Container Rates Slump As “Bullwhip Effect” Enters Terminal Phase

The infamous “bullwhip” effect strikes as inventory gluts force U.S. importers to dial back shipments from overseas, driving down rates for ocean freight, which could end up causing a so-called “freight recession.”

WSJ reports U.S. companies are renegotiating shipping agreements they made during the virus pandemic highs. Some are hedging in the spot market to reduce costs associated with long-term contracts.

San Francisco-based freight forwarder Flexport said softening demand lowers freight rates but remains well above pre-pandemic levels.

Last week, the spot rate to ship a container from China to the U.S. West Coast was still four times higher than the same period in July 2019, online freight marketplace Freightos’ data shows.

A recent shipment by Carbochem Inc., an importer of activated carbon used in water treatment, cost around $16k from China to Chicago, down from $21k a year ago.

“We need to be looking at probably less than $10,000 to get anywhere close to the levels we were before and be competitive,” the firm’s president, Gavin Kahn, said.

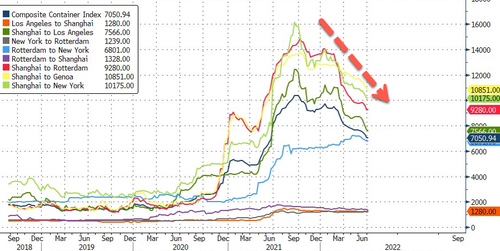

Shipping data from Bloomberg shows international freight rates have slumped over the last six months, mainly because of China shutdowns. However, U.S. importers reducing demand for cargo ships has accelerated the downward move.

The $1.5bln slide in U.S. consumer goods in May might have been a clear indication that demand for overseas products was waning and comes as Americans reduced spending on durable goods, something Target and Walmart pointed out last month.

We have detailed for readers in the last two months the terminal phase of the bullwhip effect was upon us:

Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff

Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices

Michael Burry Agrees: “Bullwhip Effect” Will Force Powell To Pivot On Rate Hikes And Q.T.

The side effect of soaring inventory to sales ratios is that retailers must liquidate inventories as consumer spending habits change. This causes retailers to reduce demand from overseas suppliers (read: Samsung Asks Component Makers To Delay Shipments Amid Build-Up In Inventories), which diminishes the need for ocean freight shipping.

In late March, FreightWaves CEO Craig Fuller warned that retailers would need to unload inventory amid signs of demand destruction. He correctly said this would cause a freight recession now could be coming true as container rates decline.

Tyler Durden

Tue, 07/12/2022 – 20:25