Key Events This Week: CPI, PPI And The Start Of Q2 Earnings Season

It’s that time of the month again where all eye look to the US CPI number, which will be released exactly half way through the week. This will be followed by the US PPI release (Thursday) and the University of Michigan survey for July on Friday where inflation expectations will be absolutely key. With US Q2 GDP currently tracking negative Friday’s retail sales and industrial production could still help swing it both ways. Staying with the US it’s time for Q2 earnings with a few high profile financials reporting toward the end of the week. As DB’s Jim Reid notes, this is a very important season (aren’t they all) as the collapse in equities so far in 2022 is largely due to multiple compression and not really earnings weakness.

Elsewhere China’s Q2 GDP on Friday alongside their main monthly big data dump is a highlight as we see how data is rebounding after the spike in Covid. In Europe, it will be a data-packed week for the UK.

Going through some of this in more detail now and US CPI is the only place to start. DB economists note that while gas prices fell in the second half of June, the first half strength will still be enough to help the headline CPI print (+1.33% forecast vs. +0.97% previously) be strong on the month but with core (+0.64% vs. +0.63%) also strong. They have the headline YoY rate at 9.0% (from 8.6%) while core should tick down from 6.0% to 5.8%.

Aside from an array of Fed speakers, investors will be paying attention to speeches from the BoE Governor Bailey (today and tomorrow). Markets will be also anticipating the Bank of Canada’s decision on Wednesday, and another +50bps hike is expected based on Bloomberg’s median estimate. Finally, G20 central bankers and finance ministers will gather in Bali on July 15-16.

In Europe, it will be a busy week for the UK, with monthly May GDP, industrial production and trade data due on Wednesday, among other indicators. Germany’s ZEW Survey for July (tomorrow) will also be in focus as European gas prices continue to be on a tear amid risks of Russian supply cut-offs. Speaking of which, Nord Stream 1 closes from today to July 21st for maintenance with much anticipation as to what happens at the end of this period. Elsewhere, Eurozone’s May industrial production (Wednesday) and trade balance (Friday) will also be due.

Finally, as Q2 earnings releases near for key US and European companies, key US banks will provide an early insights on the economic backdrop and consumer spending patterns. Results will be due from JPMorgan, Morgan Stanley (Thursday), Citi and BlackRock (Friday). In tech, TSMC’s report on Thursday may provide more insight into the state of supply-demand imbalance in semiconductors. In consumer-driven companies, PepsiCo (tomorrow) and Delta (Wednesday) will also release their results. The rest of the day by day week ahead is it the end as usual.

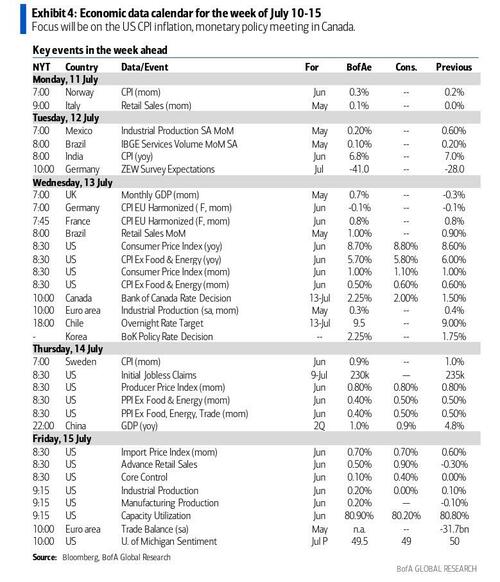

Here is a day-by-day calendar of events, courtesy of Deutsche Bank:

Monday July 11

Data: Japan June M2, M3, machine tool orders, May core machine orders, Italy May retail sales

Central banks: Fed’s Williams speaks, BoE’s Bailey speaks, BoJ’s Kuroda speaks

Tuesday July 12

Data: US June NFIB small business optimism, Japan June PPI, Germany and Eurozone July ZEW survey

Central banks: Fed’s Barkin speaks, BoE’s Bailey speaks, ECB’s Villeroy speaks

Earnings: PepsiCo

Wednesday July 13

Data: US June CPI, real average earnings, monthly budget statement, China June trade balance, UK May monthly GDP, industrial and manufacturing production, construction output, index of services, trade balance, Eurozone May industrial production, Germany May current account balance

Central banks: Fed’s Beige Book, BoC decision, Quarterly Monetary Policy report

Earnings: Delta Airlines

Thursday July 14

Data: US June PPI, initial jobless claims, UK June RICS house price balance, Japan May capacity utilisation, Canada May manufacturing sales, Germany June wholesale price index

Central banks: Fed’s Waller speaks, ECB’s Centeno speaks

Earnings: TSMC, JPMorgan, Morgan Stanley

Friday July 15

Data: US July University of Michigan survey, Empire manufacturing index, June retail sales, export and import price index, capacity utilisation, industrial production, May business inventories, China Q2 GDP, June new home prices, industrial production, retail sales, fixed assets, property investment, Japan May tertiary industry index, EU27 June new car registrations, Italy May general government debt, Eurozone May trade balance, Canada June existing home sales, May wholesale trade sales

Central banks: Fed’s Bostic speaks, ECB’s Rehn speaks, Bank of Italy’s Quarterly Economic Bulletin

Earnings: Citigroup, BlackRock, Wells Fargo, UnitedHealth

* * *

Finally, looking at the US, Goldman writes that the key economic data releases this week are the CPI report on Wednesday and the retail sales and University of Michigan consumer sentiment reports on Friday. There are several speaking engagements from Fed officials this week.

Monday, July 11

There are no major economic data releases scheduled.

02:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a moderated discussion on the Libor transition co-hosted by the New York Fed and the UK Financial Conduct Authority. In his last public appearance, on July 8th, President Williams noted that the Fed will likely increase the federal funds rate “to something like 3-3.5% by the end of the year,” and that “how high we need to get next year … really depends on what happens with inflation, inflation expectations, and honestly, how much slowing we really see in the economy.” President Williams indicated that he expects “real GDP growth in the United States to be below 1% this year, and then to rebound slightly to around 1-1/2% next year,” noting that “with overall growth slowing to below its trend level, I expect the unemployment rate to move up from its very low current level, reaching somewhat above 4 percent next year.”

Tuesday, July 12

06:00 AM NFIB small business optimism, June (consensus 92.7, last 93.1)

12:30 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will discuss the economic outlook during a luncheon hosted by the Rotary Club of Charlotte. Audience and media Q&A are expected. On June 21st, President Barkin noted that “inflation is high, it’s broad based, it’s persistent, and rates are still well below normal,” and argued that “you want to get back to where you want to go as fast as you can without breaking anything.”

Wednesday, July 13

08:30 AM CPI (mom), June (GS +1.15%, consensus +1.1%, last +1.0%); Core CPI (mom), June (GS +0.50%, consensus +0.6%, last +0.6%); CPI (yoy), June (GS +8.88%, consensus +8.8%, last +8.6%); Core CPI (yoy), June (GS +5.71%, consensus +5.7%, last +6.0%): We estimate a 0.50% increase in June core CPI (mom sa), which would lower the year-on-year rate by three-tenths to 5.7%. Our forecast reflects a 1% drop in apparel prices from markdowns on excess inventory and a pause in the airfare surge (mom sa). However, we forecast continued increases in auto prices (new +1.4%, used +1.1%, parts +1.5%) due to the Ukraine-Russia war and China covid lockdowns. Within services, we believe labor shortages and elevated short-term inflation expectations exerted upward pressure on personal care, recreation, and household operations. We expect sequentially slower shelter inflation (rent +0.57% and OER 0.50%), reflecting slowing gains in our shelter tracker and an OER drag from imputed utilities. We estimate a 1.15% monthly increase in headline CPI, reflecting higher energy, grocery, and restaurant prices.

02:00 PM Beige Book: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the June Beige Book, most Fed districts’ contacts reported slight or modest growth, and cited labor shortages and supply chain disruptions as their most significant challenges. Contacts in three districts specifically expressed concerns about a recession, and retail and real estate contacts noted softening activity as consumers faced higher prices and rising interest rates. While we do not expect a recession, we expect growth to continue to slow and inflation to remain elevated on a sequential basis over the next few months. We therefore look for anecdotes of slowing growth and continued wage and price pressures in this month’s Beige Book.

Thursday, July 14

08:30 AM PPI final demand, June (GS +0.8%, consensus +0.8%, last +0.8%); PPI ex-food and energy, June (GS +0.5%, consensus +0.5%, last +0.5%) ; PPI ex-food, energy, and trade, June (GS +0.5%, consensus +0.5%, last +0.5%): We estimate a 0.5% increase for PPI ex-food and energy and PPI ex-food, energy, and trade, reflecting slightly softer—but still elevated—core goods inflation. We estimate that headline PPI increased by 0.8% in June.

08:30 AM Initial jobless claims, week ended July 9 (GS 230k, consensus 232k, last 235k); Continuing jobless claims, week ended July 2 (consensus 1,395k, last 1,375k): We estimate initial jobless claims declined to 230k in the week ended July 9.

11:00 AM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will discuss the economic outlook at an event hosted by the Global Interdependence Center. Text and moderated Q&A are expected. Governor Waller stressed that the Fed needs to “move to a much more restrictive setting in terms of interest rates and policy, and we need to do that as quickly as possible,” and noted that he was “definitely in support of doing another 75 basis-point hike in July, probably 50 in September.” Going forward, Governor Waller said that he was looking to “see core PCE printing at annual rates closer to 2.5-3% by year-end to feel comfortable that we could really think about backing off on rate rises,” but indicated that “it doesn’t look like that’s going to happen.”

Friday, July 15

08:30 AM Empire State manufacturing survey, July (consensus -1.3, last -1.2)

08:30 AM Retail sales, June (GS +1.4%, consensus +0.9%, last -0.3%); Retail sales ex-auto, June (GS +1.2%, consensus +0.7%, last +0.5%); Retail sales ex-auto & gas, June (GS +0.7%, consensus +0.1%, last +0.1%); Core retail sales, June (GS +0.7%, consensus +0.3%, last +0.0%): We estimate a 0.7% increase in June core retail sales (ex-autos, gasoline, and building materials; mom sa) following the flat reading in May. Our forecast reflects a pickup in high-frequency spending data, a modest boost from the new Juneteenth holiday, which the seasonal factors will not yet account for, and higher prices. We estimate a 1.4% rise in headline retail sales, reflecting a rebound in auto sales and the jump in gasoline prices.

08:30 AM Import price index, June (consensus +0.7%, last +0.6%)

08:45 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss monetary policy and uncertainty at an event hosted by the Tampa Bay Business Journal. Audience Q&A is expected. Earlier this week, President Bostic said that he was “fully supportive of moving 75 basis points” at the FOMC’s July meeting. He also noted that “we are starting to see those first signs of slowdown, which is what we need because what we have right now is a great imbalance between supply and demand that’s driving the inflation that we are seeing.”

09:00 AM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the economic outlook during a virtual event hosted by the European Economics and Financial Centre. Audience Q&A is expected. On July 7th, President Bullard argued that the US has “a good chance of a soft landing,” noting that “when I see all these recession prediction models out there, I have to smile a little bit because we know it’s not really that easy to predict a recession. These models might have a little bit of predictive power, but very little.”

09:15 AM Industrial production, June (GS +0.1%, consensus +0.1%, last +0.1%); Manufacturing production, June (GS +0.1%, consensus flat, last -0.1%); Capacity utilization, June (GS 81.0%, consensus 80.6%, last 80.8%): We estimate industrial production rose by 0.1% in June, as higher oil and motor vehicle production offset weaker natural gas and utilities production. We estimate capacity utilization increased to 81.0%.

10:00 AM Business inventories, May (consensus +1.3%, last +1.2%)

10:00 AM University of Michigan consumer sentiment, July preliminary (GS 50.0, consensus 50.0, last 50.0); University of Michigan 5-10 year inflation expectations, July preliminary (GS 3.0%, consensus 3.0%, last 3.1%): We expect the University of Michigan consumer sentiment index was flat at 50.0 and that the 5-10 year inflation expectations measure declined by one tenth to 3.0% in the preliminary July reading.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 07/11/2022 – 11:25