3Y Treasury Auction Finds Solid Demand Thanks To Highest Yield Since 2007

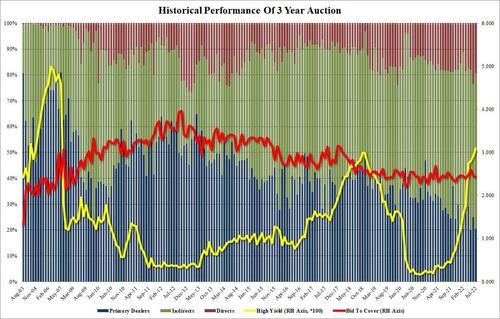

To find the last time the US 3 Year Treasury auction priced above 3.0%, one has to go back all the way to May 2007, because not even during the Lehman turmoil in 2008 or the Fed policy error of Nov and Dec 2018 did 3Y yields rise this high. We bring this up because moments ago the Treasury sold $43 billion in 3Y notes at a high yield of 3.093%, up from 2.927% in June and the highest in 15 years. Perhaps it was the surge in yields (because it certainly wasn’t the concession in today’s trade which has seen yields slide across the curve), the prompted a spike in demand by buyers, and is why after last month’s 1 basis point tail, today’s auction stopped through the When Issued 3.098% by 0.5bps.

The bid to cover of 2.428 dipped modestly from 2.453 last month and was the lowest since March (and below the 2.473 six-auction average), a mediocre result.

The internals were stronger: Indirects took down 60.4%, above June’s 51.5% and above the recent average of 58.7%. And with Directs taking down 19.4%, down from the near-record 23.6% last month, meant Dealers were left holding 20.3% of the auction, down from last month’s 24.9%, and also below the recent average of 23.9%.

Overall, a solid auction which found enough buyside demand largely thanks to the highest yield in 15 years.

Heading into the auction, yields initially dipped the bounced, only to stabilize not too far from where they were supposed to be.

Tyler Durden

Mon, 07/11/2022 – 13:22