers, including Floor & Decor Holdings (FND US), Williams-Sonoma (WSM US) and Best Buy (BBY US), amid an expected slowdown in spending in the second half of the year.

Earlier in the session, Asian stocks advanced as a weaker dollar and report of a possible end to China’s investigation into Didi Global boosted sentiment. The MSCI Asia Pacific Index gained as much as 1.7%, the biggest intraday gain in more than three weeks. Alibaba and Tencent were among the biggest boosts to the benchmark after the Wall Street Journal reported that China is expected to fine ride-hailing firm Didi more than $1 billion before wrapping up its year-long probe.

The dollar fell, underscoring waning haven demand, with the euro strengthening on the possibility of a bigger-than-expected rate hike by the European Central Bank. Asian stocks also got a boost from gains in US peers overnight amid optimism on earnings and better-than-feared subscriber numbers from Netflix. “A mix of global and local factors appear to be driving risk-on sentiment in Asia today,” said Chetan Seth, Asia Pacific equity strategist at Nomura Holdings in Singapore. “Stocks have been quite weak of late and investors appear to be very cautiously positioned, so incrementally positive news does help.” Almost all main Asian markets were higher, with the Japan benchmark climbing more than 2% ahead of its central bank’s policy decision Thursday. Key equity measures in Hong Kong rose more than 1%.

Japanese stocks climbed amid investor hopes for better-than-expected earnings and subsiding worry over interest-rate hikes. The Topix rose 2.3% to 1,946.44 at the 3 p.m. close in Tokyo, while the Nikkei 225 advanced 2.7% to 27,680.26. “Earnings from Netflix were not so bad, and this has led to an increase in expectations for better corporate performances,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management. Sony Group contributed the most to the Topix’s gain, increasing 4.1%. Out of 2,170 shares in the index, 1,966 rose and 143 fell, while 61 were unchanged. “It looks like things that had been sold off are rebounding,” said Hajime Sakai, chief fund manager at Mito Securities

India’s benchmark equity index extended gains for a fourth day in the longest rising streak this month as technology companies led advances. The S&P BSE Sensex rose 1.2% to 55,397.53 in Mumbai on Wednesday, taking its weekly advance above 3%. The NSE Nifty 50 Index advanced 1.1%, taking cues from gains in other Asian markets. A gauge of IT companies rose the most among 19 sectoral indexes, of which 13 sectors gained. Technology stocks rally was led by Tech Mahindra and HCL Technologies that gained 3.8% and 3.1% respectively. Reliance Industries Ltd contributed the most to the index gain, increasing 2.5% after a cut in windfall taxes of fuels triggered gains in oil and energy shares. Out of 30 shares in the Sensex index, 22 rose and 8 fell.

In FX, the Bloomberg dollar spot index is near flat. CHF and NOK are the weakest performers in G-10. The euro held near a two-week high, with expectations buoyed by reports the European Central Bank may consider delivering a 50-basis-point hike at Thursday’s meeting, despite earlier signaling a smaller move. The Swiss franc underperformed other Group-of-10 currencies as appetite for haven currencies waned; a Bloomberg gauge of dollar strength edged lower for a fourth day.

In rates, Treasuries were richer across the curve, adding to gains in early US session as stock futures drop. US yields richer by up to 6bp across front-end of the curve as belly and front-end outperform, steepening 2s10s, 5s30s spreads each by 2bp on the day; 10-year yields around 2.97%, richer by 5bp on the day with bunds outperforming by additional 2.5bp and gilts by 6bp. Italian benchmark 10-year yields fell as much as 16 basis points to 3.17%; the yield spread over German equivalents narrowed to 199bps as Mario Draghi offered to remain as prime minister. Bunds outperformed with gilts, as traders adjust expectations for Thursday’s ECB policy meeting. US auctions resume with $14b 20-year bond reopening at 1pm ET; WI yield around 3.385% is ~10bp richer than June’s stop-out, which tailed the WI by 0.2bp. UK gilts advanced, shrugging off an inflation print that showed consumer price growth accelerated to a new 40-year high in June

In commodities, crude futures dropped with WTI trading within Tuesday’s range, falling 1.7% to trade near $102.40. Brent falls 1.1% near $106.15. Most base metals trade in the green; LME nickel rises 3.1%, outperforming peers. LME tin lags, dropping 0.4%. Spot gold falls roughly $4 to trade near $1,708/oz.

Bitcoin hovered above $23,000 after climbing out of a one-month-old trading range.

To the day ahead now, and data releases include UK and Canadian CPI for June, US existing home sales for June, and the Euro Area’s preliminary consumer confidence for July. Otherwise, earnings releases include Tesla and Abbott Laboratories.

Market Snapshot

S&P 500 futures up 0.2% to 3,945.00

STOXX Europe 600 up 0.2% to 424.21

MXAP up 1.3% to 158.52

MXAPJ up 1.0% to 520.62

Nikkei up 2.7% to 27,680.26

Topix up 2.3% to 1,946.44

Hang Seng Index up 1.1% to 20,890.22

Shanghai Composite up 0.8% to 3,304.72

Sensex up 1.4% to 55,533.19

Australia S&P/ASX 200 up 1.6% to 6,759.21

Kospi up 0.7% to 2,386.85

German 10Y yield little changed at 1.23%

Euro up 0.1% to $1.0238

Gold spot down 0.2% to $1,707.69

U.S. Dollar Index little changed at 106.64

Top Overnight News from Bloomberg

Prime Minister Mario Draghi told the Rome senate on Wednesday that his fractious coalition can be rebuilt, tamping down concerns he’ll quit the government and throw Italy into chaos. Markets rallied after his comments.

Russian President Vladimir Putin signaled that Europe will start getting gas again through a key pipeline, but warned that unless a spat over sanctioned parts is resolved, flows will be tightly curbed.

UK inflation hit a new 40-year high in June, intensifying the cost of living crisis and heaping pressure on the Bank of England to deliver an aggressive interest-rate increase next month

Some suppliers to Chinese real estate developers are refusing to repay bank loans because of unpaid bills owed to them, a sign that the loan boycott that started with homebuyers is starting to spread.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks followed suit to the gains in the EU and the US where sentiment was underpinned by Nord Stream optimism and a weaker buck. ASX 200 was led higher by tech outperformance and with miners firmer after further quarterly output updates. Nikkei 225 gained with the BoJ expected to stick with ultra-loose policy at its 2-day policy meeting. Hang Seng and Shanghai Composite conformed to the heightened risk appetite with tech encouraged despite reports Chinese authorities will fine Didi more than USD 1bln over data security breaches, as this ends a year-long investigation and paves the way for a Hong Kong listing. However, gains were somewhat capped in the mainland after the PBoC maintained its Loan Prime Rates which was as expected but disappointed outside calls for a cut to the 5yr LPR to assist with the ongoing mortgage strike issue, while China’s daily COVID cases surpassed 1,000 for the first time since May. China is yet to reach a deal with foreign bondholders over restructuring, according toEvergrande (3333 HK) WSJ sources

Top Asian News

Chinese military said it monitored US destroyer Benfold’s crossing of the Taiwan Strait and said frequent provocations by the US demonstrate that the US is a destroyer of peace and stability in the Taiwan Strait, while it added that troops in the theatre remain on high alert at all times, according to Reuters.

COVID cases in Japan are set to reach a record high in excess of 150k, according to the Nikkei.

Shanghai is to require residents to take a minimum of one COVID test per week until August 31st, according to an official; while Macau is to reopen some casinos on Saturday, July 23rd, according to Reuters source

VW’s Affordable Brands to Become More Similar Under the Hood

Pakistan Finance Chief Blames Politics as Rupee Drops to Record

Shift to Quality From Value in Japan Stocks Is Coming: Jefferies

China Tech Stocks Gain on Renewed Bets of Crackdown Ending

South Korea Investigates Abnormal Crypto-Linked FX Transactions

US Official Sees Russia Export Controls as Model for China

European bourses are modestly firmer at present as we move towards the week’s key risk events and as participants had already reacted to the Nord Stream developments. Stateside, futures are posting similar price action with key earnings including on the docket; aside fromTesla corporate developments, the US-specific docket is slim. German government will pass on some energy costs to consumers, as a component of the Uniper (UN01 GY). rescue package, according to Reuters sources. Subsequently, Handelsblatt reports Germany could take a 30% stake in Uniper.

Top European News

UK May House Price Index Rises 12.8% Y/y

VW’s Affordable Brands to Become More Similar Under the Hood

Draghi Tells Senate His Coalition Can Be Rebuilt: Italy Update

Italian Bonds Rally After Draghi Says Coalition Can Be Rebuilt

US Official Sees Russia Export Controls as Model for China

Draghi Says Italy’s Governing Coalition Can Be Rebuilt

FX

Kiwi extends gains vs Greenback ahead of NZ trade data amidst favourable AUD/NZD cross flows and as Aussie loses momentum against Buck, NZD/USD hovers around 0.6250, AUD/NZD circa 1.1050 and AUD/USD just over 0.6900.

DXY attempts to draw line in sand and hold around 106.500 before US existing home sales and 20 year note auction.

Sterling regains 1.2000+ status vs Dollar after post-UK CPI setback.

Euro elevated on eve of 50-50 half or quarter point ECB hike policy meeting, EUR/USD straddles 1.0250.

Loonie stalls into Canadian inflation update and Yen pauses as BoJ starts two-day policy confab, USD/CAD holds above 1.2850 and USD/JPY off sub-138.00 low

Bonds

Bonds lay down firm foundations for midweek revival.

Bunds up to 151.89 from 150.83 low, recover from 114.67 to reach 115.59 and touchesGilts 10 year T-note 118-10 vs 117-27 overnight low ahead of data and 20 year supply.

BTPs even more resurgent between 124.79-122.84 parameters after Italian PM Draghi’s pre-Senate debate speech.

Commodities

Crude benchmarks are modestly softer after Tuesday’s firmer settlement, newsflow has been relatively sparse and focused on, but not adding much, to recent Nord Stream updates ahead of the maintenance period concluding on Thursday.

US Private Inventory Data (bbls): Crude +1.9mln (exp. +1.4mln), Gasoline +1.3mln (exp. +0.1mln), Distillate -2.2mln (exp. +1.2mln), Cushing +0.5mln

Qatar sold September-loading Al-Shaheen crude at USD 9-10/bbl above Dubai quotes which is the highest premium in four months, according to sources.

India cut the windfall tax on diesel and aviation fuel shipments by INR 2/litre and cut taxes on domestically produced crude to INR 17k/ton.

Russian President Putin said Gazprom plans to fulfil its obligations and that there are no grounds for Ukraine to shut down one of the gas transit routes to Europe, while he added that one more Nord Stream 1 and thatturbine is expected to be sent for maintenance later this month Gazprom is ready to pump gas as. Furthermore, Putin said attempts to cap Russian oil prices will lead to prices skyrocketing and said Nord Stream volume will drop if the turbine return is delayed, according to Reuters.

Spot gold has been slightly choppy, extending to incremental new highs and lows during European hours, though fairly steady above USD 1700/oz overall.

US Event Calendar

07:00: July MBA Mortgage Applications, prior -1.7%

10:00: June Existing Home Sales MoM, est. -1.1%, prior -3.4%

10:00: June Home Resales with Condos, est. 5.35m, prior 5.41m

DB’s Jim Reid concludes the overnight wrap

It’s going to be a huge 36 hours for Europe with questions over gas flows, Draghi’s future, the anti-fragmentation tool and last but not least whether the ECB move by 25bps or 50bps tomorrow. The very fact that we’re now contemplating 50bps is potentially yet another global incidence of forward guidance being ramrodded by the force of inflation.

This story came from numerous news sources which indicates that perhaps the ECB were trying to float the idea of 50bps to see the reaction or to try to put some pressure on the doves in the committee. It not impossible that it’s part of a trade-off to get a stronger anti-fragmentation tool for Italy. If we do get 50bps that would take the deposit rate out of negative territory for the first time since 2014, and go against the forward guidance from the June meeting, where they said in no uncertain terms that “the Governing Council intends to raise the key ECB interest rates by 25 basis points at its July monetary policy meeting.” Overnight index swaps moved to price in an additional +7.7bps worth of hikes at the upcoming meeting, with the 37.0bps worth priced in being almost equidistant between 25bps and 50bps.

This comes as Draghi makes a statement to the Italian senate today at 930 CET ahead of a day of debates. We should know more about whether this government can carry on or is about to collapse. See my CoTD yesterday (link here) for a reminder that Italy has had 162 governments in the last 131 years and that this near 18 month Draghi administration has actually outperformed the average life by around 3 months. Also see our economists latest thoughts (link here) on the political impasse in Italy published last night.

However the most important event is probably the Nord Stream pipeline theoretically reopening tomorrow. Yesterday it was reported by Reuters that flows would restart through the pipeline tomorrow, but this would be at a reduced capacity. What that capacity is we don’t know but the market has certainly got more worried about zero flows in recent weeks so if we got close to the 40% capacity we saw in the weeks before the 10-day maintenance period that would be very bullish for markets in the near term and according to our German economists’ supply monitor (link here), Germany could just get by through the winter. The Kremlin also know that so maybe they would cut back a little more than pre-maintenance levels. Indeed Putin was quoted overnight as saying supplies could be cut again if there are more delays in the return of the turbine from Canada. So we will see what we hear today in terms of clues.

Our utilities analyst James Brand suggested that utilities get told a day in advance what sort of flows are to be expected through pipelines. This isn’t usually published but these are exceptional times and if the info is available it will undoubtedly come out. Natural gas futures fell for a 4th consecutive session yesterday, coming down -1.78% to €154 per megawatt-hour. So nothing dramatic at this stage. A reminder that one of my CoTDs last week (link here) explained why a complete shut off was probably not in Putin’s best interest.

Markets were already bouncing back before the gas headlines but there was no doubt this gave it an extra impetus, especially in Europe. Unsurprisingly the DAX (+2.69%) led the way but the STOXX 600 (+1.38%) also rallied, with every sector on the day higher and a slight skew toward cyclicals outperforming defensives.

The S&P managed to hold on to its morning gains yesterday unlike on Monday, rallying +2.76% for its best daily performance in almost a month, while the NASDAQ outperformed climbing +3.11%, its best daily performance over the same time frame. Indeed, it was an incredibly broad-based advance for the S&P 500, with the 494 companies in the index moving higher representing the most daily gainers since April 2020 when policy relief measures were coming in left and right. That came in spite of a cut in Johnson and Johnson’s (-1.46%) full-year 2022 guidance to now expecting adjusted EPS of $10.00-$10.10, rather than $10.15-$10.35 previously. After the close, Netflix reported that they lost fewer subscribers than was feared, which drove their shares +7.71% higher in after-hours trading. That will come as welcome news for the streamer, which was down more than -66% YTD, highlighted by two forgettable earnings reports to start the year, with their share price falling -21.79% after 4Q21 earnings and falling -35.12% after 1Q22 earnings.

Over in fixed income, even with the 50bps ECB chatter bonds were relatively subdued but those headlines did prompt a yield sell-off. 10yr bunds (+6.2bps), OATs (+3.0bps) and BTPs (+4.0bps) all moved higher in yield terms on the day, and the more policy-sensitive front-end yields saw slightly larger increases. Gilts (+2.1bps) were a relative outperformer, although that reflected the fact that the BoE moving by 50bps (see more below re BoE Bailey’s speech) was already priced in, whereas for the ECB it very much wasn’t. Those developments on interest rates were a factor helping the Euro to strengthen +0.84% against the US Dollar, taking it to its strongest level since the beginning of the month.

Treasury yields soldoff modestly across the curve, which flattened -3.0bps to -22.5bps (2s10s). 10yr yields climbed back above 3%, gaining +3.5bps, bringing them +10.6bps higher to start the week. 2yrs increased +6.3bps, which coincided with fed futures pricing increasing in 2023, contrary to recent increases which were driven by increases in Fed pricing through the end of 2022. Indeed, the timing of the first Fed rate cut was pushed into Q2 2023, with policy rates expected to stay above 3.5% through the spring. As I type, yields on the 10yr USTs are fairly stable.

Onto BoE Governor Bailey’s annual Mansion House speech, where he said that “a 50 basis point increase will be among the choices on the table when we next meet”. So an explicit acknowledgement that they could follow the Fed and other central banks (maybe the ECB) in moving by a larger increment, which would mark the first time they’ve moved by more than 25bps since the BoE gained operational independence in 1997. He also made some comments on QT, saying that the next meeting would be “time for the MPC to discuss the strategy for beginning to sell the gilts held in our Asset Purchase Facility Portfolio”, and that they were looking at a reduction “of something in the region of £50-100bn in the first year.”

Overnight in Asia equity markets are strong. The Nikkei (+2.37%) is leading gains across the region this morning followed by the Hang Seng (+1.91%) and the Kospi (+1.04%) whilst the Shanghai Composite (+0.67%) and CSI (+0.43%) are slightly underperforming. Moving ahead, stock futures in DM point to further gains with contracts on the S&P 500 (+0.58%), NASDAQ 100 (+0.62%) and DAX (+0.75%) all trading up.

In central bank news, China maintained status quo on the benchmark rates for corporate and household loans, leaving the one-year loan prime rate (LPR) at 3.70%, and the five-year LPR at 4.45%, in line with market expectations, despite rising financial risks amid slowing economic growth. Elsewhere, the Reserve Bank of Australia (RBA) Governor Philip Lowe indicated that inflation for the second quarter (scheduled next week) will further step-up and there needs to be a path back to 2% to 3% inflation.

Oil prices are falling in Asian trade after rising earlier with Brent crude (-0.33%) lower at $107/bbl and WTI futures (-0.66%) at $103.53/bbl as we go to press.

Here in the UK, the competition to become Prime Minister continues with just 3 candidates now left in the Conservative leadership race: former Chancellor Rishi Sunak, trade minister Penny Mordaunt and Foreign Secretary Liz Truss. Sunak has been leading among the MP’s ballots, but a YouGov poll yesterday found that when it comes to the final 2 that the grassroots members vote on, then Sunak would lose to either Mordaunt or Truss. Today will see the final ballot of MPs take place ahead of that membership vote, and whilst Sunak is just shy of the votes needed to make the final 2, the big question is whether the remaining spot is taken by Mordaunt or Truss, with the betting markets favouring Truss’ chances.

On the data side, US housing starts fell to an annualised rate of 1.559m in June (vs. 1.580m expected), their lowest level in 9 months, and building permits similarly fell to a 9-month low, with an annualised 1.685m (vs. 1.650m expected). Meanwhile in the UK, the number of payrolled employees rose by +31k in June (vs. +68k expected).

To the day ahead now, and data releases include UK and Canadian CPI for June, US existing home sales for June, and the Euro Area’s preliminary consumer confidence for July. Otherwise, earnings releases include Tesla and Abbott Laboratories.

Tyler Durden

Wed, 07/20/2022 – 08:02