Foreign Demand Slides In Ugly, Tailing 10Y Auction

After yesterday’s average 3Y auction, moments ago the Treasury sold $33 billion in a 10 Year reopening (technically a reopening of the 9Y-10M cusip EP2), in an auction that could have certainly gone better.

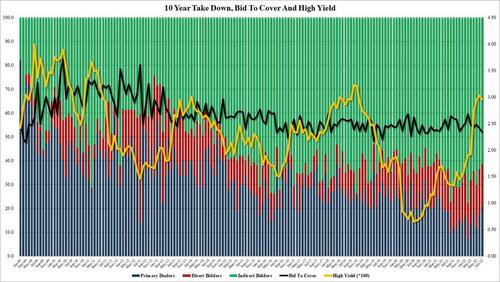

The high yield of 2.96% was down from June’s 3.03%, the first drop since Nov 2021; even so with the lack of concession due to the sharp drop in yields for the past two days, the auction priced with a 2bps tail to the 2.940% when issued, the fifth consecutive tail for a 10Y auction and the 8th in the past 9.

The ugliness continued below the surface, with the Bid to Cover of 2.34 sliding below last month’s 2.41 and the lowest since Oct 2020; obviously it was well below the 2.50 six-auction average.

The internals were also ugly with Indirects, or foreign purchasers, awarded just 61.3% of the auction, below June’s 63.6% and the lowest since April 2021 (not to mention well below the average Indirect takedown of 68.3). And with Directs taking down 20.7%, Dealers were left holding on to 18.0% of the auction, the lowest since April.

Overall, an ugly auction, one which roundtripped yields back to Friday’s pre-NFP level.

And now, all eyes turn to tomorrow’s final coupon sale for this week – the 30Y auction which will take place just a few hours after what could be the first double-digit CPI print since 1980.

Tyler Durden

Tue, 07/12/2022 – 13:28