China Credit Growth Explodes To 4th Highest Ever In June… It’s Still Not Enough

After several months of surprisingly, almost painfully low credit creation in China – the country that for the past decade was the sole global growth dynamo – in June Beijing has finally redeemed itself.

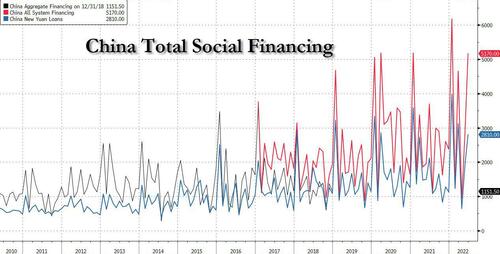

In June, China’s total social financing, RMB loans and M2 all came in far above expectations, with the rapid credit growth in June likely reflecting a combination of strong fiscal policy support (record-high single-month government bond issuance), further easing in credit supply (PBOC urged banks to accelerate loan extensions) and recovery of credit demand on easing Covid restrictions and activity growth recovery.

June total social financing (TSF) beat expectations again after showing a strong rebound in May, and rose by 5.17 trillion CNY, the fourth highest monthly increase on record. The sequential growth of TSF stock accelerated to 15.4% mom annualized in June, from 12.8% in May. Overall CNY loans growth also accelerated and grew 13.7% M/M annualized from 13.0% in May. M2 year-on-year growth increased to 11.4% yoy in June, vs. 11.1% in May, and expanded by 14.8% in month-over-month annualized terms, vs. 15.6% in May. Here are the numbers:

New CNY loans: RMB 2810bn in June vs. consensus: RMB 2400bn. Outstanding CNY loan growth: 11.2% yoy in June (13.7% SA ann mom, estimated by GS); May: 11% yoy (13% SA ann mom).

Total social financing: RMB 5170bn in June, vs. consensus: RMB 4200bn.

TSF stock growth was 10.8% yoy in June, faster than the 10.5% in May. The implied month-on-month growth of TSF stock accelerated to 15.4% (seasonally adjusted annual rate) from 12.8% in May.

M2: 11.4% yoy in June vs. Bloomberg consensus: 11% yoy. May: 11.1% yoy (+15.6% SA ann mom estimated by GS).

And visually:

Among major TSF components, shadow banking credit showed a small net increase in June (entrusted loans and undiscounted bankers’ acceptance bills grew by RMB 99bn in June, vs. the RMB 20bn increase in May, seasonally adjusted). Based on loans to different sectors, the rebound in loan growth was broad-based. Corporate mid-to-long term loan growth was 24.8% vs. 12.4% mom annualized in May. Corporate bill financing showed a small contraction of 0.7% vs May, perhaps due to policymakers’ guidance and concerns over arbitrage via bill financing. On loans to households, total household loans expanded by 10.2% month-over-month annualized, vs. an increase of 3.9% in May. Household medium-to-long term loans, which are mostly mortgages, grew 7.7% month-over-month annualized in June, vs. 2.6% in May. Government bond net issuance surged to RMB 1.6 trillion (NSA basis), the highest single-month net issuance on record, as policymakers required local governments to finish special bond issuance by the end of 1H. Corporate bond net issuance was RMB 327bn in June (after seasonal adjustment).

M2 growth also surprised to the upside at 11.4% Y/Y, the highest since late 2016. Fiscal deposits declined by RMB 437bn in June, broadly similar to the change in June 2021 despite record-high government bond net issuance, implying very strong fiscal spending in June.

According to Goldman, detailed breakdown of June credit data pointed to improvement of credit demand – corporate medium-to-long term loan growth accelerated in June while bill financing slowed. Household loan growth also improved although short-term household loans (consumer credit) grew faster than medium-to-long term household loans (mostly mortgages). That said, the bank believes that similar to previous outlier credit creation months, broad credit growth could slow in the near term after the rapid growth in June, barring additional major policy easing measures such as additional local government special bond issuance, or more credit support from policy banks.

That’s the not so good news, because as Bloomberg’s Simon White writes, “China’s nascent recovery will remain muted, restraining further equity upside, until there is a clear sign measures of liquidity are sustainably turning up.”

Taking a step back, White notes that China’s total social financing (TSF) increased in June as the effects from the country’s incrementally rising credit and fiscal easing feed through. In May, the PBoC urged banks to lend more, while last week the Ministry of Finance announced it was considering allowing local governments to issue a chunky $220 billion of special government bonds in the second half, an unprecedented rise.

In any case, the 12-month sum of the TSF is now rising almost 10% on a year-on-year basis, after spending most of the past 15 months in contraction territory.

Echoing Goldman, the Bloomberg Markets Live strategist notes that while this would normally be a pretty unassailable sign of a strong boost to growth ahead, in China that is not necessarily the case: “Given banks are effectively arms of the state, government-directed financing means that new credit finds its way most easily to SOEs, who are often not the companies most in need. This means the growth multiplier from new credit is lower than if it was extended more broadly to the private enterprises that need it most.”

As White notes, the kind of stimulus in China that has a more pronounced impact on growth is so-called “flood-like stimulus.” This is broad-based, unfettered easing with limited control from the authorities where the credit created ends up. It was the flood-like stimulus in the mid-2010s that led to rampant expansion in the shadow banking sector that eventually prompted China to pull back on easing for the sake of financial stability and greater state control. As a result, “there has been little appetite for flood-like stimulus since then, with officials stating as lately as June that such easing is not on the cards.”

That said, the constraints on state-mandated lending mean that TSF growth has a poor relationship with economic growth. A much better relationship is seen with real M1 growth. This rose strongly in previous episodes when stimulus was flood-like, but the modest upturn this year looks already to be sputtering.

As White concludes, “this means economic growth in China is likely to continue to incrementally improve, but remain muted and at risk of stalling” especially since Covid remains an ongoing headache for the stock market, as today’s news showed. In short, after an impressive 20% bounce off the lows, the market has hit resistance. But much bad news is already priced in. Yet, it is difficult to see how we get the next leg up in the stock market while real M1 growth remains subdued…

Tyler Durden

Mon, 07/11/2022 – 23:20