Bonds & Stocks Slammed As Hottest CPI In Over 40 Years Sparks Surge In Rate-Hike Odds

Well that wasn’t supposed to happen.

It seems ‘peak inflation’ is not here and markets are stunned.

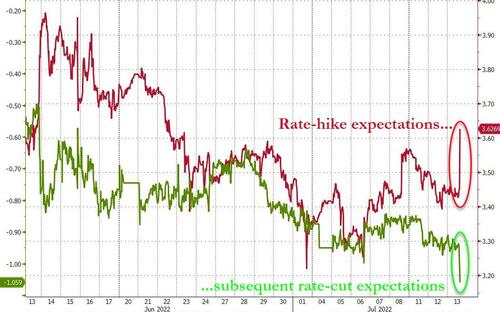

Rate-hike expectations are soaring (and 100bps of rate-cuts are now priced in for next year)…

With the odds of a 100bps hike in July now at 30%… (and 150bps is fully priced-in now over the next two meetings)

We know where to look for confirmation…

All eyes on Nick Timiraos with the hundo leak

— zerohedge (@zerohedge) July 13, 2022

All of that has sent stocks violently lower…

The euro briefly traded below parity…

And bond yields aggressively higher (with the yield curve flattening dramatically – 2Y +14bps, 30Y +5bps)…

The yield curve (2s30s) is back near its lowest since 2007 and on the verge of inversion again…

The one redeeming feature is that the market is now pricing in 17bps of rate-cuts in Q1 2023 (as The Fed fights off the recession it created).

When will stocks look through the recession and start pricing in the next round of QE?

Tyler Durden

Wed, 07/13/2022 – 08:54