Shrinking Population Is Another Problem For China’s Housing Market

By Ye Xie, Bloomberg Markets Live commentator and reporter

The wave of mortgage-payment boycotts has spurred China’s regulators into action. Beijing may be able to prevent the issue from morphing into a bigger crisis. In the bigger picture, however, the housing downturn will be a multi-decade process amid a shrinking population.

After a growing number of homebuyers refused to pay mortgages on stalled home projects, regulators have moved to restore market confidence. Mitigating measures being considered include allowing homeowners to temporarily halt mortgage payments and urging local governments and banks to provide more funding to developers, Bloomberg reported.

The authorities may quell this latest disruption in the beleaguered property market since the number of affected mortgages remains small, for now. But it’s clear that this housing downturn will remain a drag on the economy for years to come. The high-turnover, pre-sale model relied upon by developers has been severely impaired, while households are already deep in debt.

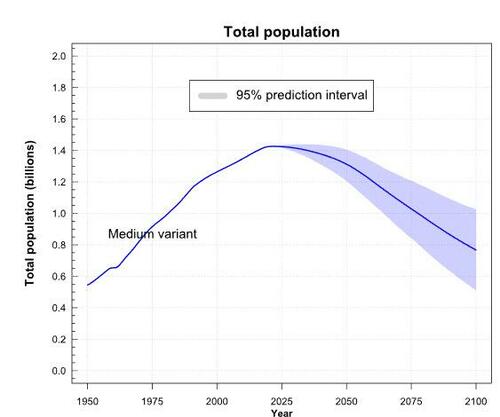

Moreover, demographic headwinds have been gathering momentum since the pandemic. The United Nations’ new population forecast released earlier this month — the first in three years — suggests that China is poised to cede the status as the world’s most-populous nation to India next year. The UN projected that China’s population will peak this year, instead of in 2031 as previously estimated. The population is forecast to shrink by 90 million – more than the current population of Germany today — by 2050.

Even this forecast may be too optimistic, according to Julian Evans-Pritchard, a China economist at Capital Economics. The UN predicts China’s fertility rate bottomed out in 2021 and is set to rise slowly for the next 30 years. Evans-Pritchard said that’s “implausible” and fertility is more likely to decline, as it did in other Asian countries in recent years. He pointed out that the UN has failed to predict the drop in China’s fertility rate over the past few years.

A shrinking population brings all sorts of problems, including slower economic growth and a larger pension shortage. It’s also a reminder that the property market has turned from a tailwind to headwind for the Chinese economy for years to come. The demographic changes mean that China’s housing demand is likely to fall from 8 million units per year in the 2010s to only 1.5 million by 2050, Goldman Sachs estimated last year.

It’s a long winter ahead for China’s property market.

Tyler Durden

Mon, 07/18/2022 – 21:55