Real-Time Card Data Reveals “Broad-Based Slowdown”: Spending Growth Turns Negative For Low Income Households

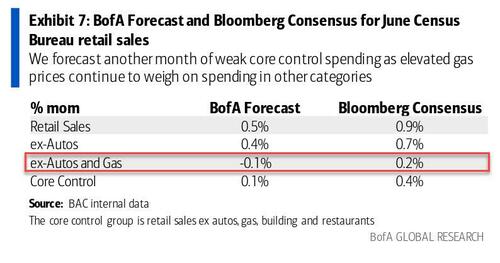

After last month’s disappointing retail sales, which confirmed what we already knew, namely that the US consumer was getting tapped out after maxing out credit cards in recent months, the latest total card spending per household, as measured by BAC aggregated credit and debit cards, returned modestly to the green, rising 0.3% month-over-month (mom) in June on a seasonally-adjusted basis, prompting BofA economist Aditya Bhave to forecast a 0.4% mom increase in the Census Bureau’s ex-auto retail sales figure in June, and expects the core control group (retail sales ex auto, gas, building materials and restaurants) to increase by a below-consensus 0.1% mom.

While the headline retail sales number may appear solid, since inflation remained solid-er in June, the card data suggest there is a risk that real (inflation-adjusted) consumer spending declined for the second consecutive month.

Which brings us to the next point: the latest BofA card spending data reveals a broad-based slowdown.

As BofA notes, last month we were encouraged by the fact that services spending was picking up the slack as stay-at-home goods demand faded. Alas, the story for June is more concerning. Gas prices reached all-time highs in mid-June before easing off modestly through month-end. Gasoline spending rose another 4% in June and is up 20% over the last five months.

This has started to take a toll on other categories of consumer spending, including services.

In June, spending on travel and restaurants fell for the first time since January (when the Omicron wave peaked), while durable goods spending dropped for the fourth consecutive month.

Worse, for the week ending July 2, airline, lodging and restaurant spending by lower-income households were all basically flat on a year-over-year (yoy) basis…

… and on a consolidated bases is now negative compared to 2021!

What about the split between debit and credit card spending? BofA economists note that one common concern they hear is whether lower-income households with liquidity constraints are being forced to spend more on their credit cards because of inflation; while they claim they have not seen much evidence of this in the BAC card data, they admit that credit card spending has modestly outpaced debit card spending for lower-income cohorts over the last year..

… even though debit card spending has grown much more relative to pre-pandemic levels, which of course is to be expected courtesy of trillions in stimmies which parked in various checking accounts (and has been mostly bled dry by now).

What is more concerning is that as exhibit 21 shows, credit card usage among low income cohorts is declining, not because of increased frugality but because as we showed last week, after an explosive move higher in Q1 in credit card balances..

… most American households are now maxed out and the “easy” sources of purchasing power are gone, which means the Biden admin will be hard pressed to come up with another major crisis that allows it to dispense with a few more trillion in stimmies to preserve social order and peace.

Tyler Durden

Mon, 07/11/2022 – 20:20