Euro-Area Rates Market Prices In Record Anxiety Ahead Of ECB Decision This Week

By Ven Ram, Bloomberg Market Live analyst and reporter

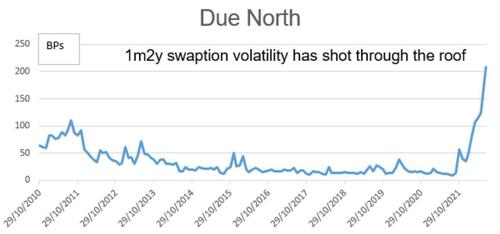

Euro-area rates markets haven’t been this skittish. Ever.

Short expiries of front-tenor swaptions are so elevated that they are factoring in daily moves of more than 13 basis points on underlying swaps. The angst coincides with the European Central Bank preparing to take its first tentative step toward policy normalization.

Given the not inconsiderable headwinds facing the ECB, you may question how much the central bank would really be able to “normalize” rates, and you wouldn’t have to be far too skeptical to question that. For, just a while ago, the two-year swap rate was around 2%, and to say that we have come off from those levels would be the understatement of the week.

The markets are taking a pretty grim view of how the euro-area economy will cope, and it indeed feels like a bit of irony that we may get to know about whether Russia will indeed turn back those crucial gas supplies on the same day the ECB meets. An adverse decision could not only hobble the economy, but also catapult soaring natural-gas prices — which have already spiraled away — even higher.

For the ECB, though, there seems no respite, caught between fears of weaker growth and inflation that sent its forecasts faster to a paper-shredder than you can send a print command.

And then there are fears of fragmentation, to tackle which the ECB may unveil a blueprint. Oh, not to mention, the brewing political crisis in Italy that policy makers may be concerned about.

Little wonder that the rates markets are caught up in so much angst.

Tyler Durden

Mon, 07/18/2022 – 12:51