Bank Of Canada “Front Loads” Tightening, Shocks Market With 100bps Rate-Hike

In a surprise to the markets (expecting a 75bps hike), the Bank of Canada hiked interest rates by 100bps, adding language around the perceived need to “front-load the path” to higher rates.

“The bank is guarding against the risk that high inflation becomes entrenched because if it does, restoring price stability will require even higher interest rates, leading to a weaker economy,” Governor Tiff Macklem and his officials said in the July monetary policy report

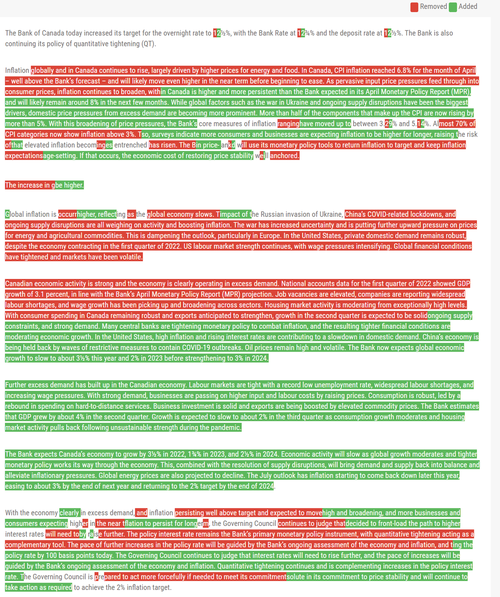

As the redline below shows, they made significant changes…

This is the largest BoC rate-hike since 1998…

While growth estimates were revised down, a soft landing is still the base case with the economy expected to expand 3.5% in 2022, 1.8% next year and 2.4% in 2024. Inflation is forecast to be back at target by end of 2024.

CPI:

2022: 7.2% (prev. 5.3%)

2023: 4 6% (prev. 2.8%)

2024: 2.3% (prev. 2.1%)

GDP:

2022: 3.5% (prev. 4.2%)

2023: 1.8% (prev. 3.2%)

2024: 2.4% (prev. 2.2%)

Despite the size of the ‘front loading’, The Governing Council continues to judge that interest rates will need to rise further.

The Loonie’s reaction is perhaps surprising in its undecided-ness. Despite chopping stronger and weaker, the Canadian Dollar is really not changed that much against the US Dollar post the BOC decision…

As Bloomberg notes, The Bank of Canada joins more than 30 other central banks around the world that have raised interest rates by a full percentage or more this year.

Tyler Durden

Wed, 07/13/2022 – 10:12