The Fate Of The Euro After Parity Is In The Hands Of Putin

Echoing what we first wrote two weeks ago when explaining why July 22 may be the most important day in modern European history, today Bloomberg’s Mak Cudmore writes that “the fate of the European industry, and hence the global economy, hinges on the future of Russian gas flows.”

While US CPI, the ECB meeting next week and the Fed policy decision the week after will understandably generate much analyst commentary, they all matter much less to global markets than if Russia instigates a sudden energy-shortage in Europe after the July 22 planned Nord Stream 1 restart date, Cudmore notes, adding that traders should “expect the region’s assets to trade with a risk-premium all this week until there’s clarity, which means any developments should be watched very closely.”

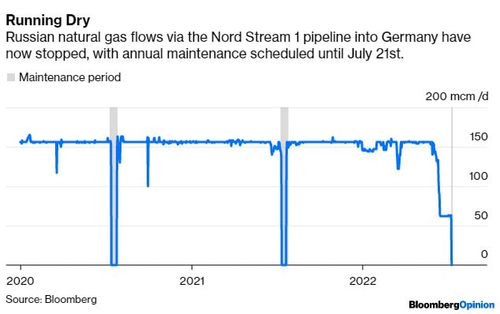

As a reminder, today the primary pipeline will be turned off for 10 days of maintenance. That much is known and expected. The nervousness is around whether it will be turned back on as scheduled. The good news from the weekend is that Canada has agreed to make a sanctions-exemption to export the key turbine needed. The more worrying development is Russia threatening to shut down an oil export terminal for a month, as flagged by Julian Lee, signaling its leverage in this situation.

EUR/USD was trading at 1.0430 this day last week when Cudmore flagged that parity is an unambitious target for euro bears in the context of the gas crisis. Now the pair is trading at 1.0066 and parity will likely be seen this week (if not today) just on the back of stress/concern over the pipeline outcome.

It’ll be binary after that: If the flow of gas isn’t turned on as scheduled, the pair will trade much lower very rapidly, but there’s room for a sizeable relief rally if flows resume as scheduled.

Tyler Durden

Mon, 07/11/2022 – 10:45