Reverse Bullwhip Arrives: Amazon Prime Day Blows Away Record Thanks To “79% Off” Discounts

The US may be rapidly sliding into a major recession, but one wouldn’t know it looking at the spending bonanza that just took place during the two-day Amazon Prime Day sales event, which – according to Bloomberg – is bolstering confidence in the strength of the consumer (although Morgan Stanley disagrees).

The company sold more than 300 million items over two days, more than any prior Prime Day, and a blowout record which reinforces JPMorgan CEO Jamie Dimon’s somewhat cheerful message on consumption.

Amazon Prime (2+) Day was held on July 12 and 13 of 2022 and consumer reports show that online shoppers spent $11.9 billion total on the two-day event. According to the Adobe Digital Economy Index, the money spent this year represents an 8.5% growth in revenue compared to last year’s Prime Day totals. The second day of Amazon Prime Day (July 13) saw totals surpass $5.9 billion, making it the second biggest day for U.S. online spending to date in 2022, the first biggest day, being day one (July 12) of the two-day Prime Day event

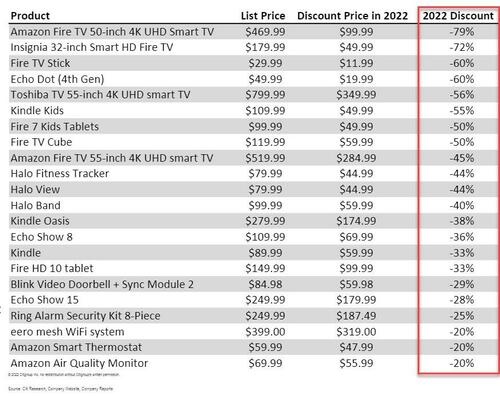

There was a simple reason for this buying frenzy – Amazon just demonstrated the types of discounts we should expect to hit outlets as the bullwhip effect goes into reverse: categories that saw the most purchases include toys, apparel, electronics, TVs, computers and back-to-school supplies, largely thanks to never before seen discounts for some items.

Here is Citi’s Ronald Josey with some observations on the Prime Day discounts (more in his note Thoughts on Prime Day 2022 available to pro subscribers):

Amazon Deals in Spotlight: As expected, Amazon is offering discounts on a wide range of Amazon devices (Amazon Fire TV 50-inch 4K is 79% off) (see Figure 7). Deals span multiple categories with Back-to-School in focus given savings of up to 45% on dorm room essentials and 30% off school supplies. Other highlights include discounts on electronics (up to 50% headphones), home & kitchen (up to 50% Keurig), outdoor (up to 50% Garmin wearables), and toys (up to 40% American Girl dolls).

A far more muted signal came with BofA’s July 4th holiday spending data. According to the bank’s economist Aditya Bhave, there was only a modest “holiday bump” in spending, as measured by BAC aggregated credit and debit cards, which was up 3.5% year-over-year (yoy) in the two weeks ending July 9, which BofA views as the period during which spending would have been impacted by the July 4 holiday.

More ominously, the “holiday bump” in spending was smaller this year than in any of the prior three years despite elevated inflation this summer.

This is consistent with the bank’s previously-published view that real economic activity is slowing into a mild recession, and prompted the bank’s strategists to cut their year-end S&P target to a street low 3,600 while also predicting that the Fed’s QT would end much sooner than expected.

Tyler Durden

Fri, 07/15/2022 – 09:05