Wall Street Reacts To Today’s Shocking CPI Print

It’s official: inflation was so hot, it not only came at the highest level since Volcker hiked rates to 20% to avoid hyperinflation, but blew away pretty much all whisper numbers (it wasn’t however, as high as that fake leaked BLS report).

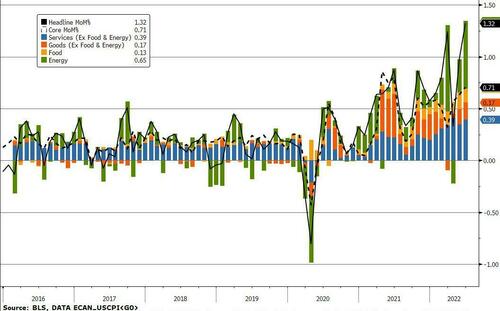

As noted earlier, headline CPI prices surged by 1.3% (1.32% unrounded) M/M in May – the highest monthly increase since the early 1980s – driven by soaring energy and service prices, smashing consensus expectations of a 1.1% increase.

Energy prices spiked 7.5% mom as gasoline prices reached record levels in mid-June. Food prices increases 1.0%.

Meanwhile, yoy headline CPI inflation made a new 40-year high of 9.1%.

As Bloomberg notes, the red-hot inflation figures reaffirm that price pressures are rampant and widespread throughout the economy and continue to sap purchasing power and confidence. That will keep Fed officials on an aggressive policy course to rein in demand, and adds pressure to President Joe Biden and congressional Democrats whose support has cratered ahead of midterm elections.

More importantly from the Fed’s perspective, the core CPI also beat expectations, rising 0.7% (0.71% unrounded) mom versus consensus at 0.6%. The yoy rate dropped from 6.0% to 5.9%, because of base effects.

The strength in core inflation was broad-based:

Core commodities rose 0.8% as new and used car prices took another leg up, rising by 0.7% and 1.6% respectively.

Apparel, medical care commodities and other goods saw increases of 0.8%, 0.4% and 0.5%, respectively.

Meanwhile core services increased by 0.7%. The main driver was a 0.6% increase in shelter prices (OER and rentals were up 0.7% and 0.8%).

Medical care services prices also increased sharply by 0.7%.

The one silver lining in this report is that travel-related inflation appears to have cooled off: lodging was down 2.8% and airline fares fell 1.8%. However, airfares remain very elevated: they are up 56% year-to-date.

While the decline in energy prices in the last few weeks points to near-term relief on headline inflation in the coming months, the main takeaway from this report according to Bank of America (which just made a H2 2022 recession its base case), is much-stronger-than expected underlying price pressures in both core goods and core services.

And while the bank’s outlook for core goods includes mild deflation over the coming year, it concedes that there is little in this report to suggest it is coming anytime soon (unless of course the Fed pushes us into a depression). In addition, core services inflation is likely to remain sticky given the continued strength in the labor market.

One potential nuance is that PCE inflation might come in meaningfully softer than the CPI – as has been the case for the last two months – given the lower weight of shelter in the PCE. In any case, the PCE outlook will become clearer after tomorrow’s PPI report.

Nonetheless, the bottom line is that this report keeps the Fed on its tightening path, and most banks expect a 75bp hike in July and a 50bp hike in September, with the market now pricing in 30% odds of a 100bps rate hike. To give some perspective on the speed at which the Fed is hiking, consider the back-to-back 75 basis point rate hikes that now seem set for June and July: That’s more than two years’ worth of tightening in the last cycle!

Last but not least, as we discussed earlier, BofA repeats that today’s report is consistent with the bank’s fresh view that the “inflation tax” will weigh on consumer spending, driving the economy into a mild recession (how that wasn’t obvious say a week or a month ago, when anyone with half a frontal lobe could see it, remains a mystery).

Bank of America aside, this is what some other pundits and Wall Street thinkers said in response:

Jan Hatzius, chief economist at Goldman Sachs: “The year-on-year rate nonetheless fell one tenth to 5.9% as last June’s surge in used car prices dropped out of the calculation. The breadth of core inflation increased further, with 6-month annualized inflation now above 6% for 42% of the basket. Shelter categories surprisingly accelerated further (rent +0.78%, owners’ equivalent rent +0.70%). And car insurance (+1.9%), recreation admissions (+1.7%), and day care (+0.7%) also contributed to 31-year high in core services inflation (+0.70%). Also of note, the labor-intensive “food away from home” category rose at a 41-year high pace (+0.95%), in part reflecting a rebound in “Food at Employee Sites and Schools” as firms phase out free-meal programs (+24.2% mom, but still -43.2% since February 2020). Core goods prices were generally strong as well, including for autos (new +0.7%, used +1.6%, parts +0.4%), apparel (+0.8%), and tobacco (+0.6%). On the negative side, travel categories pulled back somewhat after surging in the spring (airfares -1.8%, hotel lodging -2.8%). Headline CPI rose 1.32%, 0.22pp above consensus, on higher energy (+7.5%) and food (+1.0%) prices. The 36-year-high rent reading poses upside risk to the path of the funds rate in the second half of the year, as shelter is one of the largest and most persistent inflation categories.”

Ellen Zentner, chief economist at Morgan Stanley: “After May’s upside surprise across all major categories, this report is the second in a row that shows inflation pressures continuing on a broad basis.” But: “The outlook points to some inflation deceleration from here. In particular, energy price inflation is likely to reverse sharply in July on the back of falling commodity and retail gas prices, which points to a substantial drop-off in sequential headline inflation next month.”

Katherine Judge, economist at CIBC Capital Markets, doesn’t hold out much hope for better news on core inflation soon: “Although gasoline prices have fallen into July, suggesting an easing in headline inflation ahead, core annual inflation could accelerate ahead as base effects will no longer be biasing that measure down, while higher shelter prices will continue to feed through to that index.”

Neil Dutta, economist at Renaissance Macro:“Given my reading of the Fed’s reaction function, the odds of recession are going up and the likelihood of a pivot is going down given today’s CPI inflation data.”

Ian Lyngen, rates strategist at BMO Capital markets says 100bps in July is not “our base case,” but watch out after the surprise shift in June. “We were surprised in June with the upsized hike so are waiting on any incoming Fedspeak to clarify the Committee’s thinking on the pace of tightening.”

Quincy Krosby, chief equity strategist at LPL Financial, says the climb over 9% caught the market off guard: “This week’s University of Michigan’s preliminary consumer sentiment index release, and particularly its consumer 5-year inflation expectations results, becomes even more crucial for markets, not to mention the Fed.”

Jay Hatfield, CEO at Infrastructure Capital Advisors, says this may signal the peak. “We forecast that this print will mark the peak of inflation as the Fed’s 15% shrinkage of the monetary base, which is the fastest decline since the great depression, will curb inflation as the QT has caused the dollar to appreciate by over 12% this year which has caused commodities to plummet by over 20% since the measurement period for June CPI.”

Jason Furman, the Obama economic official who criticized last year’s $1.9 trillion spending plan, has come out in favor of the revised economic agenda, which features about a trillion dollars in revenue gains to fund half a trillion of deficit reduction with much of the rest going to cut drug costs. Furman tweets: “At this point fiscal policy should help too, the best option on the table being ~$500b of deficit reduction & Rx price slowing through reconciliation.”

Paul Krugman, the person who said the fax machine would be more valuable than the internet, tows the White House party line and says that “today’s hot inflation number is already out of date, not reflecting falling gasoline prices and other factors that have recently gone into reverse. But hard to imagine that the Fed won’t hike by 75 anyway.” What is hilarious, and apparently too difficult for brilliant minds like Krugman to comprehend is that the moment the market prices in the Fed pivot due to too much inflation, commodity prices will explode higher, sending inflation even higher.

David Kelly, global strategist at JPMorgan Asset Management, says that “this is a very unusual economy and I hope the Federal Reserve recognizes that. This is a very hot report but I think this is the last hot month in inflation heatwave.”

Priya Misra, strategist at TD Securities, says “this keeps pressure on the Fed to keep going. I think this is really a tough backdrop for risk assets and for the Fed.” She highlights her forecast of 75 bps in July, which she says gets the Fed to neutral. She adds that a 100 bps hike might be “too market-destructive.”

Kathy Bostjancic, at Oxford Economics, points out that energy prices have increased by 41.6% on a year-on-year basis. Bostjancic says she’s anticipating the Fed hike by 75 basis points in September as well, not just July. That would be three in a row. We had been saying that “50 was the new 25” for Fed rate hikes in the spring. That’s turned into “75 is the new, new 25.”

George Goncalves, bond strategist at MUFG says: “The current Fed has an inflation problem and they can’t waver from tightening even when there are some signals of a recession. The Fed can invert the curve by 50 basis points if they go to 4% and the 10-year stays at 3%.” He adds that would likely reflect a “quasi-stagflationary environment.”

Stan Shipley, economist at Evercore ISI, says he expects the June print to push Treasury yields, inflation expectations and the dollar higher in the near term.

John Lynch, CIO at Comerica Wealth Management, focuses on the inverted yield curve: “The first time in April was a warning, but this instance can be viewed as a signal. Whether or not the fundamentals of employment and household balance sheets justify recession, various confidence surveys and supply constraints suggest one may be upon us.”

Seema Shah, chief global strategist at Principal Global Investors, says inflation keeps “defying expectations for a peak to be reached… With inflation now above 9% it is simply unthinkable that the Fed could slow its tightening pace and certainly market chatter about a Fed pivot will stop now. A 0.75% hike in July is surely a done deal and further increases of that magnitude cannot be ruled out. We see rates moving to 4.25% next year as the Fed desperately attempts to recover from its earlier erroneous inflation read.”

Ira Jersey, from Bloomberg Intelligence: “The market’s knee-jerk reaction pricing for nearly one more hike in September makes perfect sense to us after the stronger across-the-board CPI report. We think July and September 75-bp moves are more likely than a 1% hike at any one meeting.”

Florian Ielpo, head of macro at Lombard Odier Asset Management: “The acceleration of the monetary cycle is not yet behind us, and we will have to wait until 2023 to see the Fed consider a pause in its cycle. The ‘good news is bad news’ mentality will remain firmly in the minds of investors until there is some sign of slowing inflation.”

Tyler Durden

Wed, 07/13/2022 – 11:38

Recent Comments