Labor Market Reality-Check Sends Stocks, Bond Yields Tumbling

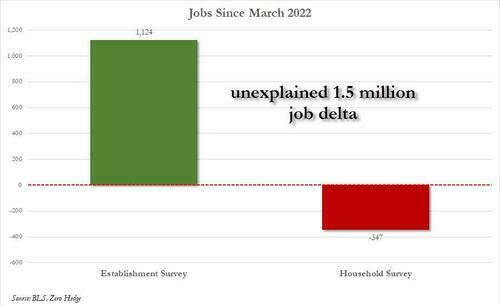

As humans actually spent some time over the weekend examining the jobs data from Friday (and reading our post from Friday morning), the realization dawned that the labor market was in fact nothing like as strong as talking heads had proclaimed.

Household survey losing jobs and multiple jobholders rising are not a good sign for the consumer.

That realization sent futures down Sunday night and things went just a little bit more turbo at the US equity cash open, bounced across the EU Close and then sunk back to the Lows into the close…

The short-squeeze appear to have run its course…

Source: Bloomberg

Bonds were bid across the curve, with the longer-end outperforming (10Y -10bps, 2Y -4bps), erasing much of Friday’s meltup in yields…

Source: Bloomberg

10Y Yield fell back below 3.00% once again…

Source: Bloomberg

The dollar didn’t care – it just kept on doing what it does as the euro slipped ever closer to parity…

Source: Bloomberg

Arguably – based on rate diffs – the euro has a lot further to fall than just parity…

Source: Bloomberg

Oil was lower on the day (amid renewed lockdowns in China), but bounced back from overnight weakness after the US equity market opened…

Gold drifted lower again also…

Finally, as a gentle reminder, we are back at a critical level for the world’s reserve currency against its fiat peers…

Source: Bloomberg

Strap in America, this is far from over.

Tyler Durden

Mon, 07/11/2022 – 16:01