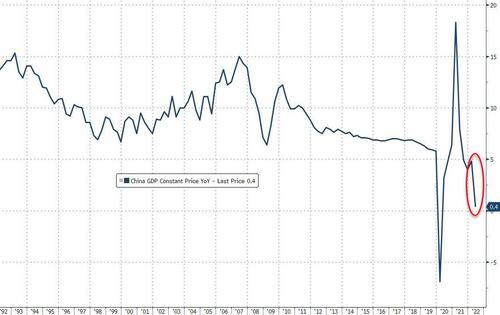

China GDP Growth Plunges In Q2

China’s economic growth hit a two-year low of just +0.4% in the second quarter, with COVID lockdowns and a collapsing property market pushing expectations of the government’s target (around 5.5%) further out of reach.

“GDP growth in 1H was only 2.5%, implying to reach 5.5% growth target, it would require average 8.5% growth in 2H, which is extremely unlikely,” explains Xiaojia Zhi, chief China economist at Credit Agricole.

This was a big miss from the +1.2% expectations and other than the COVID lockdown collapse in Q1 2020, this is by far the weakest GDP growth for China in the modern era…

The rest of the macro melange (for June) dropped tonight were mixed with Industrial Production picking up in June (but less than expected), Retail Sales smashed it (up 3.1% YoY vs +0.3%, notably though the YTD YoY is still down 0.7% YoY). China Fixed Asset Investment was flat on the month and Property Investment tumbled more than expected (down 5.4% YoY). The one (odd) bright light was the surveyed jobless tumbled to just 5.5% (from 5.7%)…

The spike in retail sales is the standout, but we fear this is unsustainable as it was likely driven by the surge in pent-up demand from 10s of millions of Chinese being completely locked down for a month.

The market is holding up on the June quarter hope. Bloomberg’s macro-based monthly forecast for China GDP (which incorporates tonight’s monthly data), suggests China GDP re-accelerating considerably in June…

As Fiona Lim, senior FX strategist at Malayan Banking Bhd in Singapore, says:

“Despite the weaker-than-expected 2Q GDP, the June activity data is decent with retail sales, FAI ex-rural beating expectations. Jobless rate came back down to 5.5% from previous 5.9% and that is reassuring. Yuan is probably reacting with relief that the bottoming out picture is still intact. That said, yuan bulls may not get much momentum from this set of data given the that the real estate is still under pressure.”

However, the ongoing COVID-Zero policy – and risk of immediate lockdowns to considerable parts of the economy – continue to make any trends undecipherable.

And as Xiaojia Zhi, chief China economist at Credit Agricole, warns:

“Given the ongoing Covid uncertainties and property market concerns, the risk to our growth forecast of 4.0% in 2022 could be on the downside, even taking into account those fiscal easing packages that have been announced.”

And finally, don’t think massive credit impulses will save economic growth, it certainly didn’t help in Q2…

But when has that ever stopped the central planners from repeating the experiment and expecting a different outcome.

Tyler Durden

Thu, 07/14/2022 – 22:17