Political Drama Is Haunting Italy’s Market Again

By Michael Msika and Jan-Patrick Barnert, Bloomberg Markets Live reporters and analysts

Italian stocks — already the worst among Europe’s major markets this year — can now add a political crisis to the list of its headwinds, which include economic slowdown, soaring inflation and looming ECB rate hikes.

The FTSE MIB has fallen about 5.6% this week, more than twice the drop of the Stoxx 600, following the reemergence of political turmoil which has led to Prime Minister Mario Draghi’s resignation, a demand later rejected by President Mattarella to avoid a major crisis. The next few days will be critical, with a likely new vote of confidence that will decide Draghi’s fate.

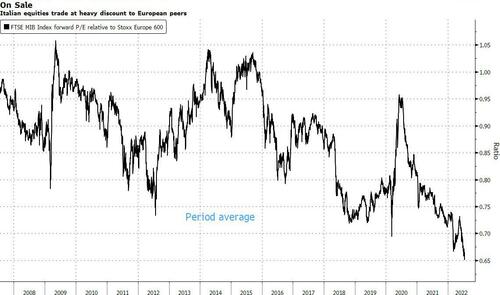

That’s cemented Italy’s position as the worst-performing major index in Europe this year, down 26%, and means the country’s equities are now trading at a record 35% forward P/E valuation discount to European peers.

“While a political solution that keeps the Draghi government in place remains possible, the possibility of early elections is growing,” says Equita analyst Domenico Ghilotti, who sees negative consequences for Italian assets from the turmoil.

Ghilotti says political chaos may lead to wider yield spreads, which is negative for Italian banks, and could also put some asset sales and M&A — such as at Telecom Italia and Rai Way — at risk, given the government’s involvement. Also in danger is the 19 billion euros in European funds expected by Italy this year as part of its post-Covid recovery plan.

In this backdrop, it’s not surprising that demand for hedging is rising. The total put volume on the FTSE MIB has soared this month, in contrast with that of the Euro Stoxx 50. Although the move isn’t dramatic, it could mean traders are positioning for trouble ahead for Italian stocks.

Some political parties have already called for a snap election. “For BTPs, politically-induced spread widening could occur earlier than we thought, especially given rich valuations versus broader fundamentals, perhaps testing the preventative clout of the ECB’s anti-fragmentation tool due next week,” say Citi analysts Aman Bansal and Saumesh Dutta.

Bond spreads have a big impact on Italian banks due to their large exposure to the nation’s debt. That’s also a drag on the overall market, as lenders make up almost a third of the FTSE MIB. The benchmark’s relative performance had trailed the tightening in bond spreads in 2020 and 2021, but this gap has now narrowed, providing less of a cushion.

“Volatile bond markets could raise funding costs for Italian banks, and potentially hamper bond issuance activity,” according to Scope research analyst Alessandro Boratti, who notes that seven major Italian banks held about 115 billion euros of Italian sovereign debt in addition to around 102 billion euros in state-backed loans at the beginning of the year. Italian banks have significantly underperformed European peers this year.

“Even if the worst-case scenario of early elections is avoided, this crisis shows that political instability remains very much a structural feature of the Italian institutional landscape, and may result in some repricing of country risk on the expectation that the Draghi Government may be challenged again before the end of its term,” says Silvia Merler, head of ESG and policy research at Algebris Investments.

Tyler Durden

Fri, 07/15/2022 – 08:44