One Bank Warns To Brace For A “Huge” CPI Surge, But It’s All Downhill From There

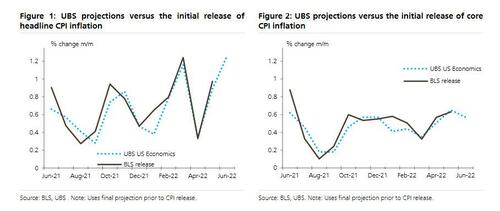

This Wednesday’s CPI release should show what UBS calls another “huge” headline CPI increase: in a note published by its US economist team (and available to pro subs), the Swiss bank projects the second largest seasonally adjusted monthly CPI rise in 40 years (a couple basis points above March this year and behind only September 2005). At 1.26%, the UBS CPI projection is above the current Bloomberg consensus average of 1.07%, and the bank’s forecast for the June NSA CPI level, at 296.101, is about 8bps higher than recent CPI swaps fixings.

While energy prices account for more than half of the June price jump with gasoline prices rising 11% compared to May, according to AAA retail gasoline prices peaked on June 13 and have fallen 22 cents per gallon over the past three weeks, suggesting close to half of the gasoline price surge in June will be reversed in the July CPI. Alas, it’s not just gas: outside of energy prices, UBS expects that the June CPI to show large increases in prices for food, new and used vehicles, rents (as we warned one year ago), and airfares.

Energy and food prices aside, and focusing on “core” prices, UBS projects the seasonally-adjusted core CPI moved up 57bp in June – just a few basis points above the average increase since October. The bank expects that one-third of the strong June core price increase will be from airfares and motor vehicles, which however it believes will ease notably in coming months and do not provide much signal for future inflation. Specifically, CPI airfares are projected to have risen another 3¾% in June, though according to Hopper actual domestic airfares peaked in mid-May and have dropped roughly 15% since then (CPI airfares should begin to reflect this decline in the July data).

For new and used vehicles, prices are rising strongly, but production has picked up and that higher production should also begin to push vehicle prices down in a few months.

Instead, UBS suggests paying greater attention to the following three categories.

Owners’ equivalent rent (OER): OER increased 60bp in May after 8 months in a 40 to 45bp range. Was the May jump a one-off or the start of even higher increases (for the answer, again read this)? It is likely that much of that May jump was persistent and UBS has pencilled in a 55bp increase in OER for June. That said, rents for new leases slowed starting late last summer and the usual lags suggest the peak monthly increase in OER was either in May or will occur in the next few months.

Core goods outside of transportation: Prices for non-transportation core goods have contributed notably to the rise in inflation over the past year but have slowed substantially since their peak monthly increase in January. Here too a question is whether core goods prices become a drag on inflation? Unlike us (we are confident that bullwhip effect driven liquidations will lead to a big price drop), UBS expects core goods prices will continue to slow but will not yet become negative.

Core services outside of shelter, medical, and transportation: Rising wages could force greater increases in this relatively persistent category, but the trend has not been clear in recent months.

Looking at full-year data, consensus is emerging across most Wall Street banks that inflation is projected to peak at 9.0% with the June CPI before starting to decline with falling gasoline prices in July.

Core CPI inflation, in contrast, peaked in March at 6.5% and is projected to have edged down to 5.8% in the June release. The monthly pace of inflation is then expected to slow notably over the remainder of the year, though July and August CPIs should see core inflation temporarily rising back up to 6%.

UBS is not the only bank to forecast that inflation has now peaked: in its own take on inflation and the current state of global economy, Goldman agrees with UBS that the headline CPI is likely to show another 40-year record in June, but at the same time, the combination of slower growth and reduced supply-chain disruptions has increased Goldman’s confidence that underlying inflation pressure will indeed come down in H2 (this, even as Goldman’s commodity team projects a rebound, although the recent declines in wholesale and retail gasoline prices suggest that the energy impulse to sequential headline inflation will be negative in the next couple of months).

There is another, more reasonable explanation for why inflation has peaked: as even Goldman now admits (repeating what we said last December), the Fed’s relentless jawboning of ongoing 75bps rate hikes has fueled concerns that Fed officials have become so determined to “whip inflation now” that they will end up triggering an avoidable recession. Thus, markets now project meaningful rate cuts in 2023 and the 5-year 5-year forward breakeven CPI inflation rate has fallen to 2.1%, consistent with PCE inflation of just 1.8% given the historical gap between the two measures!

For what it’s worth, Goldman has kept its terminal funds rate estimate of 3¼-3½% unchanged since the WSJ article that foreshadowed the 75bp move. However, the bank now expect this rate to be reached as soon as year-end, with another hike of 75bp this month, 50bp in September, and two final 25bp hikes in November and December.

Finally, perhaps the simplest confirmation that global inflation has now peaked comes courtesy of the Citi G10 inflation surprise index which peaked in March and has declined since then.

Tyler Durden

Mon, 07/11/2022 – 14:47